There was not one overarching news item this week, but these are the ten things in the world of technology and innovation that caught my eye.

1. Grand Theft AI

For writing this newsletter, I take notes during the week of topics that seem interesting to me. On Saturday, I ask four AI search engines to rank them in order of relevance: ChatGPT from OpenAI, Gemini from Google, Claude from Anthropic and Perplexity, from Grand Theft AI.

At least, that's what The Verge calls the creators of Perplexity by seemingly systematically committing plagiarism:

"Perplexity is basically a profit-seeking middleman on high-quality sources. The original value of search engines was that by collecting the work of journalists and others, the results from, say, Google, sent traffic to those sources.

But by providing an answer instead of directing people to a primary source, these so-called "answer engines" deprive the primary source, ad revenue, and keep that revenue for themselves. Perplexity belongs to a group of vampires that includes Arc Search and Google itself.

But Perplexity has gone a step further with its Pages product, which creates a summary report based on those primary sources. It is not just quoting a sentence or two to directly answer a user's question - it creates a fully aggregated article and it is accurate in the sense that it actively plagiarizes the sources used.

Forbes discovered that Perplexity bypassed the publication's pay wall to provide a summary of an investigation the publication did into the drone company of former Google CEO Eric Schmidt."

So Perplexity is stealing journalists' copyrighted work. Reason for Wired to launch an investigation that was summarized with the headline, "Perplexity is a bullshit machine."

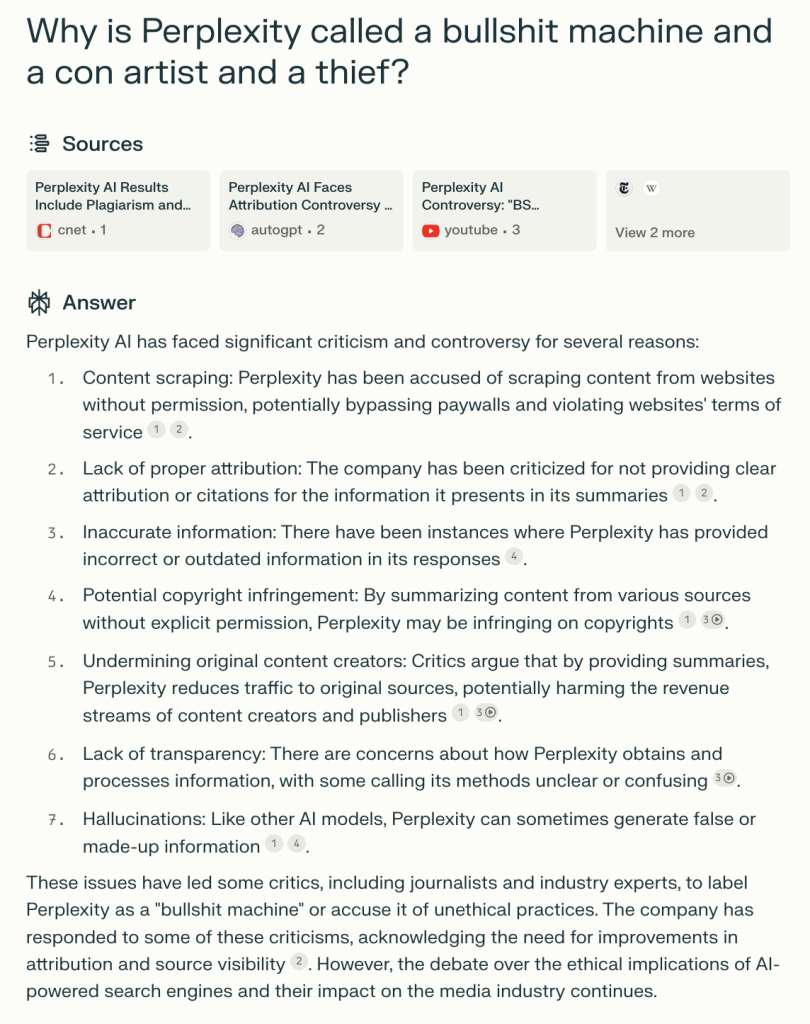

Forbes has written a neat summary of the storm brewing around Perplexity's hijacking. According to Reuters, Perplexity is not the only AI company whose business model is to steal and sell other people's information, yet there is reason enough to ask Perplexity itself how it is. So I asked it this question:

That is a clear answer, even with neat source citation above the answer.

Amazon by Jeff Bezos examines Perplexity by Jeff Bezos

The funny thing is that AWS, Amazon's hosting arm, has launched an investigation into Perplexity's practices. Because like many AI companies, Perplexity runs on AWS servers, perhaps also because it is partly funded by Amazon founder and major shareholder Jeff Bezos.

"AWS's terms of service prohibit abusive and illegal activities and our customers are responsible for complying with those terms," Amazon said, but in practice it won't be too bad because Bezos will never allow his own investment in Perplexity to be wiped out by Amazon.

2. MIT pioneer finds generative AI overrated

MIT Professor Emeritus of Robotics Rodney Brooks finds Generative AI, the type of AI based on Large Language Models (LLMs) such as Perplexity and ChatGPT, impressive technology, but perhaps not as capable as many suggest. " I'm not saying LLMs aren't important, but we have to be careful how we evaluate them," Brooks told TechCrunch.

He says the problem with Generative AI is that while it is perfectly capable of performing a certain set of tasks, it cannot do everything a human can, and humans tend to overestimate its capabilities.

"When a human sees an AI system perform a task, they immediately generalize that to things that are similar and make an assessment of the AI system's competence; not just performance on that task, but competence around it," Brooks said. "And they tend to be very overoptimistic, and that's because they're using a model of a person's performance on a task."

He added that the problem is that generative AI is not human or even human-like, and it is wrong to ascribe human capabilities to it. Brooks' view echoes analyses by Martin Peers and Jenn Zhu Scott, which I wrote about earlier this month.

By the way, some self-reflection is not foreign to Brooks: on his own blog, he tracks the accuracy of his own predictions. Including self-conceived color system, very interesting.

3. Applications for Solana ETFs.

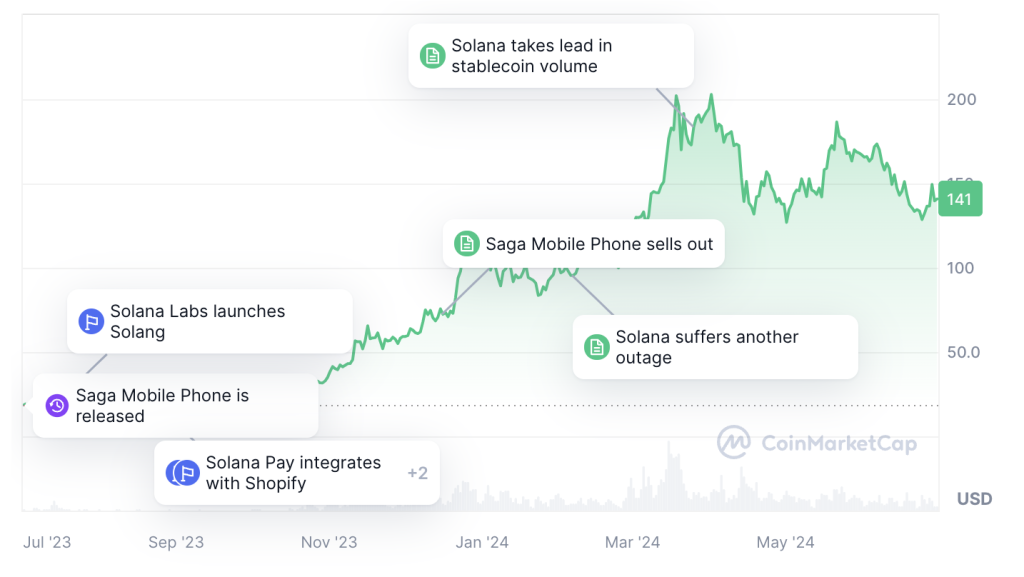

Applications were filed on Thursday and Friday for permission from US financial authorities to launch exchange-traded funds(ETFs) for cryptocurrency Solana.

It marks an extraordinary last year for Solana, in which it grew rapidly as a platform for decentralized applications due to high speed, low cost and good development tools, and also saw the value of the SOL token increase by as much as 648%.

After Bitcoin, Ethereum and BNB, Binance's token, Solana is now the fourth largest cryptocurrency in the world measured by total market value. Judging by developments, Solana will pass BNB before the end of this year and become the third largest cryptocurrency in the world after Bitcoin and Ethereum, not counting stable token USDT (the digital counterpart to the dollar).

SEC vs. Metamask

It wasn't all celebration in the world of Web3, as the crypto world likes to call itself these days. On Friday, it was announced that the U.S. securities watchdog SEC is filing a lawsuit against Consensys, best known as the maker of the popular Metamask wallet.

According to the SEC, Consensys operates Metamask as an unregistered broker. A substantively nonsensical argument, since Metamask provides a technical service where users exchange cryptocurrencies with each other. The SEC's argument would mean that the sale of envelopes is also subject to regulation because people sometimes put money and sometimes gift cards in them to give or sell to each other.

Rather, the value of the SEC should be to use meaningful definitions to determine the difference between when a cryptocurrency is a means of payment, when it is an investment and when it is a voting card. The difference between a love letter or a death threat is in the content of the text, not the form of transmission.

President Biden and his comrade Gary Gensler, head of the SEC, are as savvy in the crypto world (excuse, Web3 world) as Don Quixote and Sancho Panza are in the fight against windmills. In a presidential race that, at least until last week's debate, still seemed difficult to predict, it is also politically awkward of Biden to continually battle Web3 (I'm learning).

The percentage of voters among people active with technology and Web3 is high, while few votes can be won by continuing to kick against Web3 in this way. Smart politicians do not make neck-and-neck issues about which at best they can stumble and with which they can win little. Meanwhile, Trump appeared as a cheerful guest on a popular technology podcast.

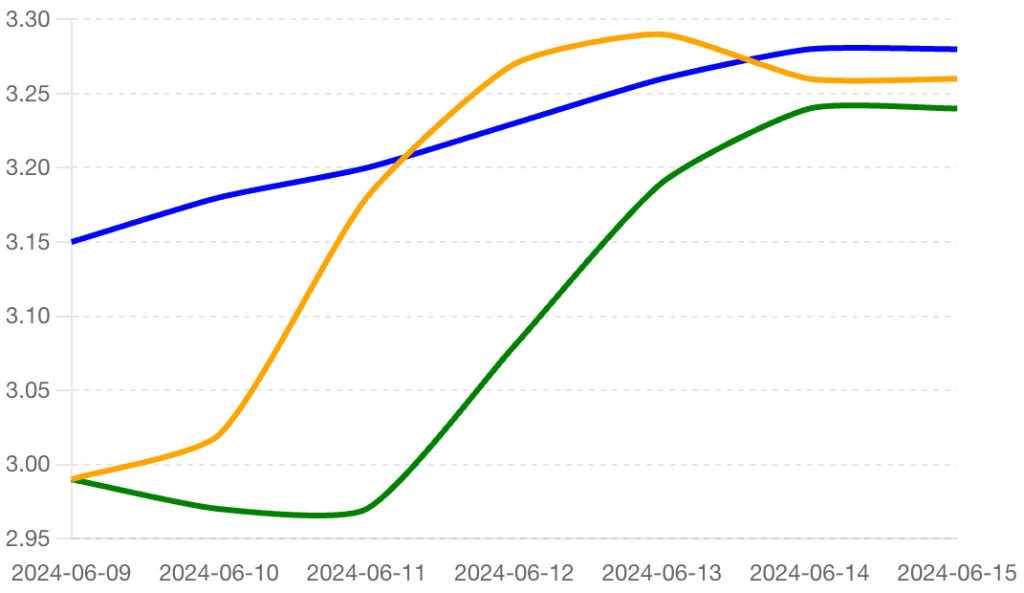

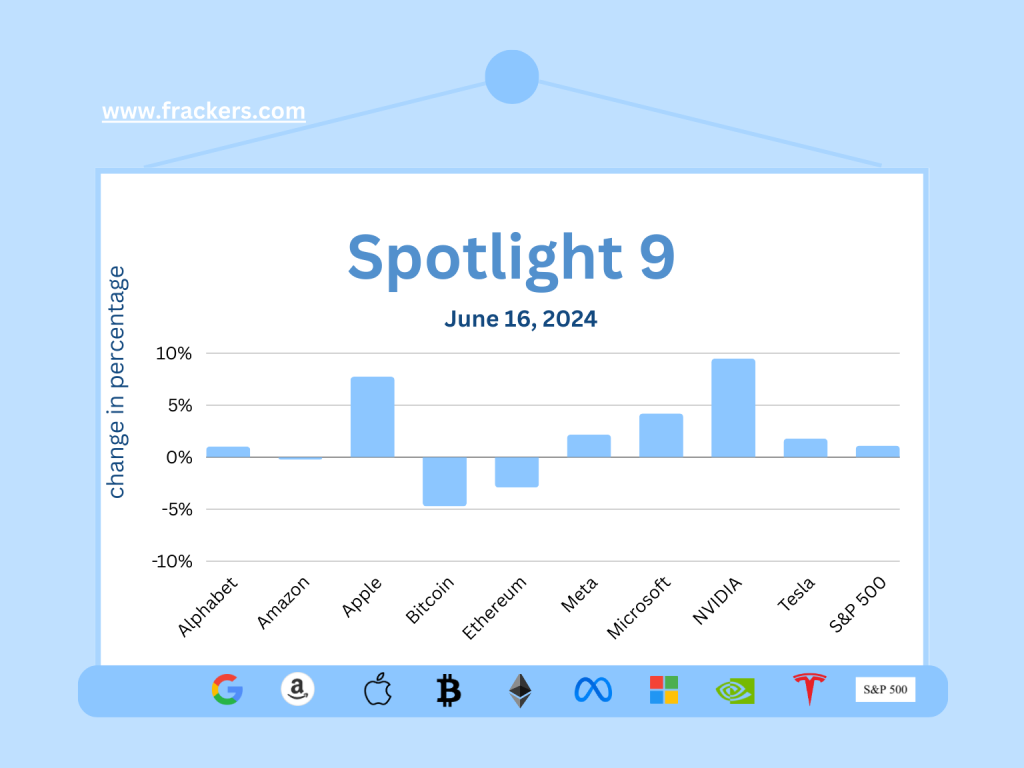

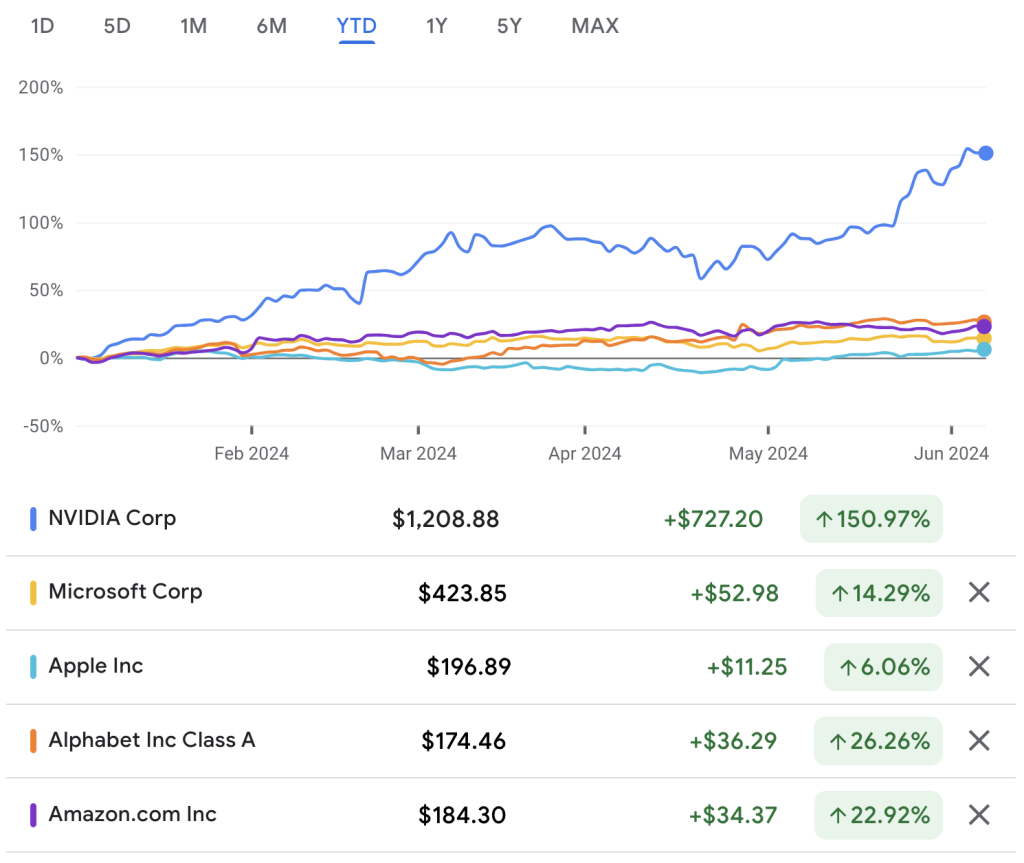

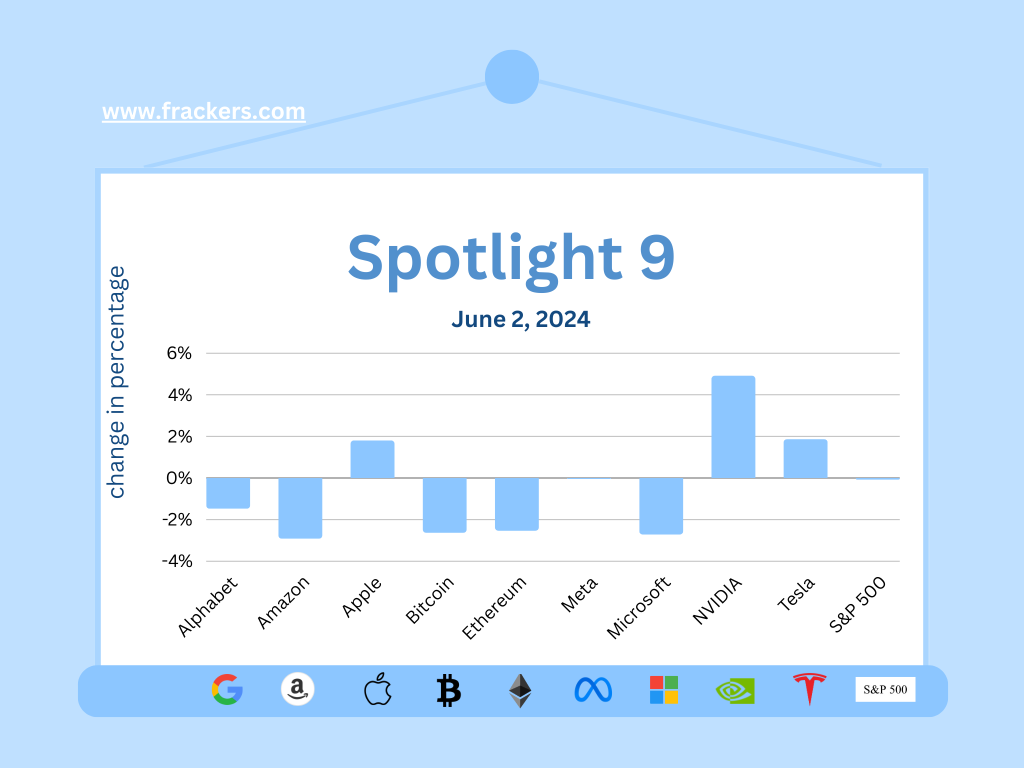

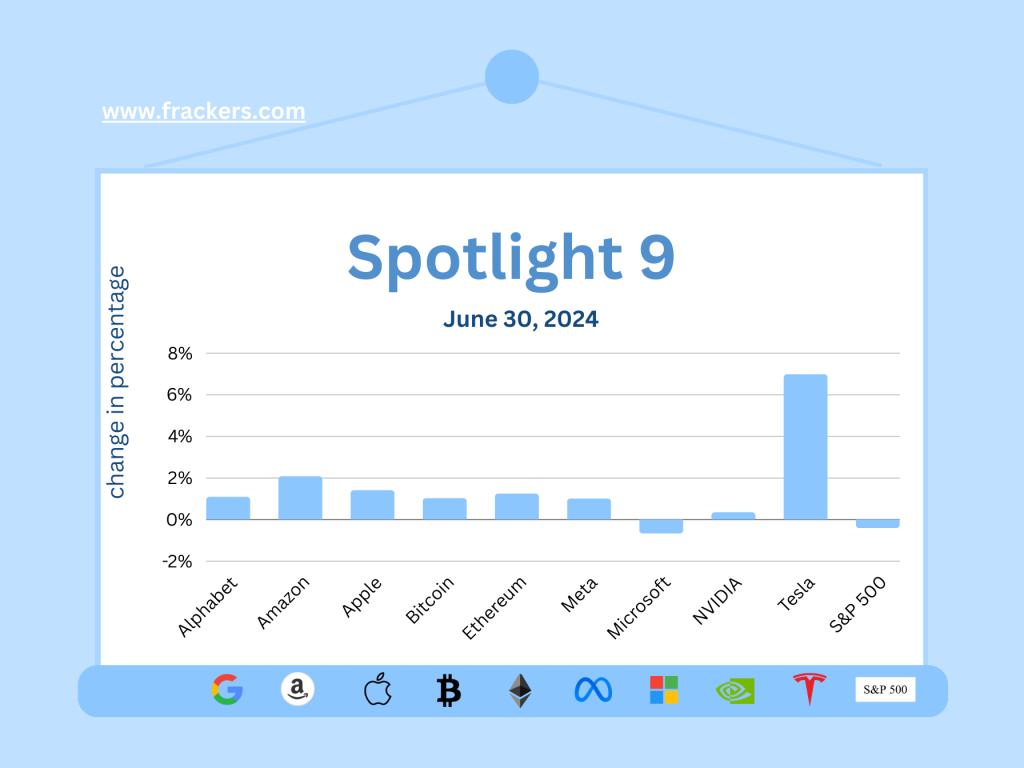

It was otherwise a rather soporific stock market week, with Nvidia recovering slightly from a share price decline due to profit grabs earlier this month. Microsoft is again the world's most valuable company, Apple number two and Nvidia number three.

As often said, let's look again at the end of the year. Unlike Professor Brooks, I hardly ever predict anything, but the prediction that Nvidia, unlike Microsoft and Apple, will come out with downright spectacular third-quarter earnings, I dare you.

4. Three tons of damages due to faulty facial recognition

The U.S. city of Detroit is paying three hundred thousand dollars in damages to a man who was wrongly designated a shoplifter due to improper use of facial recognition technology.

It won't be the last time that too much reliance on complex technology leads to the wrong conclusions. With facial recognition, more often a problem is that people of color are confused with each other.

iPhone users can test it for themselves on their own photos. If there are no dark-skinned people among them at all, it might be a clue to get out of one's own bubble more often.

5. Electric car battery charges in 4 minutes 37

British start-up Nyobolt has charged an electric car's battery from ten percent to eighty percent in just four minutes and thirty-seven seconds. This breakthrough, demonstrated with a purpose-built concept sports car on a test track, surpasses the current performance of Tesla superchargers, which take about fifteen to twenty minutes for a comparable charge.

The question, of course, is what this technology will cost and how soon fast chargers will be available en masse. Tesla recently had to sharply scale back its ambitions to install an infrastructure for fast chargers across the United States. So the question is with which partners Nyobolt will do the rollout.

6. 'Apple builds cheaper Apple Vision Pro'

The plan was to make a standard version of the Vision, as with the iPhone, and a more expensive Pro line. However, the plans seem to have changed and the result seems to be that a new Apple Vision will be on the market for just over half the money, but with a much worse resolution.

Unlike with phones, resolution is critical with a VR device. It is that very aspect that was rated so highly when the Vision Pro was introduced. But the device is too expensive and apparently that quality cannot be mass produced at a lower price for now.

Not plagued by false modesty, for a comprehensive analysis I gladly refer to my piece from last May in which I wrote:

"All the omens are that the Apple Vision Pro will be a flop - a flop by Apple standards, that is. But that's not a bad thing at all. At least Apple is trying to develop something new again, and that's better than unimaginatively buying back its own shares for hundreds of billions, as it has in recent years."

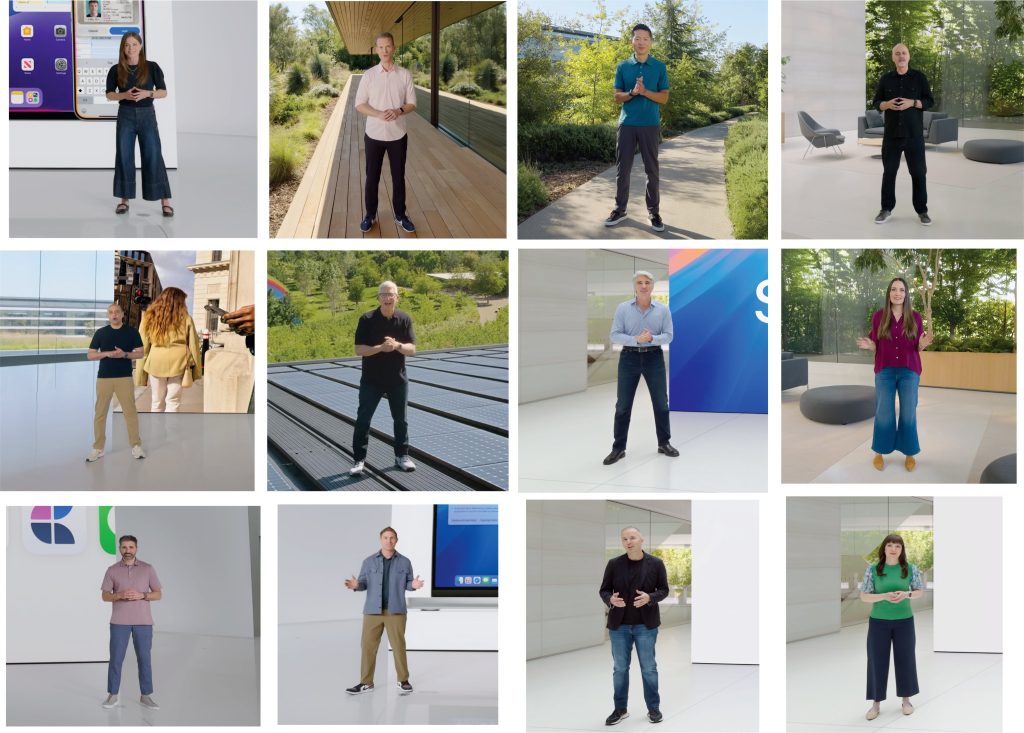

The good news for Apple is that the iPhone 16 does appear to be a sales success. Not only because of a new "capture" button, but because the expected AI features will only work on the iPhone 15 Pro with the A17 Pro chip.

No less than two hundred and seventy million iPhone owners have not updated it for four years, but if they want to use AI they will now have to. And that's good news for Apple.

7. Bad news for people with fear of flying

It's not because the media have seen articles about it click extremely well and thus there is a lot of media coverage of the phenomenon, it also turns out to be reality: Clear Air Turbulence (CTA), turbulence in clear weather, is more common than ever.

Last month, one person was killed and several passengers seriously injured when a Singapore Airlines plane bounced up and down for a minute. Surprisingly, for once it wasn't Boeing's fault.

This research from the University of Reading shows that severe turbulence in clear weather in the North Atlantic, for example, was 55% more frequent in 2020, than in 1979, "consistent with the expected effects of climate change.

8. Marc Andreessen looks back on Mosaic and Netscape

Marc Andreessen and Ben Horowitz, founders of investment firm Andreessen Horowitz (known for Facebook, Airbnb, Instagram, Zoom and many other successful companies), look back at the breakthrough of the Internet, when Andreessen co-founded Mosaic (the first Internet browser with, how is it possible, pictures!) and Netscape, the company that launched the dotcom boom.

The recap is especially interesting because the gentlemen both share many insights relevant to anyone working in the field of innovation and technology. This podcast is highly recommended.

Also frequently recommended by me: the two books Ben Horowitz wrote about entrepreneurship. First, The Hard Thing About Hard Things, about building a startup, with especially sharp analysis about what he did wrong with his company Opsware and what lessons he and the reader can learn from it.

But What You Do Is Who You Are, on how a company can build (or tear down) its own culture, is also very worth reading; even if you don't work at a startup but value a good company culture and a pleasant place to work.

9. Why women need less exercise than men

There is a difference between the sexes, which I have suspected for some time; but this time research has been done on how much exercise we need for a healthy heart and for once it is in favor of women.

A study of four hundred thousand people shows that men need to exercise five hours a week to achieve maximum positive effects for their hearts, compared to women only two and a half hours a week.

Why men are more likely to have heart attacks and at younger ages than women and what we can do about it to prevent heart failure is clearly explained in this short video from the BBC.

10. Tracer webinars: Wednesday, July 3, July 10 and July 17.

This is the sixty-first edition of this newsletter and except for the Christmas period, the appearance has always been weekly. During the summer period I switch to a monthly newsletter, so the next editions will appear on August 4 and September 1. Only on a special event will I send an update in between if possible.

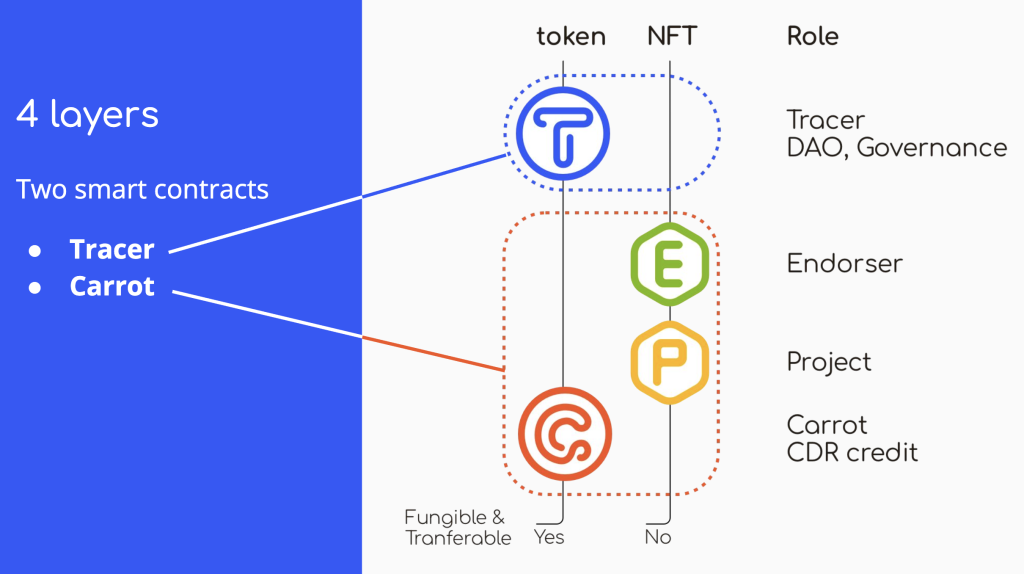

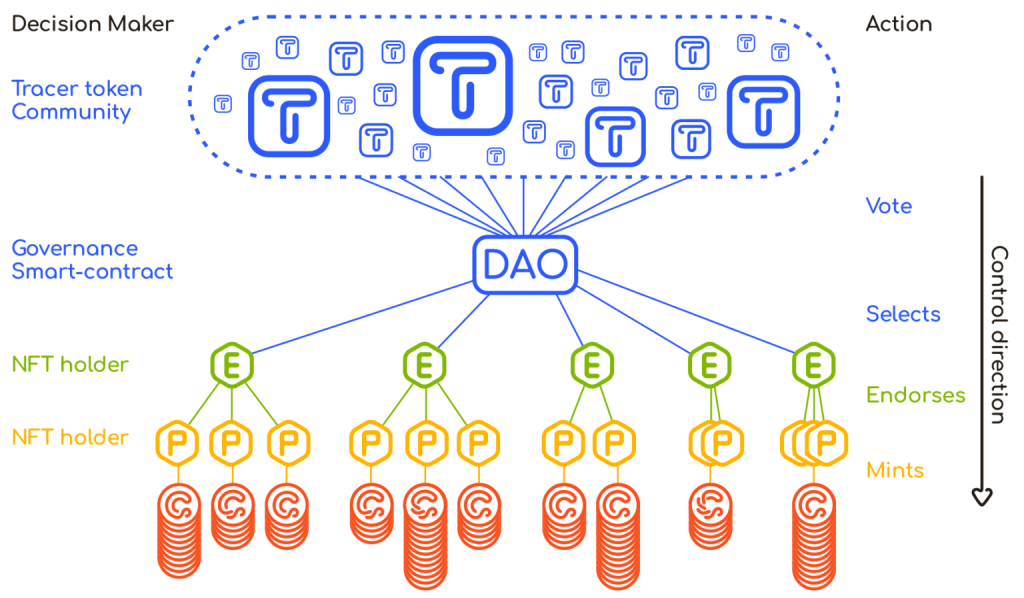

True enthusiasts 😉 Don't have to miss me all month, because this summer I'm presenting a series of webinars on the Tracer token and the Carrot (carbon removal) smart contract.

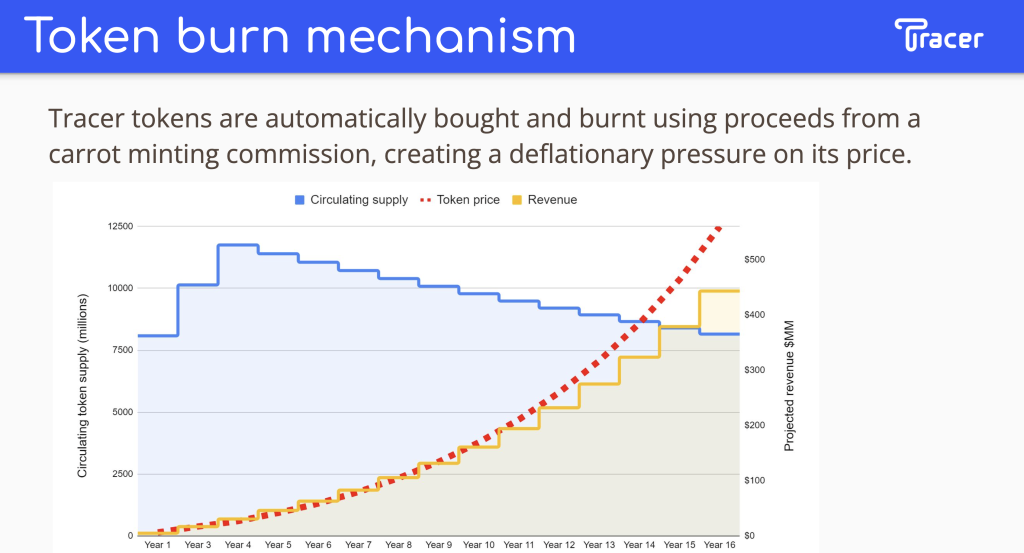

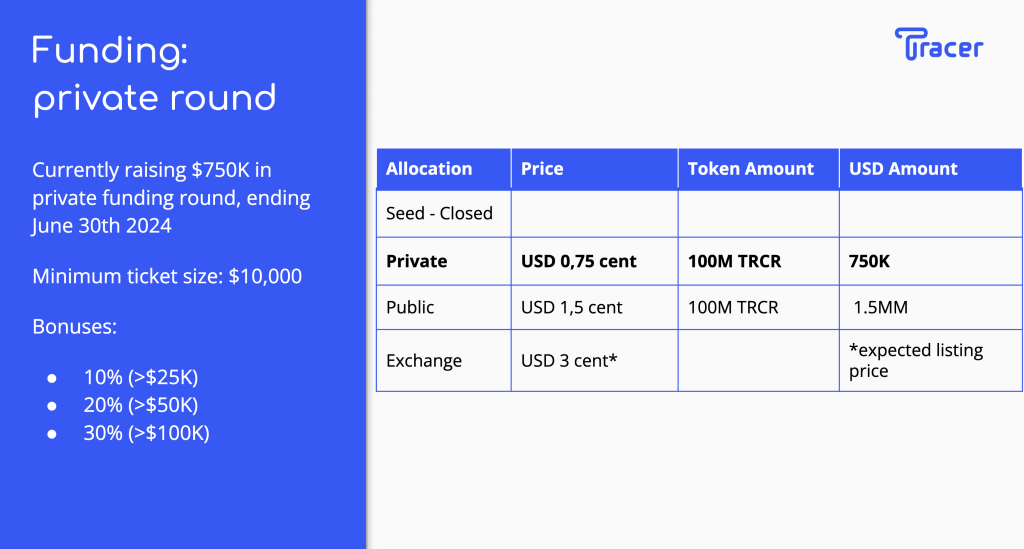

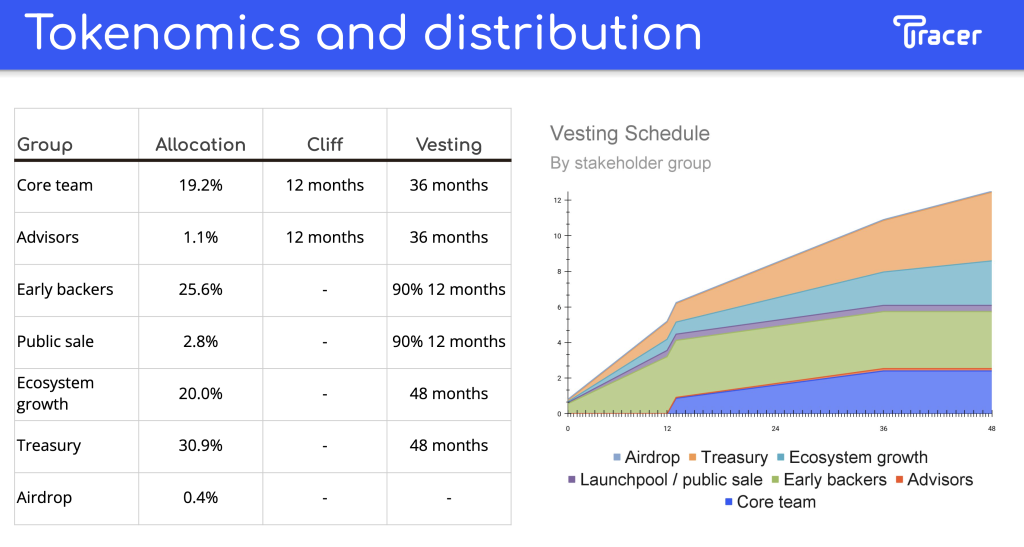

Next Wednesday, July 3, at noon Dutch time is the first webinar, in which Tracer Chief Business Officer Gert-Jan Lasterie will cover Tracer's tokenomics and explain why the token still costs $0.75 cents in the current private round and double, $1.5 cents, at the public sale later in the third quarter. Sign up for Wednesday's webinar here.

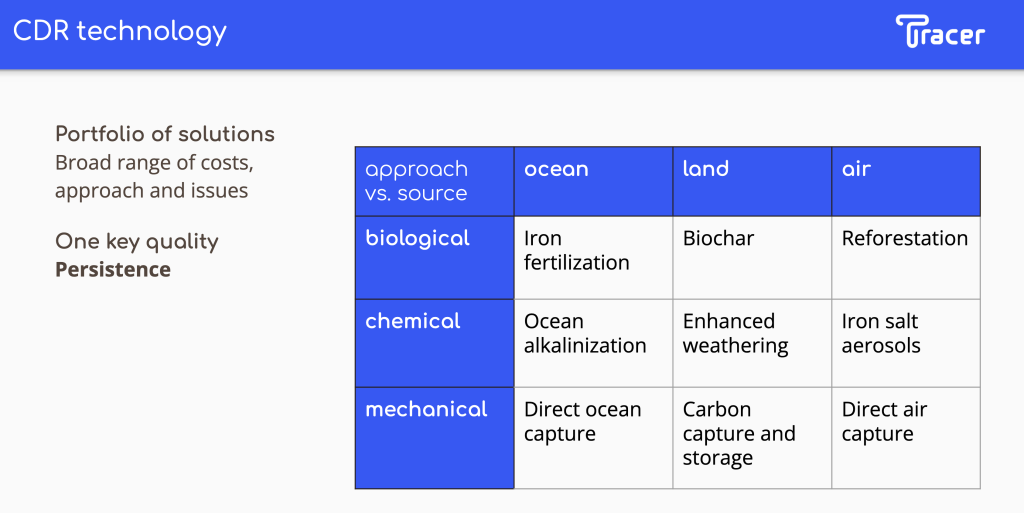

The next webinar, on Wednesday, July 10, at noon, with Tracer Chief Technology Officer Philippe Tarbouriech, will focus on the Carrot (carbon removal) smart contract and how the carbon removal credits are tokenized, and then qualified based on "grade": the duration of CO2 removal. Sign up for that Wednesday, July 10 webinar here.

Special webinar: marketing and PR in Web3

On Wednesday, July 17, there will be a webinar on the latest developments in marketing and PR from Web3 projects with a very special guest. Who that is I will announce on X and LinkedIn, so follow me there for that information and other smaller updates over the summer.

Hope to see you in the webinars and if not, see you August 4!

Happy summer,

-Michiel