Here is what the company reported compared with what Wall Street expected for the quarter ending in January, based on a survey of analysts by LSEG, formerly known as Refinitiv:

- Earnings per share: $5.16 adjusted vs. $4.64 expected

- Revenue: $22.10 billion vs. $20.62 billion expected

- profit margin: 74% (compared to 59% last year)

- Nvidia said it expected $24.0 billion in sales in the current quarter. Analysts polled by LSEG were looking for $5.00 per share on $22.17 billion in sales.

Here is what the company reported compared with what Wall Street expected for the quarter ending in January, based on a survey of analysts by LSEG, formerly known as Refinitiv:

- Earnings per share: $5.16 adjusted vs. $4.64 expected

- Revenue: $22.10 billion vs. $20.62 billion expected

- profit margin: 74% (compared to 59% last year)

- Nvidia said it expected $24.0 billion in sales in the current quarter. Analysts polled by LSEG were looking for $5.00 per share on $22.17 billion in sales.

At the heart of this stunning achievement, of course, is A.I. If there were a "shareholder value creation" hall of fame, Nvidia's creation of $277 billion in stock market value in one day, would be at the very top.

This sum, if split off as a single company, would now be the 37th largest in the S&P 500, still ahead of Bank of America and Coca-Cola. If it were split off into two companies, they would both be in the top 100, barely smaller than American Express and Siemens.

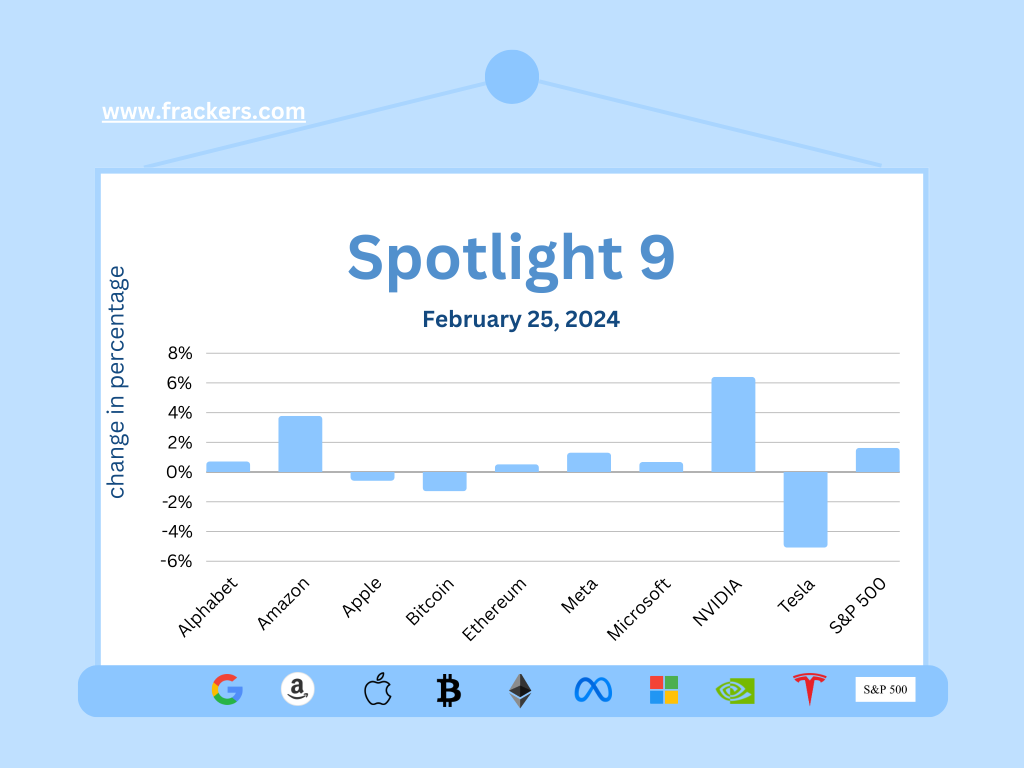

How did the markets react?

Several leading indices started the year strongly, reaching new highs following Nvidia's results. On Thursday, Japan's main stock market index, the Nikkei, rose 2.19% to close at 39,098.68 - its highest level in 34 years.

In the longer term, other factors boosted the Nikkei, including capital fleeing the troubled market in China and a drop in the value of the yen, but Nvidia's results had a knock-on effect around the world.

Europe's STOXX 600 and Wall Street's blue-chip indices Dow Jones and S&P 500 all reached new highs.

February 2024 marks the first time in history that the leading S&P 500 index has surpassed 5,000 points. As if this were not enough, this month the NASDAQ Composite, dominated by the technology industry, also nearly reached its highest level ever.

How much does AI have to do with stock market gains?

It has played a significant role in continuing to boost the big tech stocks, which play such a disproportionate role in U.S. markets alone. This week, Deutsche Bank pointed out that tech stocks were playing an increasing role in the S&P 500, the largest U.S. index. The bank pointed out that Microsoft, Nvidia, Apple, Amazon and Google's parent company, Alphabet, make up nearly a quarter of the value of the S&P 500.

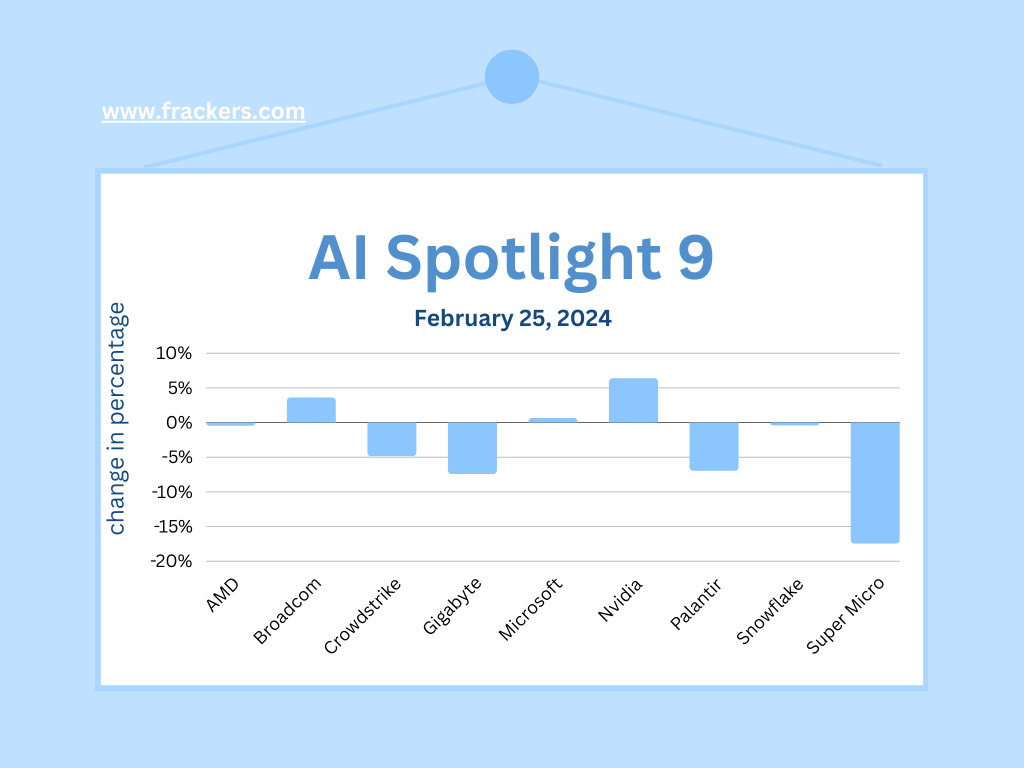

New stock market darling Super Micro is experiencing a bizarre month: the stock went from $475 a month ago, to $1,004 last week, to $860 at the close of Wall Street the day before yesterday. It recalls the dotcom boom of the late 1990s.

It is not an AI bubble but an AI boom

I refuse to call it an AI bubble, simply because there are numerous companies to point to that will grow tremendously in terms of revenue, with profit margins that remain at least the same. Nvidia and Super Micro at the forefront, but AMD is also in a strong position while software companies like Palantir should be able to greatly reduce their costs with AI, which should be able to increase their competitiveness (and thus revenue).

The problem is that such a market attracts all sorts of "investors" who barely know the difference between hardware and software, let alone between a fundamental developer like Nvidia and a particularly high-end integrator of someone else's technology, like Super Micro.

This is not to say that one investment is automatically better than another, as Super Micro and AMD were patently undervalued for a long time by investors who could not appreciate developments in AI.

Except that in a price correction and especially in a crash, the child is often thrown out with the bathwater. Think of Amazon, eBay, Apple and Microsoft; they fell as hard as pets.com (dog food home delivered) when the dotcom bubble burst. Only because investors could not distinguish the difference between fundamental developers and their customers.

The challenge for investors is to see who is a customer of whom and where the dependencies lie. Right now, Microsoft, Google, Meta and all the other developers of large-scale AI applications are cap in hand with Nvidia, begging for a handful of chips. And all the busy press releases about proprietary chips and proprietary servers notwithstanding, it will take years for them to catch up with Nvidia in terms of technology.

And then comes the problem of mass production. It is no coincidence that Sam Altman of OpenAI is trying to set up chip factories of his own, because he realizes that design alone will not be enough. And because Nvidia and Apple have well nailed down production of their chips at TSMC, it is not likely that any new party will be able to play a significant role in chip production in the coming years. AMD is a dangerous outsider.

So far, until next week!