My regular newsletter will not appear again until August 4 due to summer vacations, but I would like to ask your attention for a special webinar with Dr. Nisheta Sachdev and Gert-Jan Lasterie, to which I cordially invite you.

Dr. Sachdev to the rescue

Late last year, well-known crypto consultant and marketing specialist Nisheta Sachdev was flying back to her hometown of Dubai when the pilot asked if there was a doctor on board. Although Nisheta has medical training, she had been more into cryptocurrency than patients for years. When no other doctor showed up, she raised her hand and attended to an unwell elderly lady, who without Nisheta's help would likely not have made it.

For Nisheta, this experience was a spur to bid farewell to the crypto world, at least as a fullltime consultant, and plunge back into medical science. And that in the midst of a bull market. Give it up for Nish!

From Flabber to crypto

Gert-Jan Lasterie made exactly the opposite move last year. Not that he has a medical background, but as founder of popular Dutch entertainment website Flabber, he did bring a new form of entertainment to a mass audience on the Internet. Flabber was sold to the American hipsters of Vice and Gert-Jan went to work at Dutch e-commerce giant Coolblue with the wonderful self-proclaimed title that can best be translated as "chatty boss," or in more traditional terms: head of social media.

During his later commercial management positions at Mediahuis/Telegraaf, Gert-Jan wrote a book on crypto currencies in his spare time, which is still considered the Dutch standard work on Bitcoin. If only for the catchy and still relevant subtitle: 'How you thought you were late getting into crypto but became more successful than people who didn't read this book.'

Lasterie is so enthusiastic about the global market for blockchain technology and the opportunities decentralization offers that earlier this year he totally squandered his promising career by joining Tracer, the crypto project that fights global warming by radically changing the carbon credits market, as Chief Business Officer. Crypto against climate change, it can't get much crazier.

How does a pudgy frog become a global hype?

During the webinar, Nisheta and Gert-Jan discuss what lessons can be learned from the successes and failures of various crypto projects, which every marketer can use to their advantage.

It will be my advanced age, but how a memecoin like Pepe achieves a market cap of $5 billion within a year with people trading in it for nearly a billion a day, I find as incomprehensible as it is fascinating.

With tokens like Pepe, there is a temptation to lump crypto projects all together as pyramid schemes, and paint Web3 as one big mirage, but for the discerning follower that is becoming increasingly difficult. Now that the world's largest asset manager BlackRock has gotten into Bitcoin in earnest and ETFs are ready for Ethereum, it's getting pretty hard to maintain that it's all lunacy.

The risk of startups with faster results - or not

The question then becomes: can serious projects, trying to solve real problems, also be successful? Blockchain and crypto, or Web3 as we have to say these days, still retain the image of a promising technology that has yet to fulfill its great promise.

As an entrepreneur and former manager of funds that invested in startups, I look at it pragmatically: obviously, most crypto projects are at least as risky as the average startup. That means 95% to 99% are not going to survive the first five years.

But there is a big difference: with startups, investors sometimes have to wait years for their returns. For example, my first fund once invested in a startup that didn't yield anything until twelve years later. In the crypto world, everything moves faster; within 12 months, a buyer of a successful token can at least get back the purchase price by selling some of the tokens he bought.

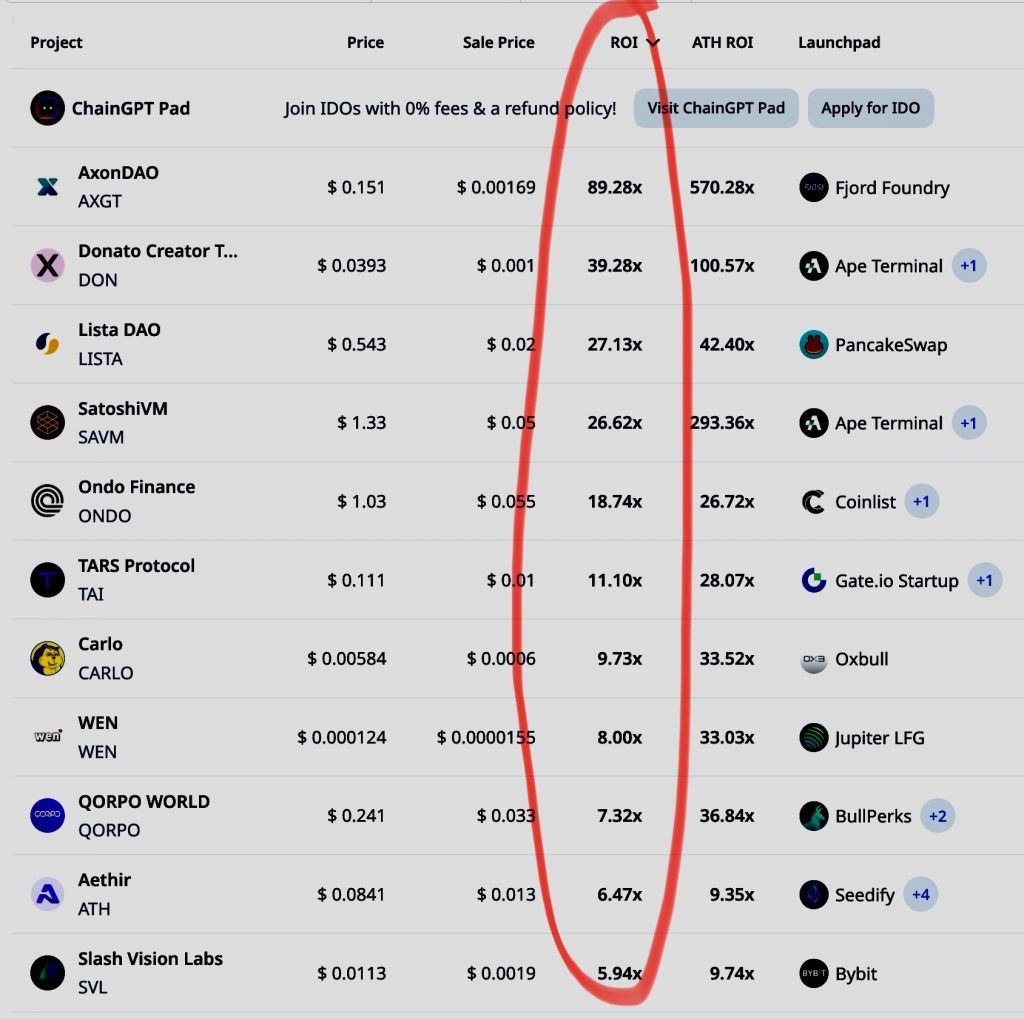

In the picture above, the key is not to focus on the ATH, the All Time High. After all, no bell rings at the highest point and the chances of selling at that exact moment are extremely slim. But on a site like Cryptorank, it is easy to see the results of coins purchased as recently as this year, for example, and see what the returns are if you would have kept them until today.

You ask, we deliver

Success and failure factors, hypes and hopes, all that sort of stuff we'll discuss in next week's webinar, but as host, I'd love to hear what questions and topics you'd like to see covered by Nisheta and Gert-Jan. We'd like to make it a lively, interactive session.

You can sign up for the webinar here, and questions and suggestions are welcome via X, LinkedIn or, of course, simply by responding to this email.

Hope to see you in this webinar and if not, see you August 4!