Elon Musk had a fantastic week and Mark Zuckerberg saw two hundred billion in market cap evaporate as shareholders doubt his billion-dollar investments in AI. Costs are high and potential returns still completely unclear as Meta AI, powered by their latest language model Llama 3, is offered free and open source.

The sentiment that returns are unclear was also often heard about investments in climate tech, yet the world's largest investor BlackRock and Singaporean sovereign wealth fund Temasek are investing heavily in this crucial sector through a new fund: Decarbonization Partners.

Those considering investing in the rapidly developing sector of climate tech and decarbonization as well, I look forward to meeting you in May when I am in the Netherlands and Singapore. But first: the surprising week of Elon Musk and Mark Zuckerberg.

Musk wins despite gas pedal glue - yes, glue

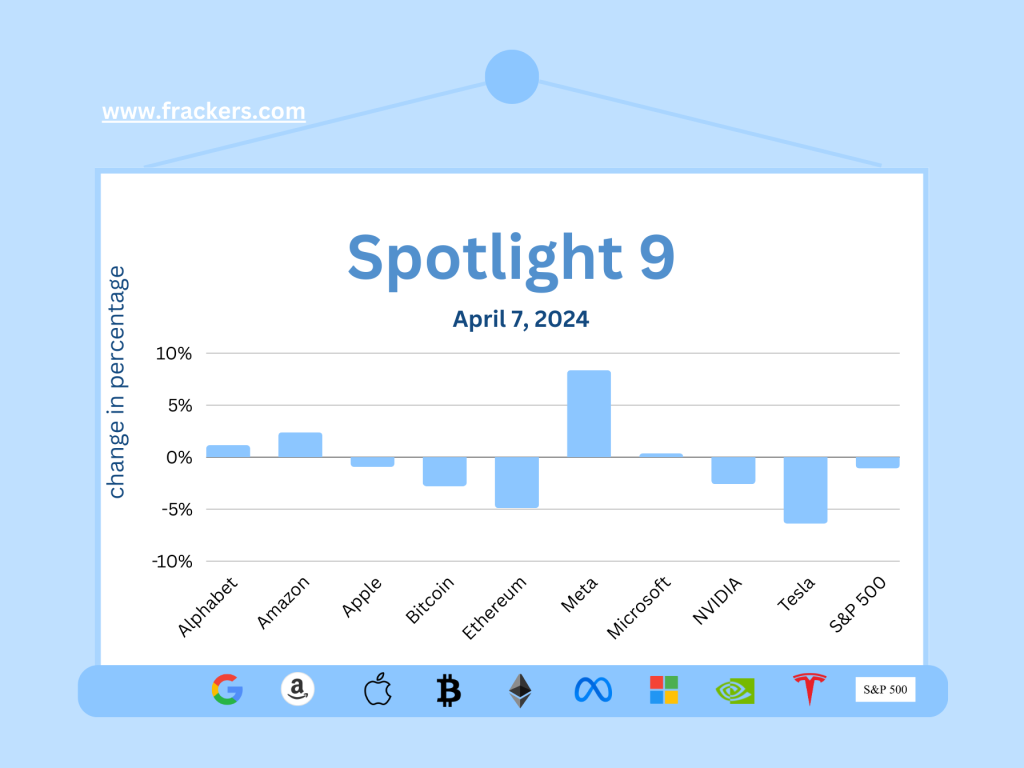

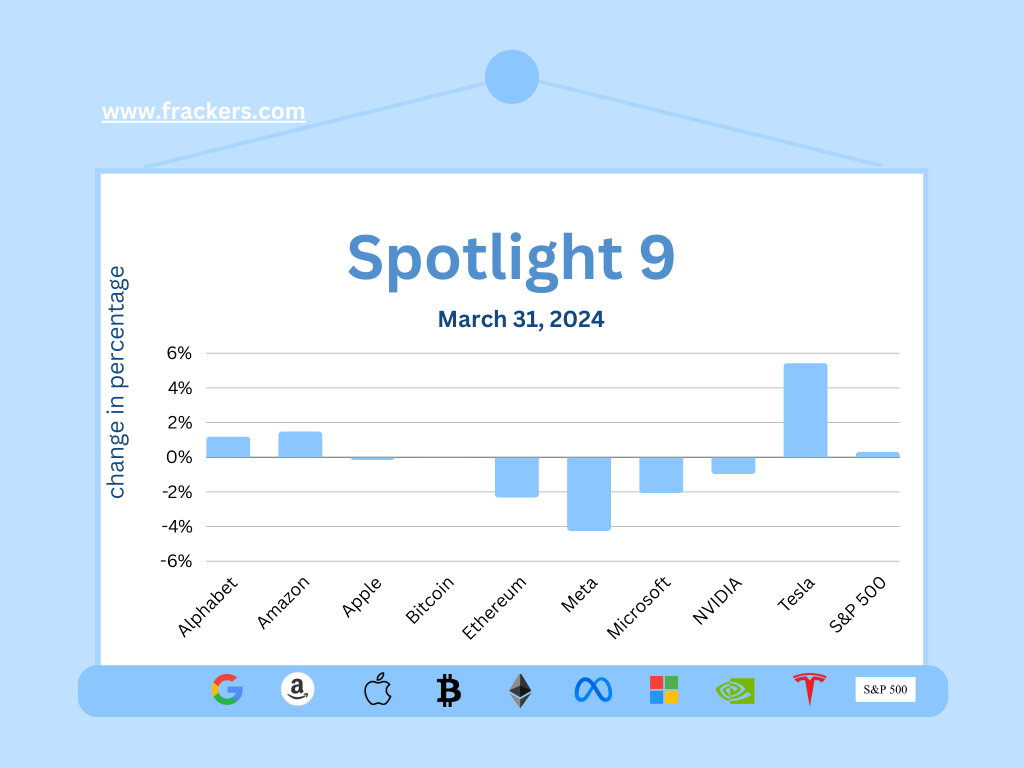

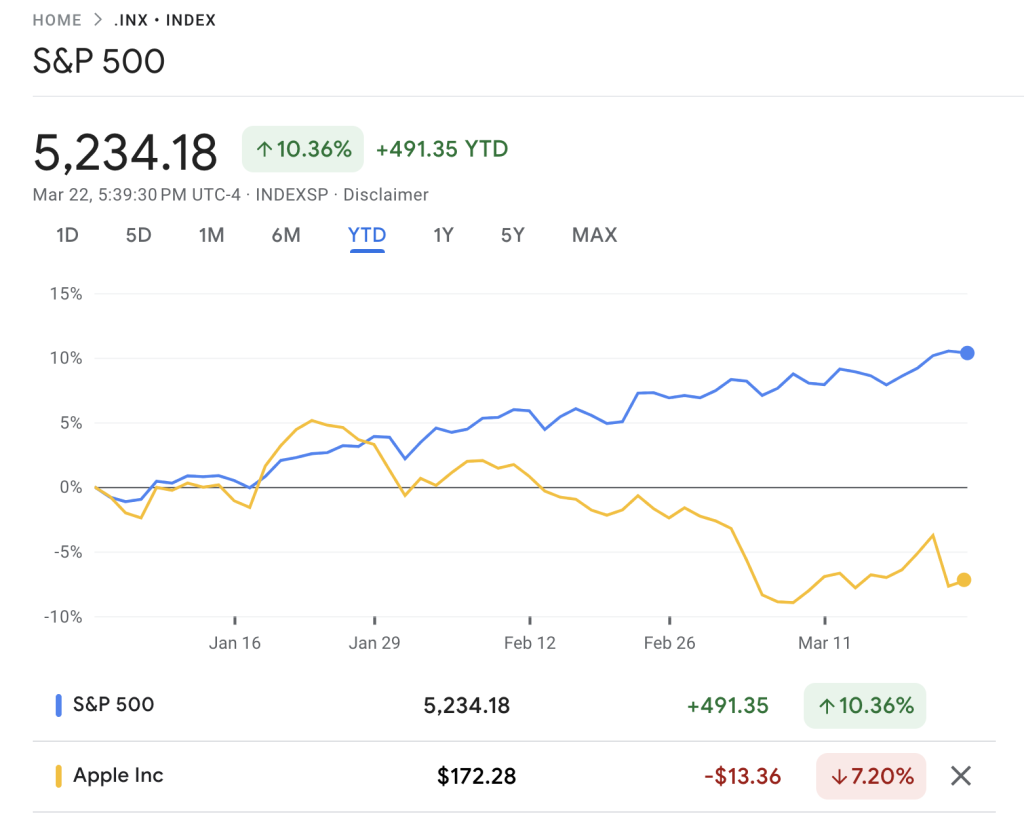

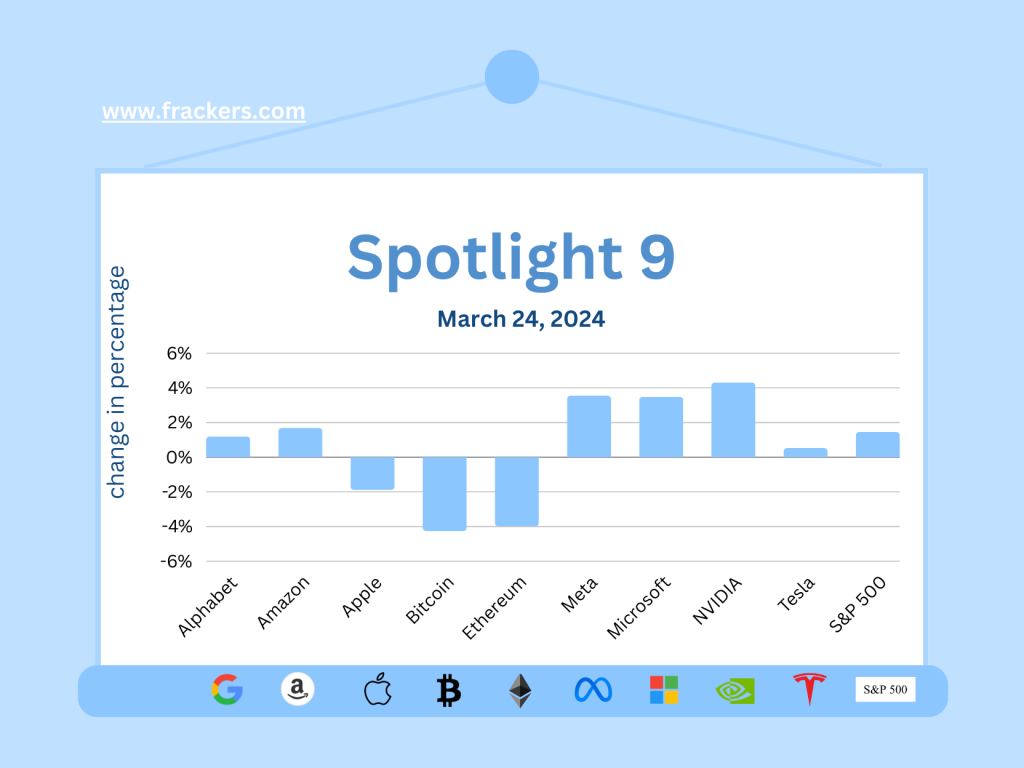

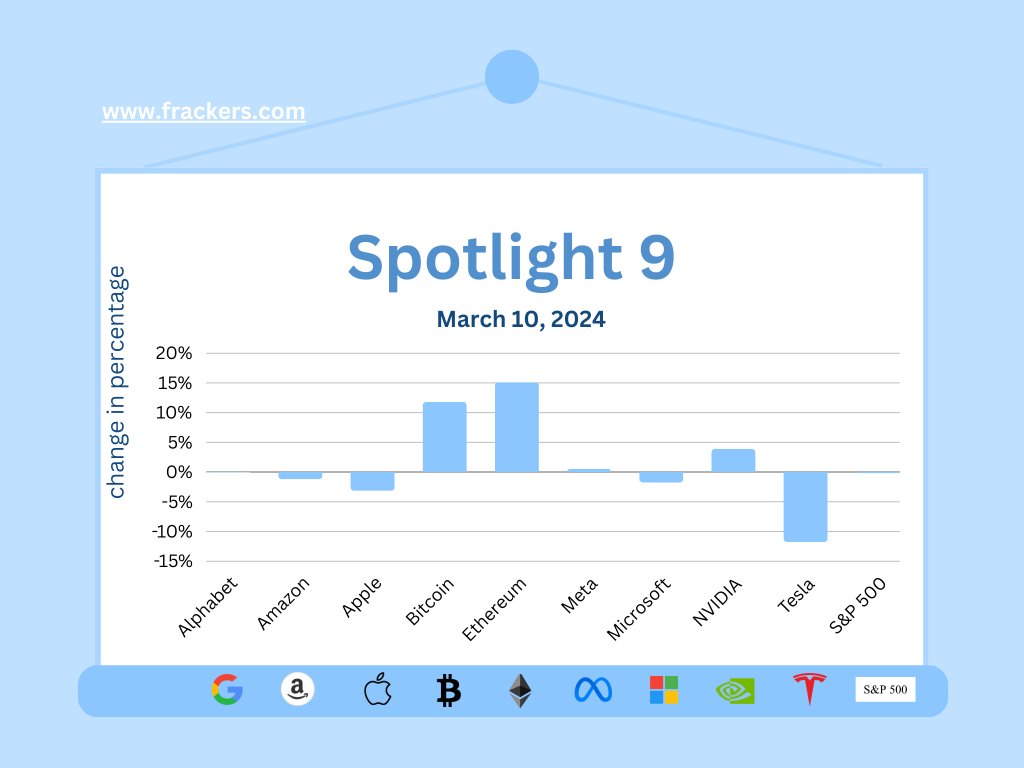

It was, as is often the case in the tech sector, a tale of two extremes this week: Tesla soared, while Meta plunged. This is especially notable because Tesla shares had slipped to $138 after reaching an all-time high of $409, while Meta was one of the biggest risers in the stock market over the last year. What happened?

After the recall of all Tesla Cybertrucks sold due to possibly glued gas pedals and unclearstories about robotaxis

were received with deafening silence from the investor side, Tesla almost hid this sentence at the bottom of page ten of its quarterly report:

"We have updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025."

In other words, Tesla's long-awaited Model 2, the cheapest Tesla ever, which is supposed to be Tesla's version of the Volkswagen Golf, the car for the masses, comes to market earlier than expected. Promptly, TSLA shares rose 12%.

Meanwhile, Musk' s intended opponent in a cage fight between what would have been the two palest fighters in the history of martial arts, Meta's Mark Zuckerberg, had one of those moments when your confidence overrules your sanity.

Zuckerberg punished for candor

During Meta's quarterly earnings presentation, Zuckerberg let slip that it will take "a number of years" before investments in AI will translate into profits. Zuckerberg added truthfully that once Meta has found a revenue model, it will be very good at monetizing it.

Only nobody heard it anymore, much like when a party runs out of drinks and snacks, then the sound system breaks down but the host happily suggests that we all hold hands and sing together. Result: a 16% collapse in Meta's share price and a loss of two hundred billion dollars in market cap.

Meta lost as much as forty-five billion dollars since 2020 via its Reality Labs division on investments in smart glasses and not-yet-existing Metaverse business. No shareholder wants Zuckerberg to lose that kind of money on his investments in AI, while meanwhile the good ole' ad business is doing spectacularly well: also because Chinese discounters Temu and Shein advertise for billions via Facebook and Instagram, ad revenue rose 27% to over $35 billion in the first quarter.

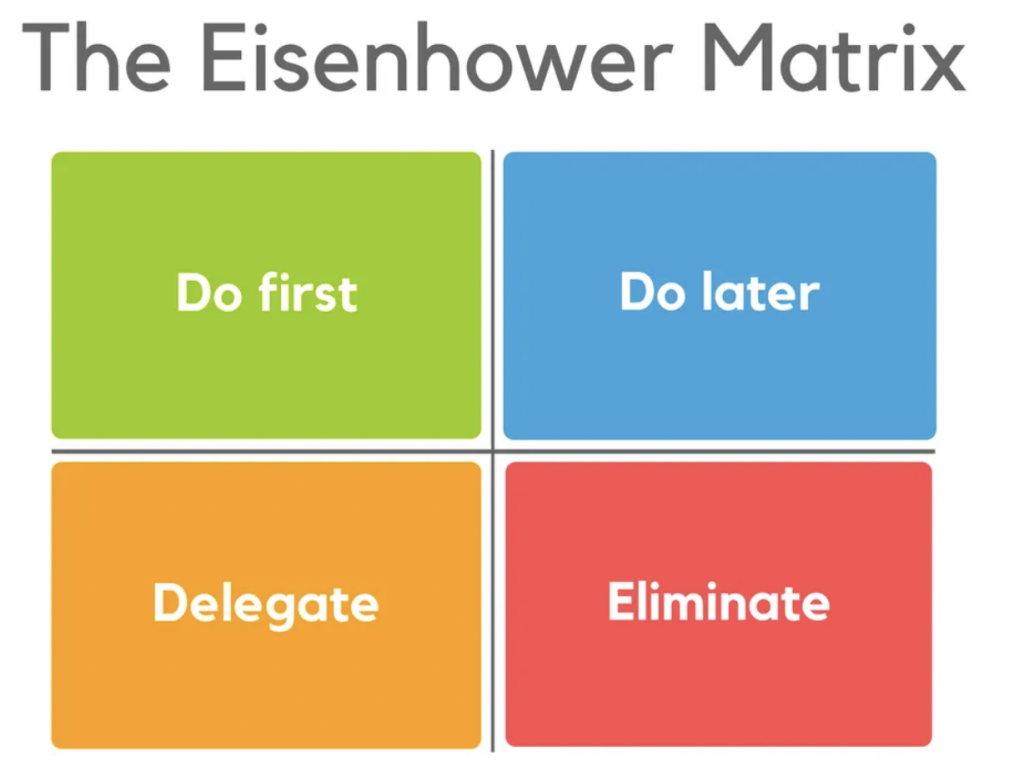

Shareholders think about today, investors think about tomorrow

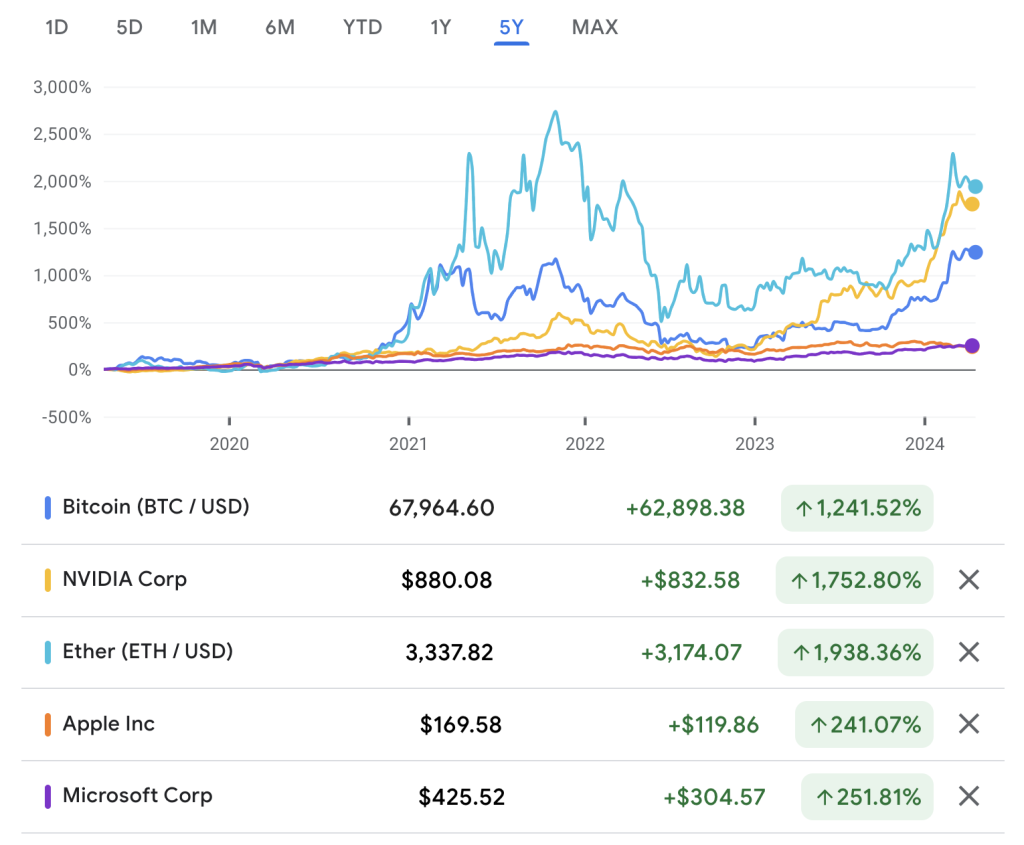

Shareholders would rather grab dividends than invest. Google owner Alphabet became worth two trillion dollars (two thousand billion) this week after it announced it would pay twenty cents per share in dividends and buy back its own shares for seventy billion dollars. This makes Alphabet the fourth most valuable company in the world after Microsoft, Apple and Nvidia.

This ignored the fact that Google's revenue growth, like Microsoft that presented outstanding quarterly numbers, was also driven by substantial growth (thirty percent) in cloud services, in which AI played a major role.

Yet Google, like all other tech companies, should be valued more on long-term vision and making the right choices in the process. Cloud services, with nine billion in revenue, are almost seven times smaller than ad revenue (62 billion), because for too long there was too little focus on cloud services and AI. Since then, Google has been playing catch-up.

Elon Musk is often ridiculed, sometimes rightly so, but anyone who looks a little longer at his activities has to admit that he possesses the rare combination of skills in being able to analyze the market correctly and subsequently position his own companies in them.

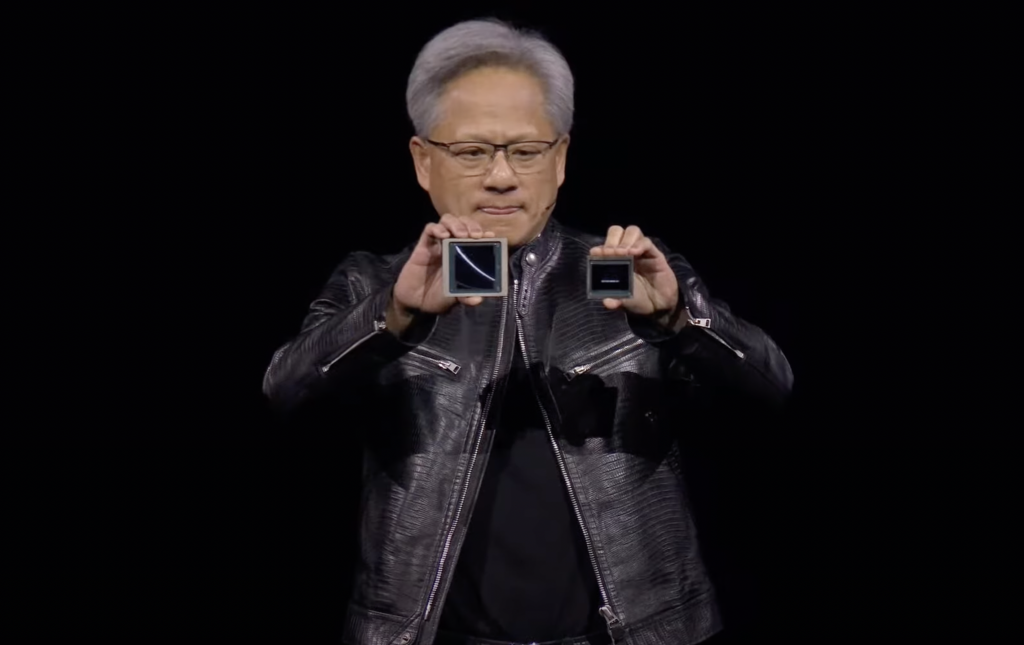

It is no coincidence that Musk, despite OpenAI's late start and dominance with ChatGPT and Google's huge competition with Gemini, managed to raise six billion dollars from investors for his AI company xAI. Last weekend that was supposed to be three billion dollars on a valuation of $15 billion, but then potential investors received an email to this effect:

"We all received an email that basically said, ‘It’s now $6B on $18B, and don’t complain because a lot of other people want in."

Now that is an email I would like to send around sometime, only with a happy smile emoticon at the end.

Elon Musk's pitch for xAI boils down to the company's ambition to connect the digital and physical worlds. Musk wants to do this by pulling training data for Grok, xAI's first product, from each of his companies, including X (formerly Twitter), Tesla, SpaceX, his tunneling company Boring Company and Neuralink, which develops computer interfaces that can be implanted in the human brain. It's a worldview that will generate a lot of resistance, but at least it shows long-term vision.

BlackRock and Temasek raise $1.4 billion for climate tech

Countering the world's biggest challenge, climate change, also requires a long-term vision combined with a willingness to invest billions. The world's largest investment firm BlackRock and Singaporean sovereign wealth fund Temasek have therefore raised $1.4 billion to invest in technologies that reduce emissions.

Predictably, the Wall Street Journal, widely read by Republican "ho-ho-not-so-fast-it-was-always-hot" investors, does not write about investments but about "wagers": a term used in a casino when putting your chips on red or black.

Greenhushing as bad as greenwashing

Knowing that the capital market looks with suspicion at the results of risky investments in unproven projects, making more and more companies guilty of greenhushing rather than greenwashing, Decarbonization Partners rushes to say that it invests only in "late-stage, proven decarbonization technologies."

It is unfortunate that investing in startups is avoided because there is much need for capital for start-ups, unproven companies; after all, how else will companies ever get to the stage of having proven themselves? It's a bit like saying as a parent that you love your kids as soon as they can walk well; but how they learn to walk, those kiddies figure that out for themselves.

In total, more than thirty institutional investors from 18 countries have invested in the fund, including pension funds, sovereign wealth funds and family offices, and at $1.4 billion it has raised even four hundred million dollars more than targeted.

Investments have already been made in seven companies developing various innovative decarbonization technologies, including low-carbon hydrogen producer Monolith that I wrote about last week, biotechnology company MycoWorks and electric battery material producer Group14. These are developments that are hopeful.

Carbon credit exchange in ... Saudi Arabia

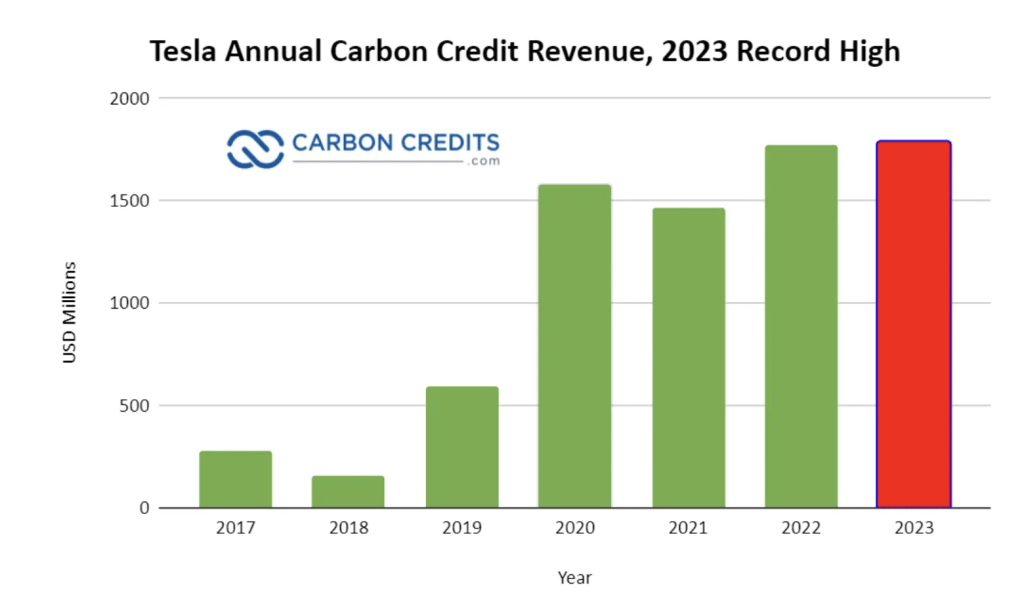

Other hopeful news that has been snowed under in all the stock market turmoil, a rare word in connection with Saudi Arabia, is that the world's largest oil state will open a carbon credit trading exchange at the end of this year in partnership with market leader Xpansiv, which will provide the infrastructure for the exchange.

The announcement of a carbon credit exchange in this region quickly resembles a chicken breeder announcing he is going vegan, but should be seen as part of Saudi Arabia' s larger plan to move to a sustainable economy. It is looking more and more like it is serious, so it will be fascinating to follow what market share the Saudis can capture in the global carbon credit market, which Morgan Stanley estimates to be $100 billion by 2030.

Finally: I'm in May in the Netherlands and Singapore

In closing, a personal note in the fifty-second edition of this newsletter. Looking back over last year, one notices that I write a lot about market developments and investments, whereas thirty years ago I just started as an entrepreneur in the tech industry, launching the first national wide available internet service provider in the Netherlands.

Because I am no longer running a business, which for me always resulted in running with blinders on toward a dot on the horizon, I have the opportunity to mentor various entrepreneurs and help them invest where possible.

Since I started this newsletter, I have regularly received friendly invitations from readers to catch up on possible joint investing. I plan to do that next month; I'll be in the Netherlands and Singapore in May. If you're interested in hearing more about the projects I support, always focused on sustainability and a large international market, I'd love to hear from you.

Have a great Sunday and see you next week!