Summer is over so starting next weekend, this newsletter will again be weekly instead of monthly. With apologies for the late mailing, herewith the most notable recent topics covered in this newsletter:

- OpenAI loses $158 per second yet is worth $100 billion

- Nvidia breaks revenue records but is very silent on customer success

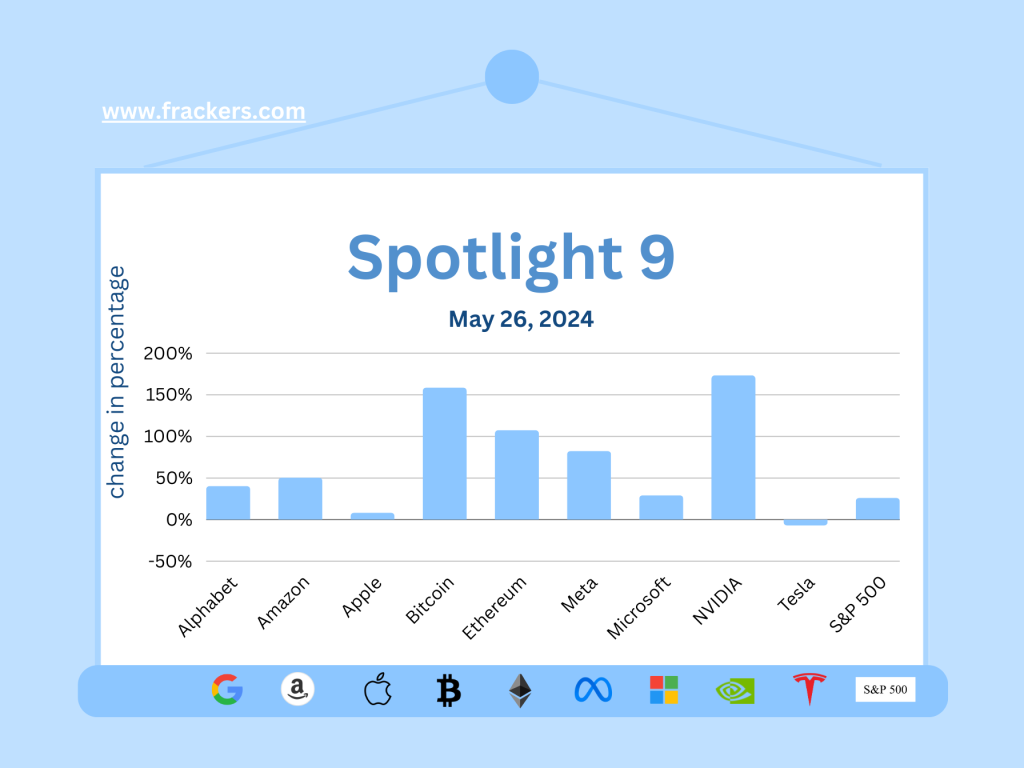

- Shares of AI-driven companies rose sharply in August

- Energy consumption of AI threatens climate goals of Big Tech companies, appear to try to change the rules of the game

- Telegram and other social media are obviously being targeted by governments

- podcast of Taylor Swift's boyfriend, and his brother, to Amazon for $100 million

- Midjourney will make hardware

OpenAI loses $158 per second but is worth $100 billion

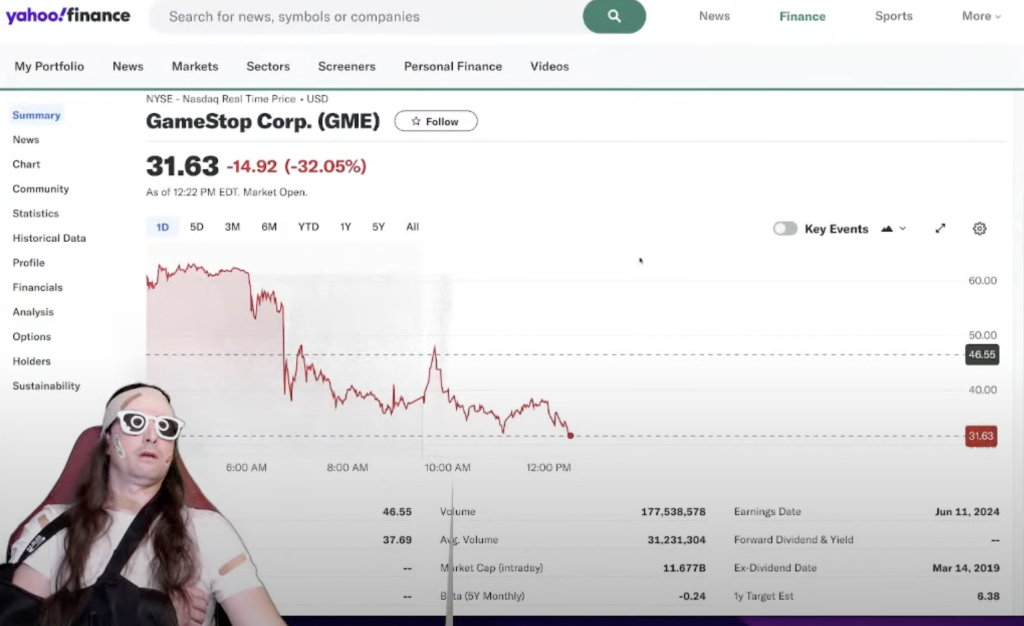

According to The Information, OpenAI, maker of ChatGPT, is fast heading for a $5 billion loss this year, or: $158 per second. This is a negligible run-up loss in the eyes of CEO Sam Altman and his supporters, as he appears to be successfully raising new funding at a valuation of $100 billion. That compares to the value Facebook had at the time of its IPO in 2012, but Zuckerberg did make $1 billion in profit!

Interestingly, the three most valuable companies in the world, Apple, Microsoft and Nvidia, apparently consider participating in this investment round. Thrive Capital as lead investor is doing $1 billion and Nvidia $100 million. That's a hefty sum, but how far does that take OpenAI?

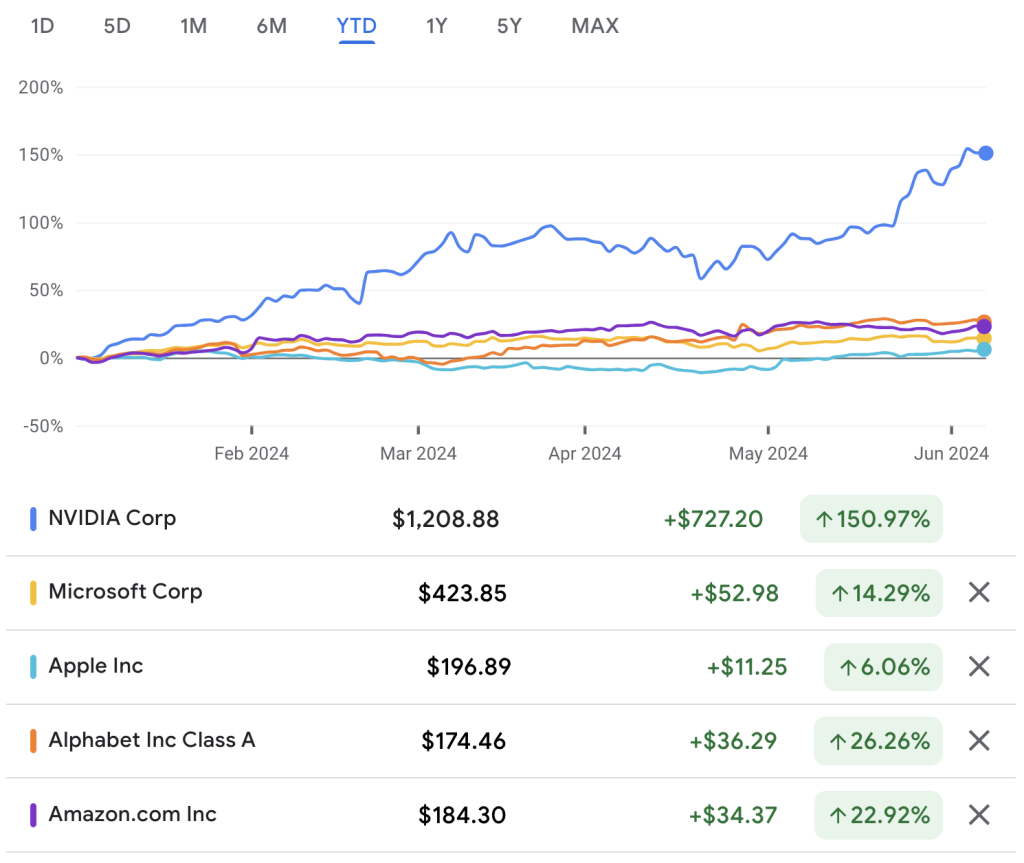

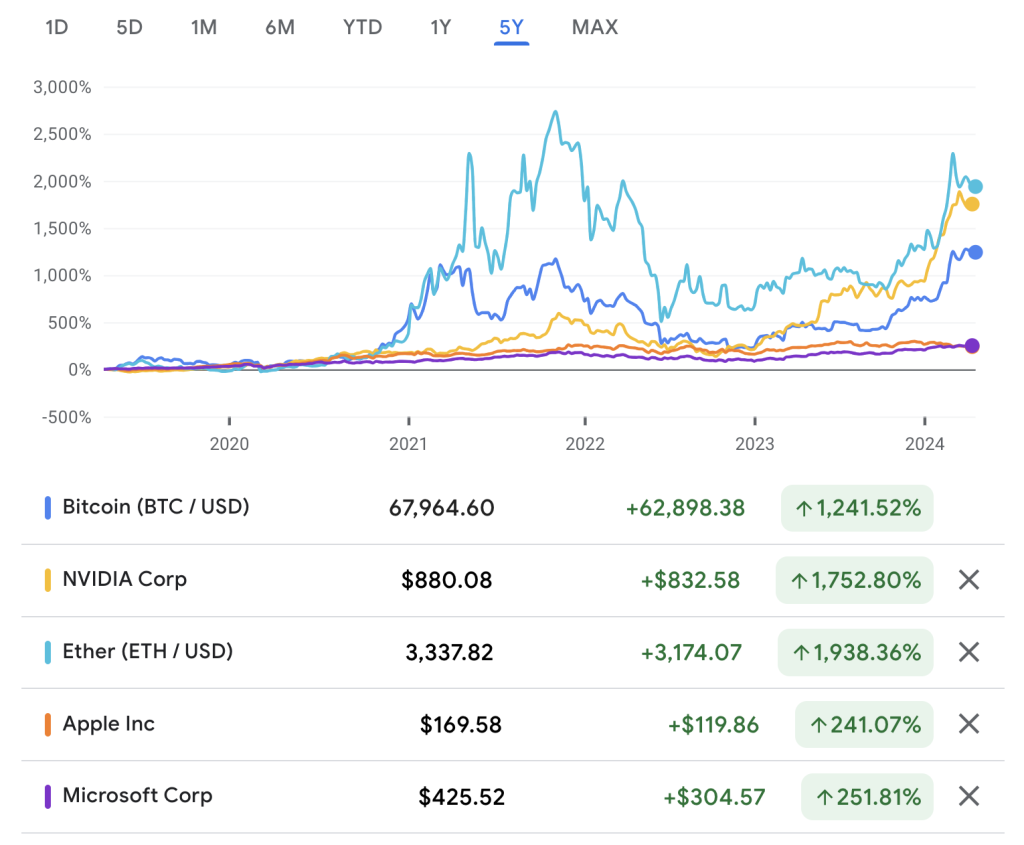

How well is Nvidia doing?

At an annualized loss of $5 billion, OpenAI can go on for a scant week with that $100 million from Nvidia, which itself posted second-quarter revenue of $30 billion with a net profit of $16.6 billion. So it only takes the chipmaker thirteen hours (!) to earn the $100 million it invested in OpenAI. A nice tip for keeping a big customer happy.

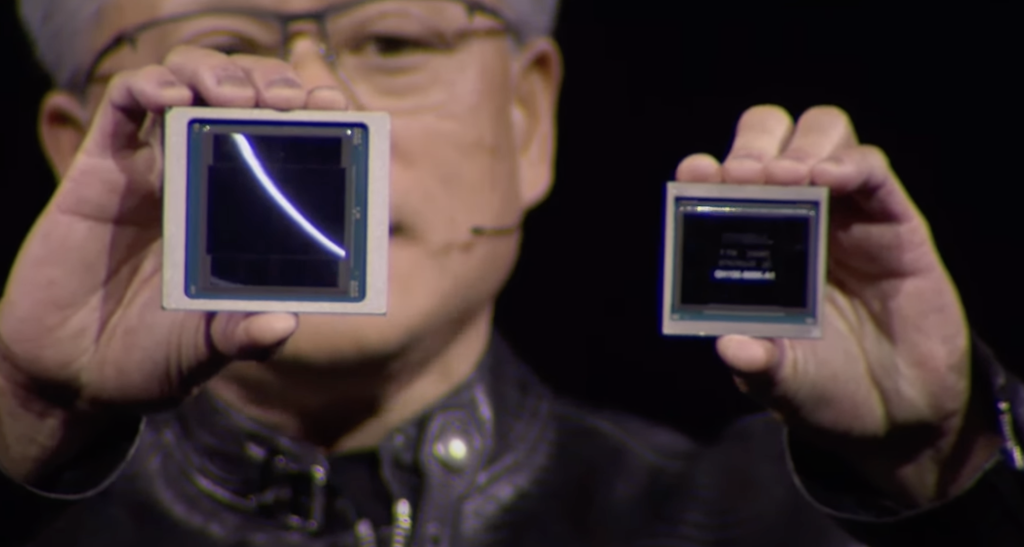

Nvidia's performance is being interpreted in different ways. People from outside the tech industry, such as financial analysts, do not seem to understand that the manufacturing problems Nvidia is experiencing in producing the new Blackwell chip are temporary.

A company's performance is determined by a combination of revenue, growth and profit. Nvidia's sales will be fine for the next few years, due to a lack of competition and the huge demand from the Big Tech companies that develop AI applications or provide platforms for AI developers: Microsoft, Amazon, Google, Oracle and Salesforce are just a few of the customers who cannot drive their AI efforts without Nvidia. So aside from revenue, Nvidia's profit margin is in good shape for now.

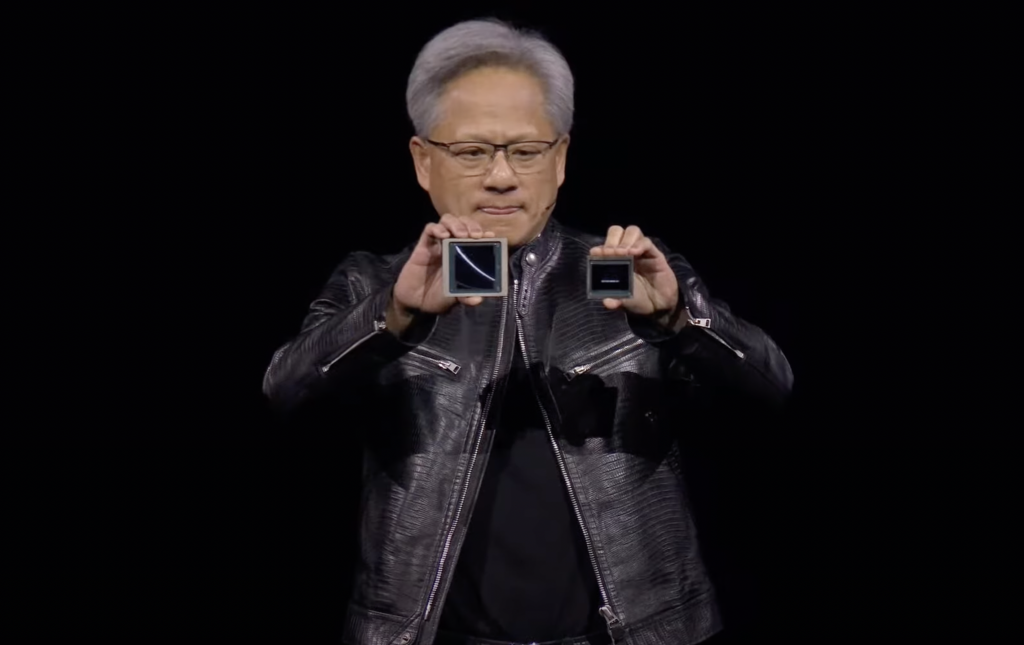

A bigger problem for Nvidia is the growing doubt that all those customers can make healthy profit margins on their AI investments. So far, those hoped-for profits are failing to materialize, and that does represent a long-term concern at Nvidia. Top executive Jensen Huang is very quiet when asked about his customers' return on their AI spending at Nvidia. The question becomes how long for Huang silence is golden.

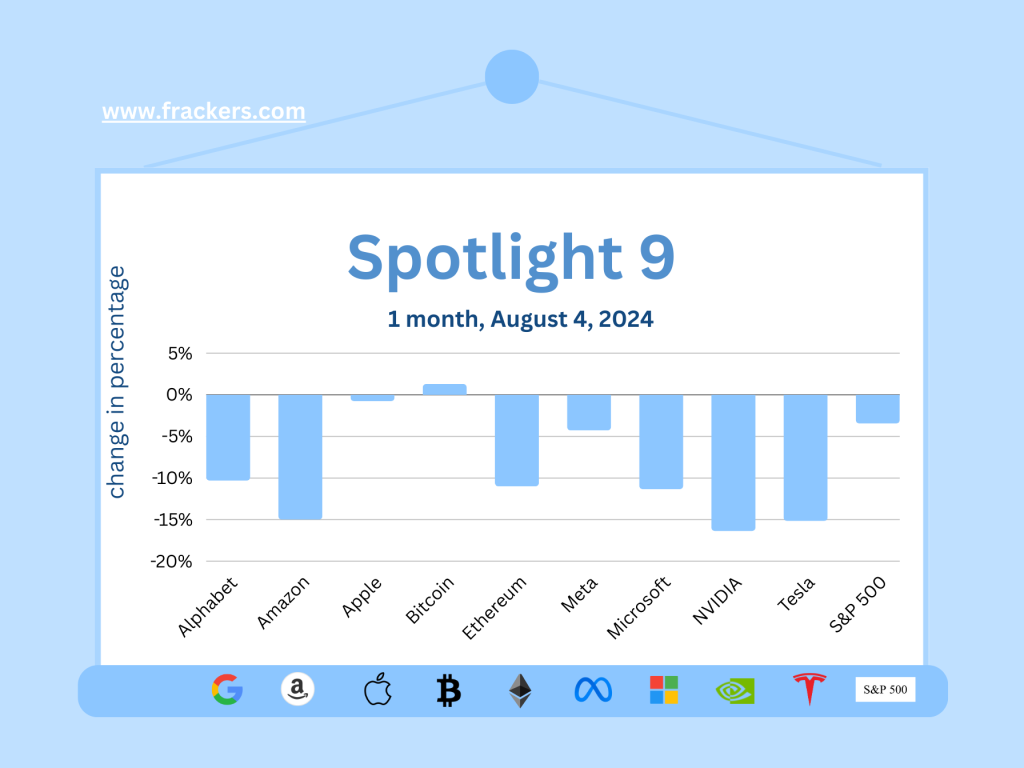

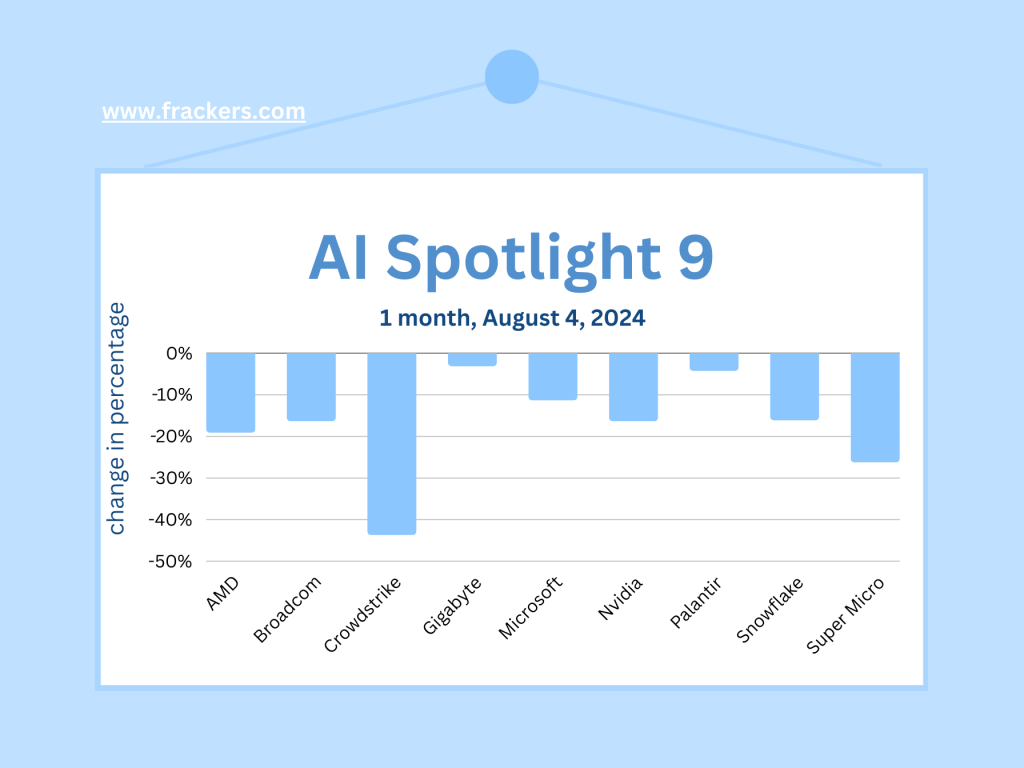

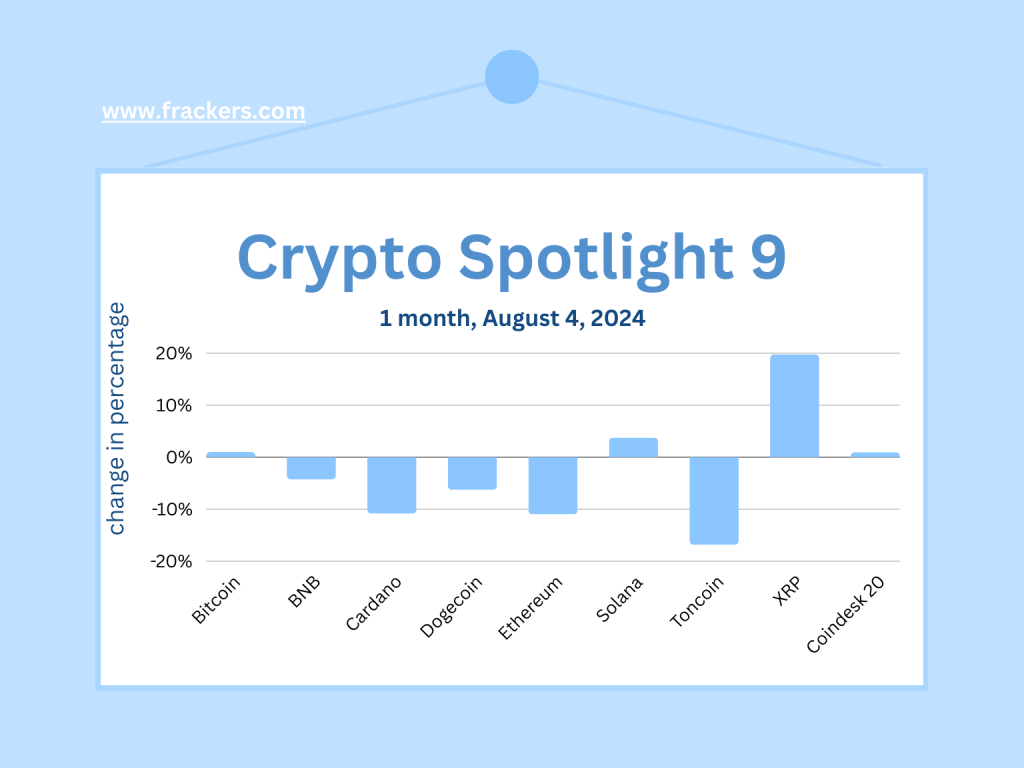

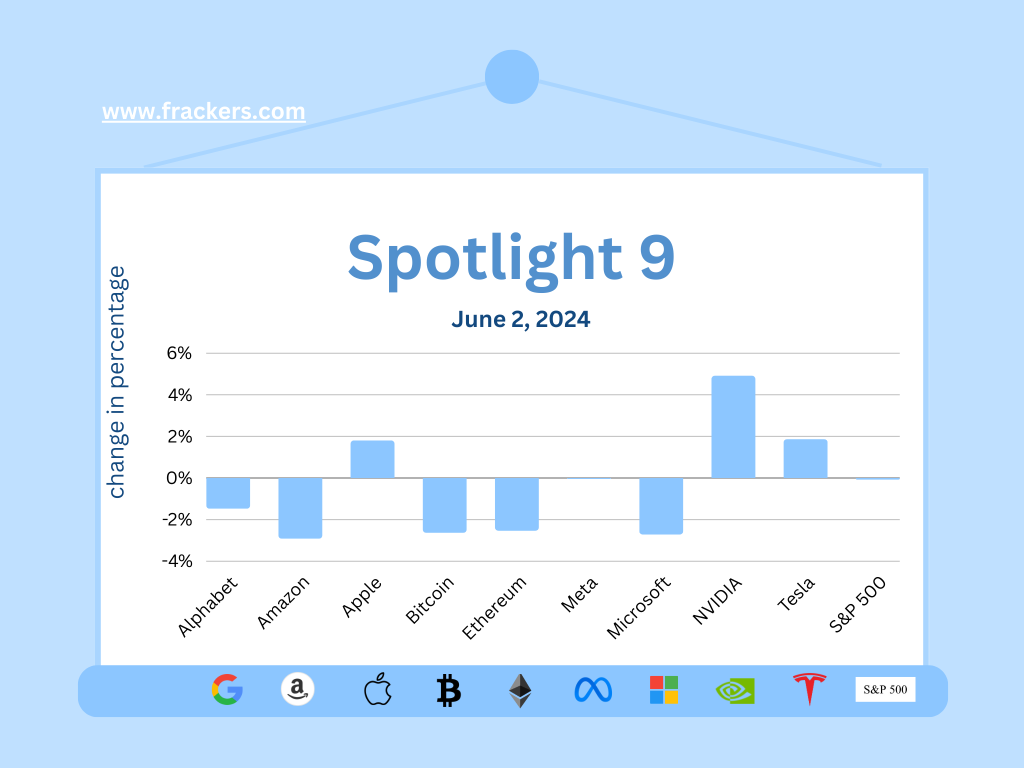

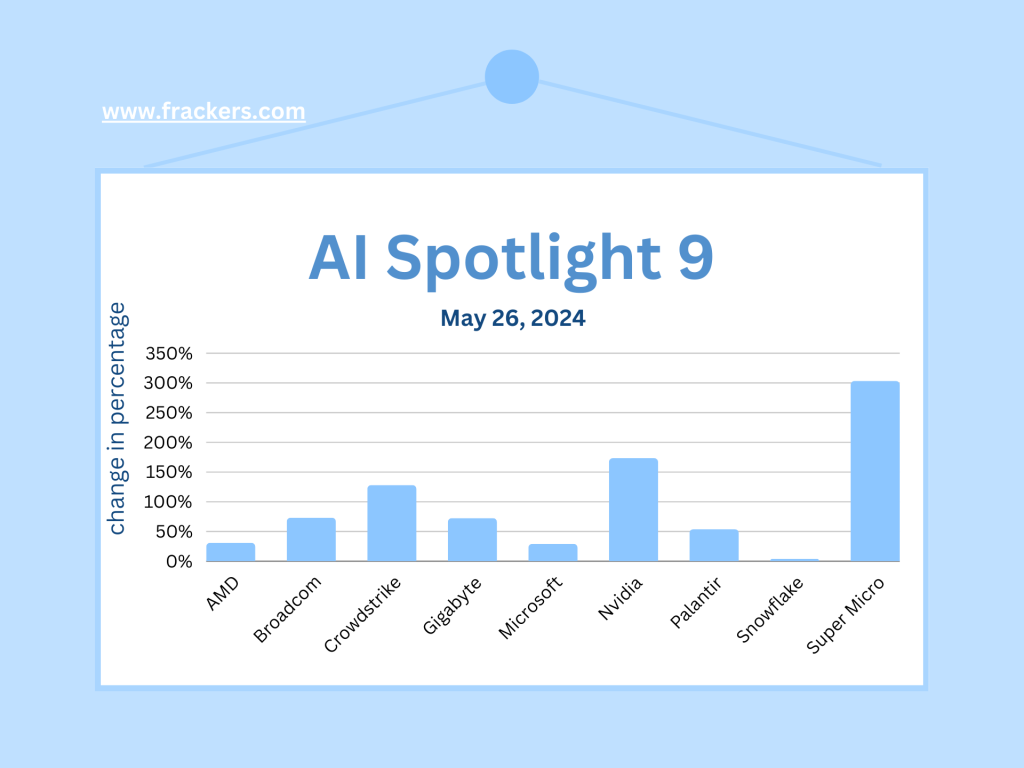

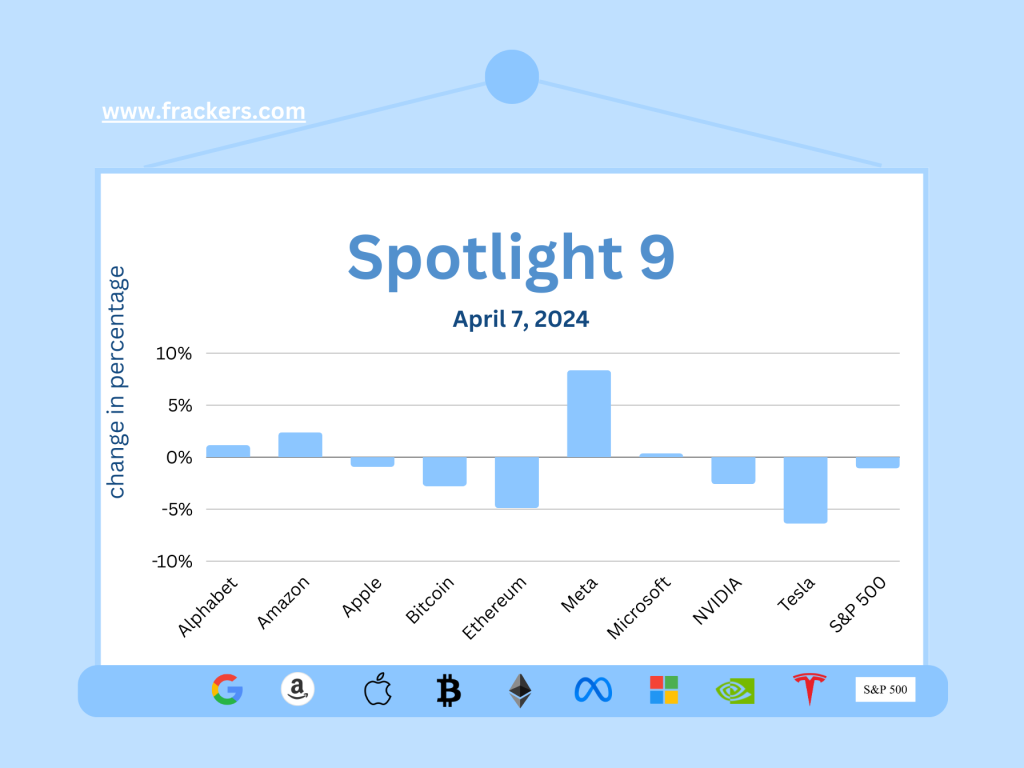

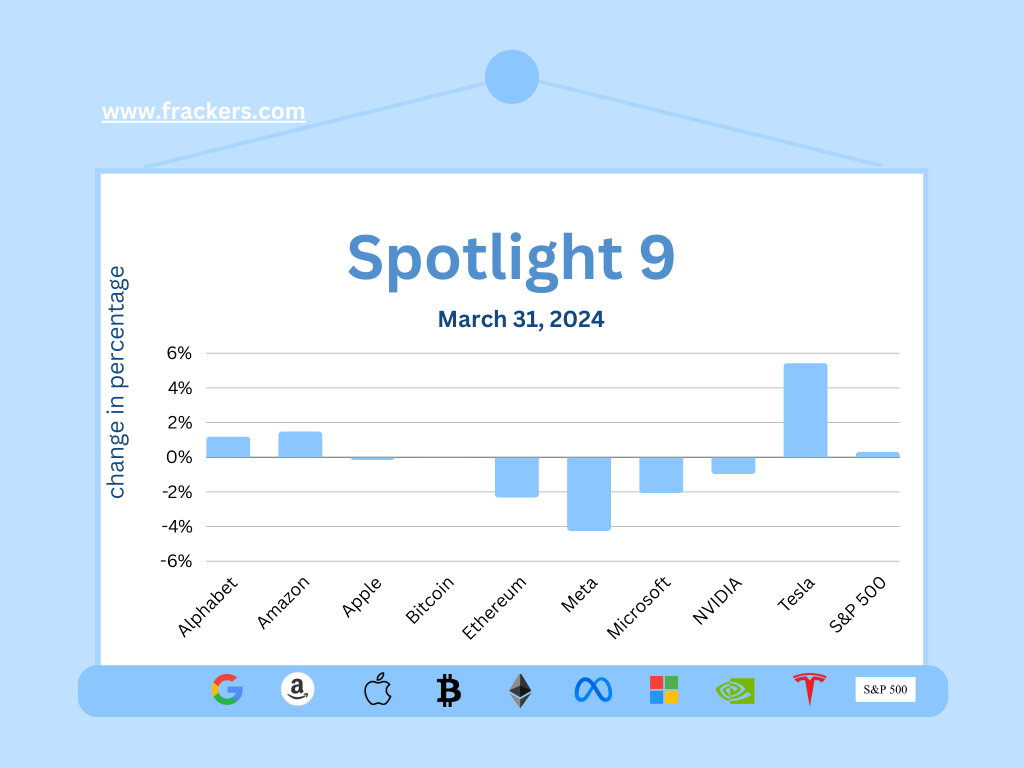

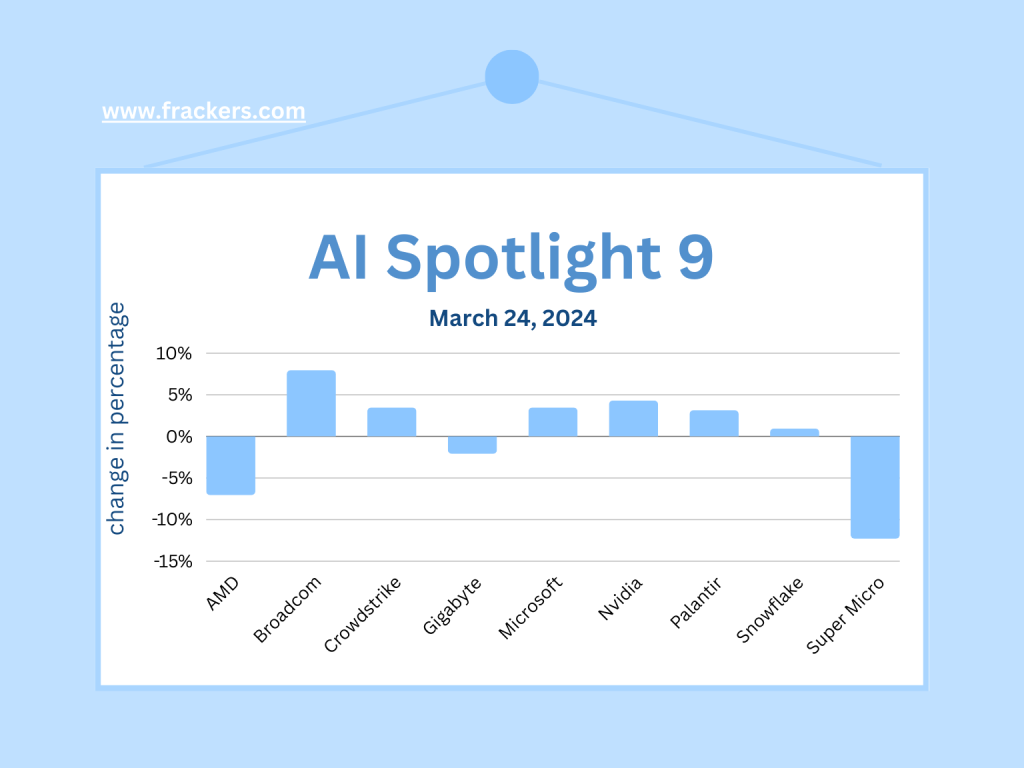

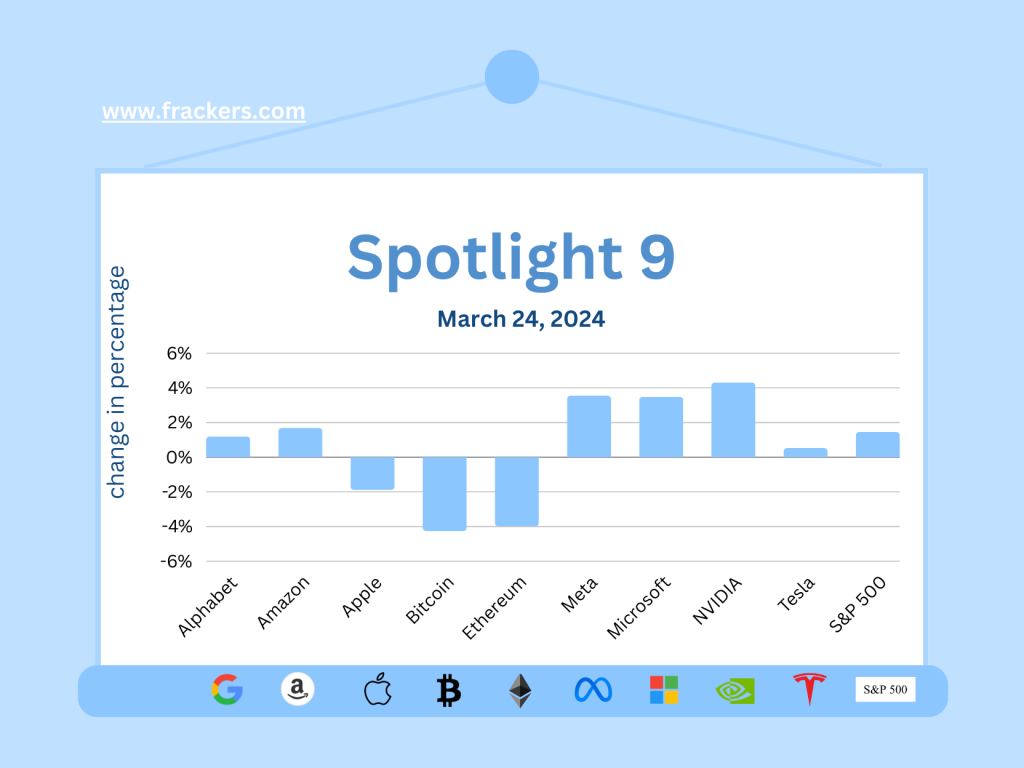

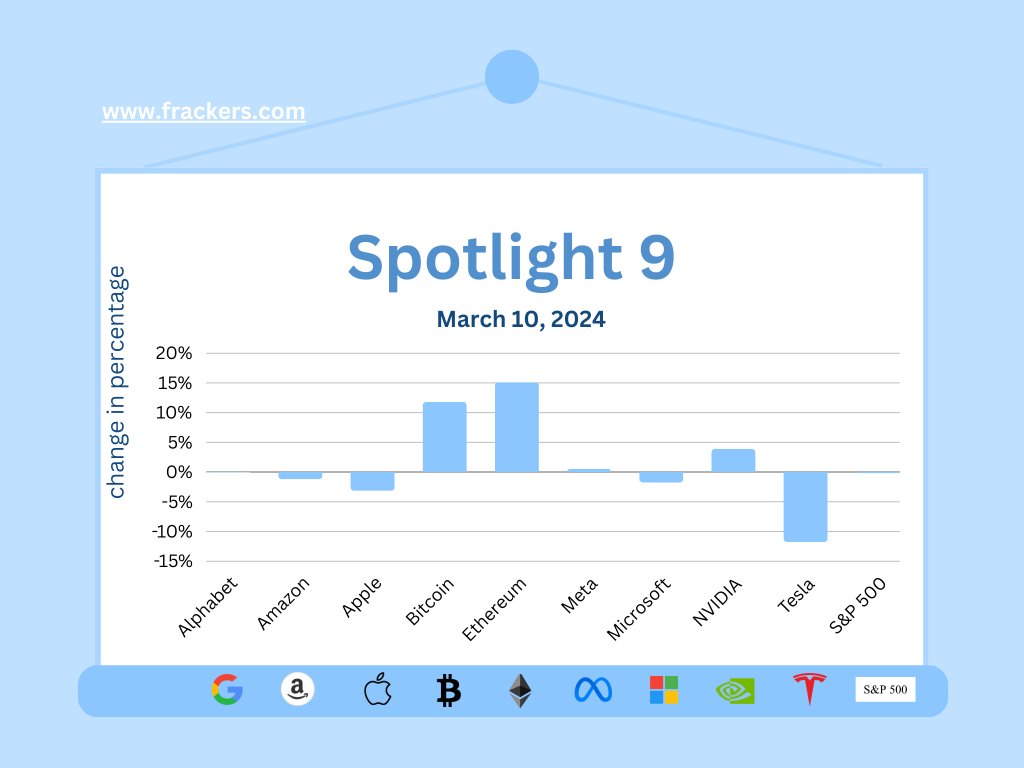

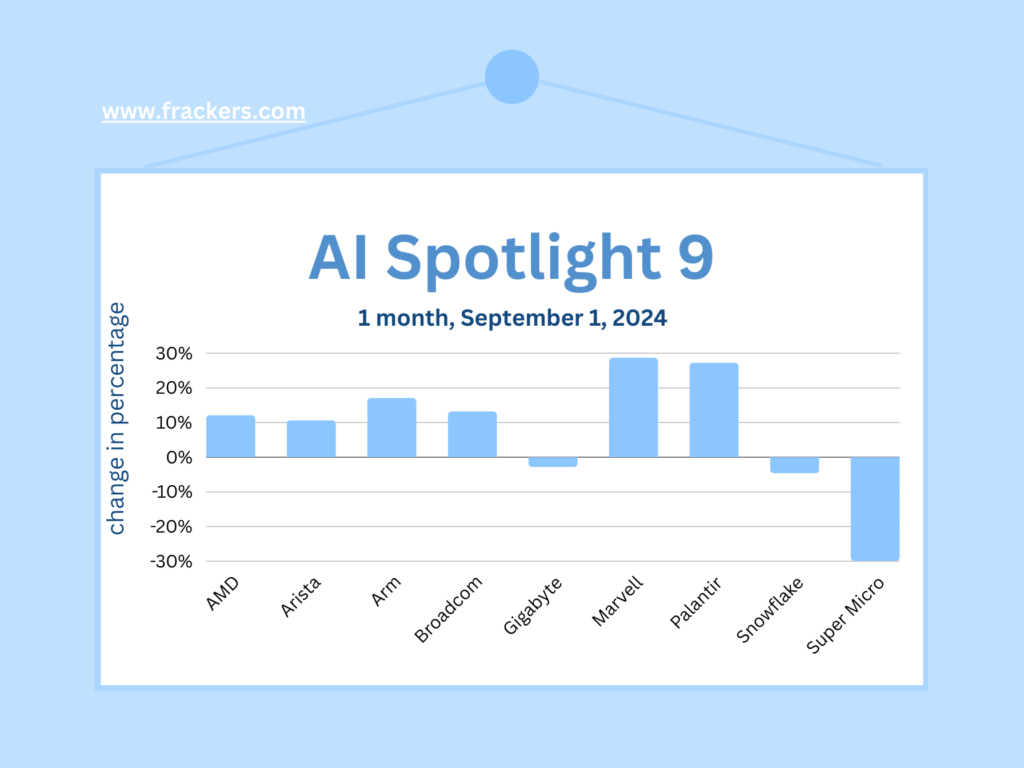

AI Spotlight 9 rose sharply in August

While NVDA shares rose over 11% last month, it was also a fine month for many other companies benefiting from the rise of AI. Super Micro took a huge hit after it failed to produce its annual results on time.

My totally subjective AI Spotlight 9 has been updated and I have added Arm (chips), Arista (networking) and Marvell (chips). After all, Nvidia, Google and Microsoft are already in the "regular" Spotlight 9 of leading tech investments.

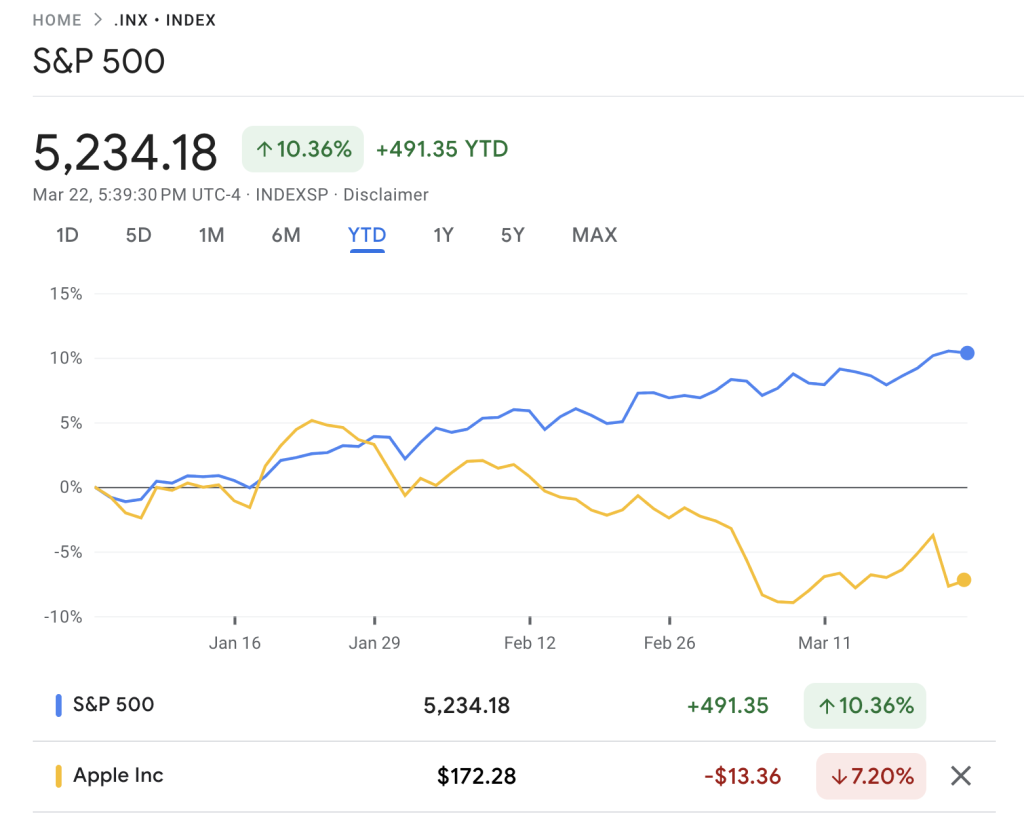

The S&P 500 closed very close to its all time high on Friday August 30th. Shares rose in the last 10 minutes of trading on Wall Street, with the S&P 500 up 1% and all major sectors on the rise. But the outlook for September is less bright.

Since 1950, the S&P 500 has generated an average loss of 0.7% in September and finished higher only 43% of the time, making September the worst month for stocks based on average return and positivity percentage. The past four September months have also been remarkably weak, with respective declines of 4.9%, 9.3%, 4.8% and 3.9% for the index. It will be interesting to see how tech stocks and especially AI companies do in the coming weeks.

AI versus climate

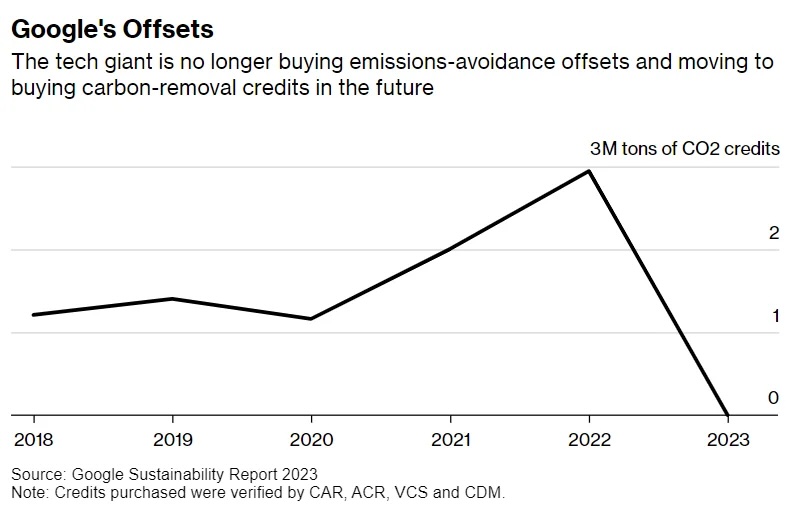

Due to the huge growth in data center energy consumption in pumping AI applications like ChatGPT and Google Gemini, tech giants risk missing their climate goals, usually ambitiously defined as "net zero," or carbon-free operations. There is great concern that smart techbros like Bezos are indirectly manipulating the definition of zero emissions

The Financial Times is particularly concerned about the influence of Amazon and Jeff Bezos's $10 billion Bezos Earth Fund on the carbon credits market, especially through its funding of the Science Based Targets Initiative (SBTi). The SBTi sets standards for corporate climate goals, but experts worry about potential conflicts of interest as large technology companies, including Amazon, want more flexibility in using carbon credits to achieve net zero targets.

This influence could change the way climate standards are set, potentially favoring cheaper carbon credits over actual emission reductions. Compare it to a penalty taker in soccer who often misses, upon which he decides to make the opponent's goal thirty feet wider and higher. And as a goalkeeper a garden gnome.

Telegram and X crackdown

Once upon a time, the credo of telecom operators was "we have zero responsibility about our customers' messages". For Internet service providers, I unfortunately know from experience, this was not such a simple matter. I wrote about that earlier. For social media, it is even clearer that they should intervene whenever possible if their networks are being used for criminal activity. The Washington Post explains it clearly:

"Global Internet regulators are no longer playing around. Two days after France sued Telegram CEO Pavel Durov on several charges, Brazil on Friday ordered the suspension of Elon Musk's X after it ignored an order to appoint a legal representative in the country. While the details differ in important ways, both cases involve democratic governments losing patience with cyberlibertarian tech magnates who perhaps turned their noses up at authorities a little too often.

The crackdown, which comes months after the passage of a law in the United States that could lead to the banning of TikTok, heralds the end of an era. Not the era of social media, which is still going strong. But the era when tech giants had free rein to shape the online world - and enjoyed a presumption of immunity from real-world consequences.

Although unfettered Internet companies have long clashed with authoritarian regimes - Google in China, Facebook in Russia or pre-Musk Twitter in Turkey - Western governments did not, until recently, consider social media and the vision of free speech they promoted to be fundamentally at odds with democracy. Politicians and regulators recognized that there were bad things on the Internet, condemned it and sought ways to limit it. But banning entire social networks or arresting their executives was simply something liberal democracies did not do. Now, for better or worse, they do."

The arrest of Durov in France is akin to firing a gun at a gnat. But until the full charges are revealed and it is clear what crimes Durov is accused of, it also remains difficult to vouch for his innocence. If Telegram is actually being used for pernicious activities and could well have intervened, appropriate punishment is warranted.

Friend of Taylow Swift and his brother podcast for $100 million

The Kelce brothers make a nice podcast, and the fact that the youngest brother is Taylor Swift's bearded arm candy also won't have deterred them from striking a $100 million deal with Amazon, which is trying to bring in more ad revenue. Actors Jason Bateman, Will Arnett and Sean Hayes struck a similar deal with satellite radio station SiriusXM early this year for their podcast, also for $100 million.

But Alexandra Cooper's podcast is the clear winner with the very well chosen name for her podcast Call Her Daddy, Cooper is reportedly getting $125 million from SiriusXM over three years.

Battle over AI photos enters new era

While Elon Musk's picture maker Grok seems to know no limitations, spitting out everything from famous singers in lingerie to Kamala Harris with a firearm, the launch of the web version of Midjourney has been much less in the news.

That's a shame, because Midjourney is a fantastic tool that was previously only available via the cumbersome Discord. Fascinatingly, Midjourney also plans to get into hardware. Since hardware head (his real title) Ahmad Abbas previously worked on the Apple Vision Pro, some think it will be "smart glasses" but Midjourney CEO David Holz is far too smart for that. Everyone knows that if you want to make money in the smart glasses business, you might as well get in the shower, light up a cigar and burn thousand-dollar bills with it.

The question is, and all suggestions are welcome: what hardware is Midjourney going to make?

Thanks for the interest and see you next weekend, then hopefully just again on Sunday!