At last, Google's response to ChatGPT's OpenAI appeared this week, highlighted by a video of Gemini, the intended OpenAI killer. The response was moderately positive; until Friday, when it was revealed that Google had manipulated some crucial segments of the introductory video. The subsequent reactions were scathing.

Google was showered with scorn and the first lawsuits should be imminent. A publicly traded company cannot randomly provide misinformation that could affect its stock price. Google is clearly in panic and feels attacked by OpenAI at the heart of the company: making information accessible.

Google under great pressure

It was bound to happen. CEO Sundar Pichai of Alphabet Inc, Google's parent company, went viral earlier this year with this brilliant montage of his speech at the Google I/O event in which he uttered the word AI no less than twenty-three times in fifteen minutes. The entire event lasted two hours, during which the term AI fell over one hundred and forty times. The message was clear: Google sees AI as an elementary technology.

Meanwhile, Google's AI service Bard continued to fall short of market leader OpenAI's ChatGPT in every way. Then when Microsoft continued to invest in OpenAI, running up the investment tab to a whopping $13 billion while OpenAI casually reported that it was on its way to annual sales of more than a billion dollars, all alarm bells went off at Google.

The two departments working on AI at Google, called DeepMind and Google Brain - there was clearly no shortage of self-confidence among the chief nerds - were forced to merge and this combined brain power should have culminated in the ultimate answer to ChatGPT, codenamed Gemini. With no less than seventeen(!) videos, Google introduced this intended ChatGPT killer.

Fake Google video

Wharton professor Ethan Mollick soon expressed doubts about the quality of Gemini. Bloomberg journalist Parmy Olson also smelled something fishy and published a thorough analysis.

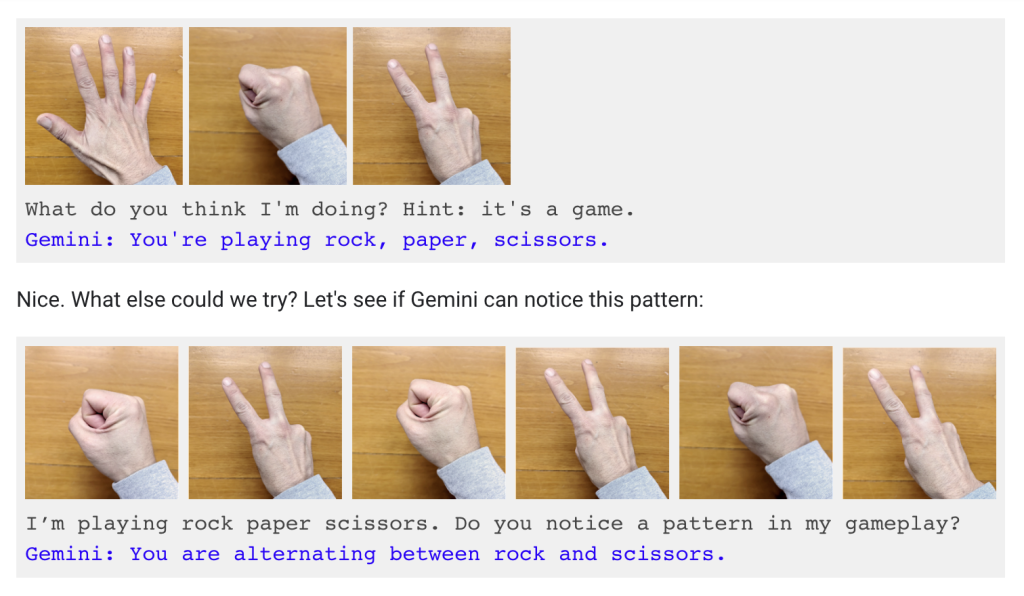

Watch this clip from Gemini's now infamous introduction video, in which Gemini seems to know which cup to lift. Moments later, Gemini seems even more intelligent, as it immediately recognizes "rock, paper, scissors" when someone makes hand gestures. Unfortunately, this turns out to be total nonsense.

Although a blog post explained how the fascinating video was put together, hardly anyone who watched the YouTube video will click through to that apparently accompanying explanation. It appears from the blog post that Gemini was informed via a text prompt that it is a game, with the clue: "Hint: it's a game."

This undermines the whole "wow effect" of the video. The fascination we initially have as viewers has its roots in our hope that a computer will one day truly understand us; as humans, with our own form of communication, without a mouse or keyboard. What Gemini does may still be mind-blowing, but it does not conform to the expectation that was raised in the video.

It's like having a date arranged for you with that very famous Cindy, that American icon of the 1990s, and as you're all dressed up in your lucky sweater waiting for Cindy Crawford, it's Cindy Lauper who slides in across from you. It's awesome and cozy and sure you take that selfie together, but it's still different.

The line between exaggeration and fraud

The BBC analyzed another moment in the video that seriously violates the truth:

"At one point, the user (the Google employee) places down a world map and asks the AI,"Based on what you see, come up with a game idea ... and use emojis." The AI responds by seemingly inventing a game called "guess the country," in which it gives clues, such as a kangaroo and koala, and responds to a correct guess by the user pointing to a country, in this case Australia.

But in reality, according to Google's blog post, Gemini did not invent this game at all. Instead, the following instructions were given to the AI: "Let's play a game. Think of a country and give me a clue. The clue must be specific enough that there is only one correct country. I will try to point to the country on a map," the instructions read.

That is not the same as claiming that the AI invented the game. Google's AI model is impressive regardless of its use of still images and text-based prompts - but those facts mean that its capabilities are very similar to those of OpenAI's GPT-4.'

With that typical British understatement, the BBC disqualifies the PR circus that Google tried to set up. Google's intention was to give OpenAI a huge blow, but in reality Google shot itself in the foot. Several Google employees expressed their displeasure on internal forums. That's not helpful for Google in the job market competition for AI talent.

Because in these very weeks when OpenAI appeared to be even worse run than an amateur soccer club, Google could have made the difference by offering calm, considerate and, above all, factual information through Gemini.

Trust in Google damaged

Instead, it launched a desperate attack. I'm frankly disappointed that Google faked such an intricate video, when to the simple question "give me a six-letter French word," Gemini still answers with "amour, the French word for love. That's five letters, Gemini.

The brains at Google who fed Gemini with data have apparently rarely been to France, or they could have given the correct answer: 'putain, the French word for any situation.'

Google's brand equity and market leadership are based on the trust and credibility it has built by trying to honestly provide answers to our search questions. The company whose mission is to organize the world's information and make it universally accessible, needs to be much more careful about how it tries to unlock that information.

Techcrunch sums it up succinctly, "Google's new Gemini AI model is getting a mixed reception after its big debut yesterday, but users may have less confidence in the company's technology or integrity after finding out that Gemini's most impressive demo was largely staged."

Right now, Google is still playing cute with rock-paper-scissors, but once Gemini is fully available it is expected to provide relevant answers to questions such as, I'll name a few, who can legitimately claim Gaza, Crimea or the South China Sea. After this week, who has confidence that Gemini can provide meaningful answers to these questions?

How many billion ican OpenAI snatch rom Google?

The reason Google is reacting so desperately to the success of OpenAI is obviously because it feels it is being threatened there were it hurts: the crown jewels. In the third quarter of 2023, Alphabet Inc. the parent company of Google reported total revenue of seventy-seven billion dollars.

A whopping 78% of that was generated from Google's advertising business, which amounts to nearly sixty billion dollars. Note: in one quarter. Google sells close to seven hundred million dollars in advertising per day and is on track to rake in thirty million dollars - per hour.

ChatGPT reached over a hundred million users within two months of its launch, and it is not inconceivable that OpenAI will halve Google's reach with ChatGPT within a few years. Everyone I know who uses ChatGPT, especially those with paid subscriptions, of which there are already millions of users, says they already rarely use Google.

Google has far more reach than it can sell so decrease in reach does not equate to a proportional decrease in revenue; but it is only a matter of time before ChatGPT manages to link a good form of advertising to the specific search queries. I mean: there's a company that makes millions per hour selling blue links above answers...

Falling stock market value means exodus of talent

Google could then quickly drop from being one of the world's most valuable companies with a market capitalization of $1.7 trillion (1,700 billion) to, say, half - and then be worth about as much as Google's hated, loathed competitor in the advertising market: Meta, the creator of in Google's eyes simple, tacky social media like Facebook, Instagram and Whatsapp. Oh, the horror.

This is especially important because in this scenario, the workforce, which in the tech sector never perks up from declines in the value of their options, is much more likely to move to companies that do rapidly increase in value. Such as OpenAI, the maker of ChatGPT.

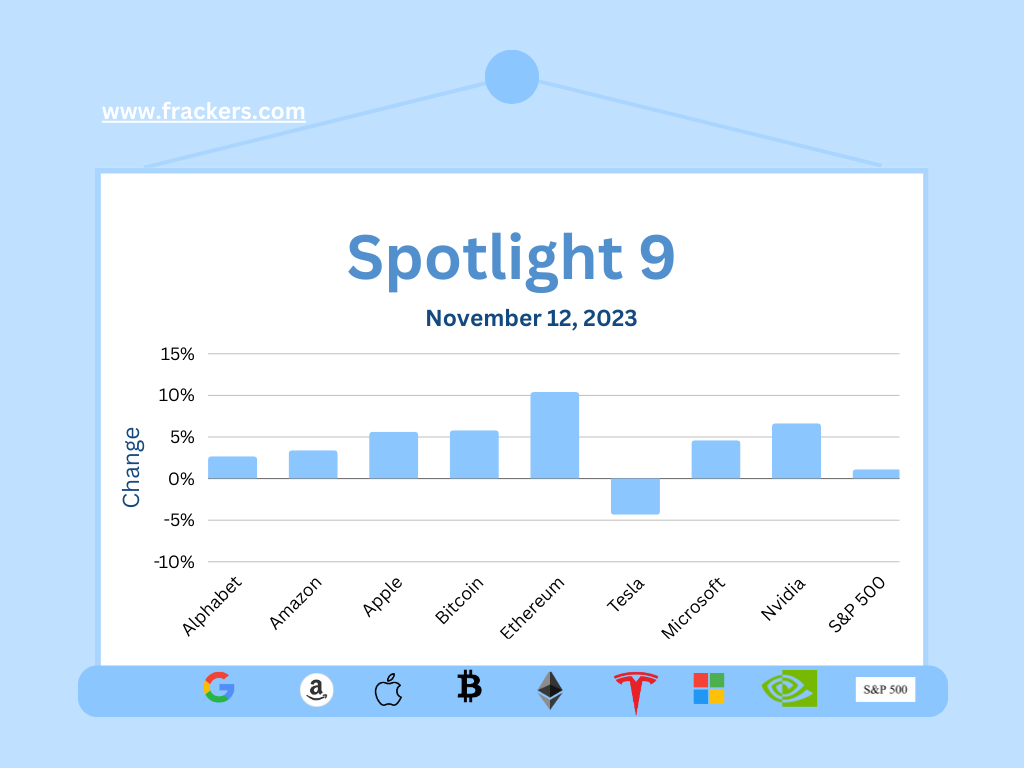

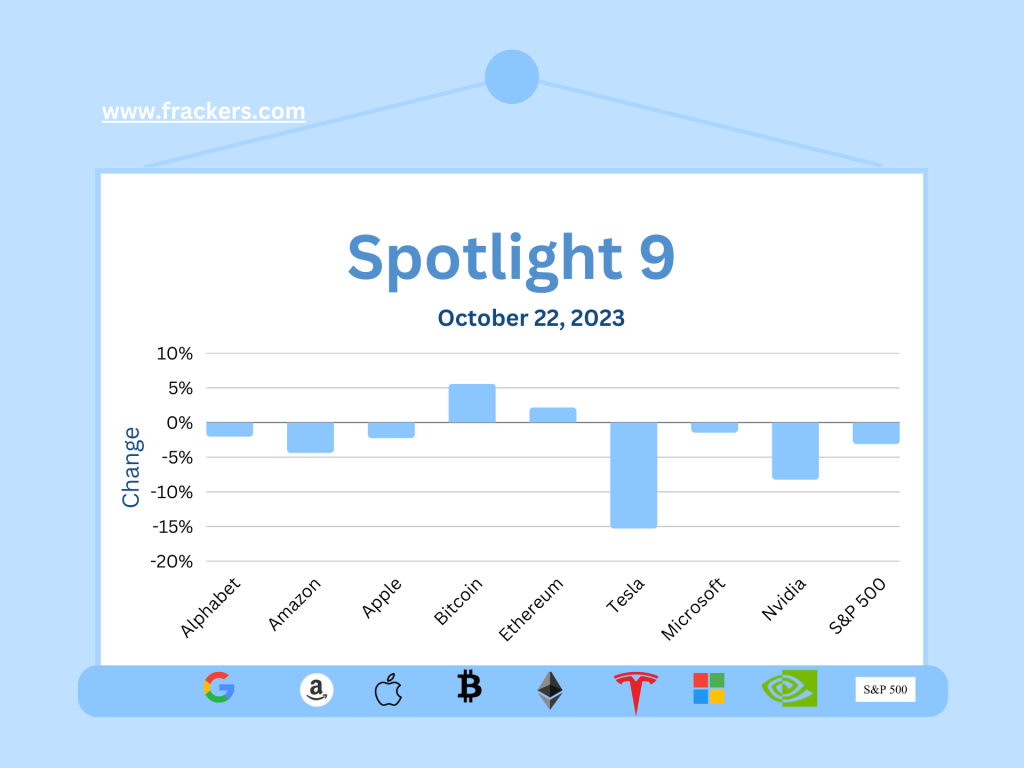

Spotlight 9: the most hated stock market rally

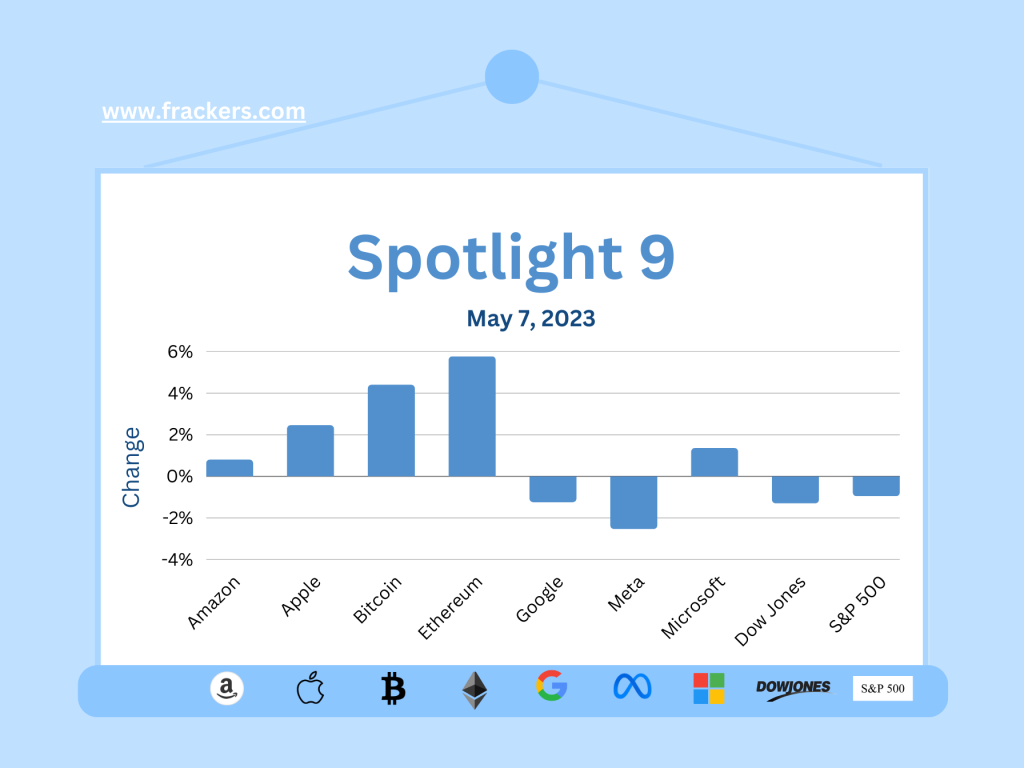

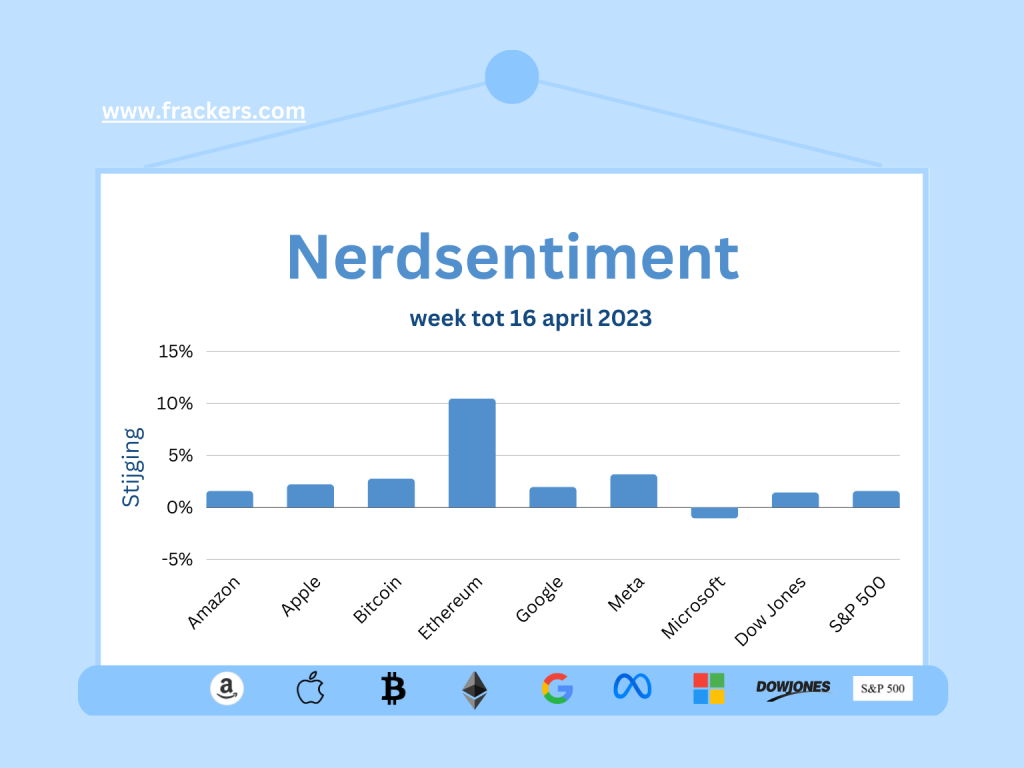

'The most hated rally,' is how crypto oracle Meltem Demirors aptly describes the situation in the crypto sector. ' Everyone is tired of hearing about crypto, but baby, we're back!'

After all the scandals in the crypto sector, the resignation of Binance CEO Changpeng Zhao, CZ for people who want to pretend they used to play in the sandbox with him, seems to have been the signal to push the market upward. I wrote last March about the problems at Binance in meeting the most basic forms of compliance.

According to Demirors, macroeconomic factors play a bigger role, such as expected interest rate declines and the rising U.S. budget deficit. The possible adoption of Bitcoin ETFs is already priced in and the wait is on for institutional investors to get into crypto. Consumers already seem to be slowly returning. Crypto investors, meanwhile, seem more likely to hold Ethereum alongside Bitcoin.

Investing and giving birth

I continue to be confirmed in my conviction that professional investors understand as much about technology as men understand about childbirth: of course there are difficult studies and wonderful theoretical reflections on it, but from what I hear from experts in the field of childbirth (mothers) it turns out to be a crucial difference whether you are standing next to a delivery, puffing along, or bringing new life into this world yourself. There is a similar difference in investing in technology or developing it.

I don't think there is a person working in the tech sector who, after reading through the reactions to Google's Gemini announcement, thought, "that looks great, I need to buy some Alphabet shares soon.

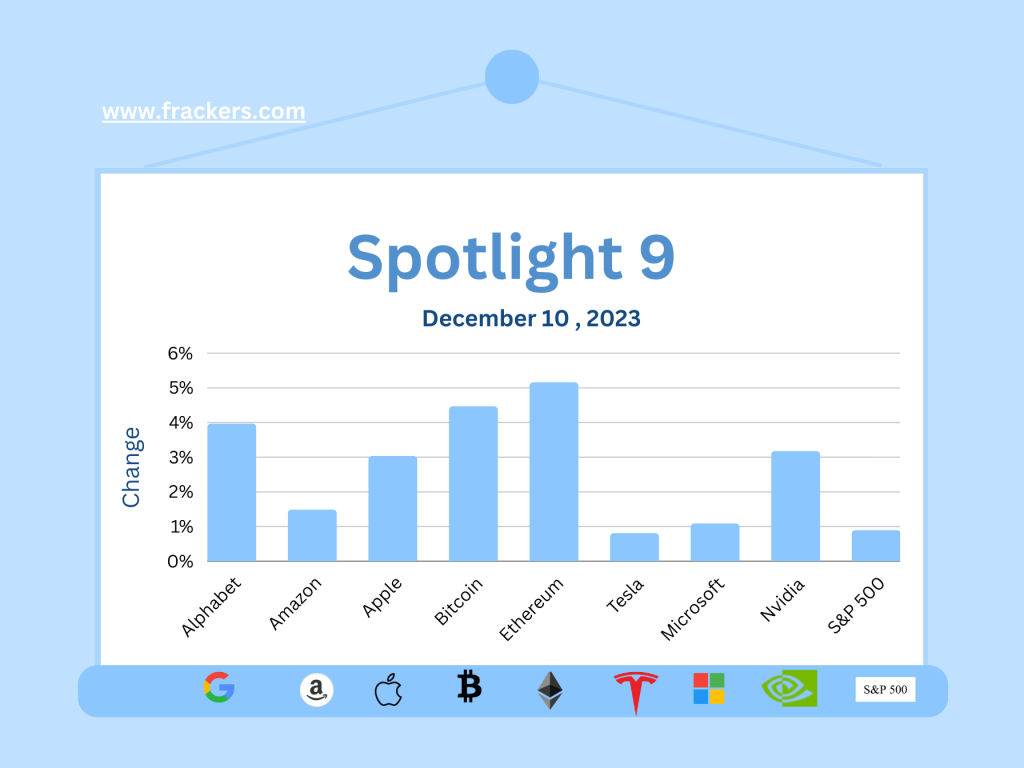

But what did Reuters report, almost cheerfully: "Alphabet shares ended 5.3% higher Thursday, as Wall Street cheers the arrival of Gemini, saying the new artificial intelligence model could help close the gap in the race with Microsoft-backed OpenAI."

Ken Mahoney, CEO of Mahoney Asset Management (I detect a family relationship) said "There are different ways to grow your business, but one of the best ways is with the same customer base by giving them more solutions or more offers and that's what I believe this (Gemini) is doing for Google."

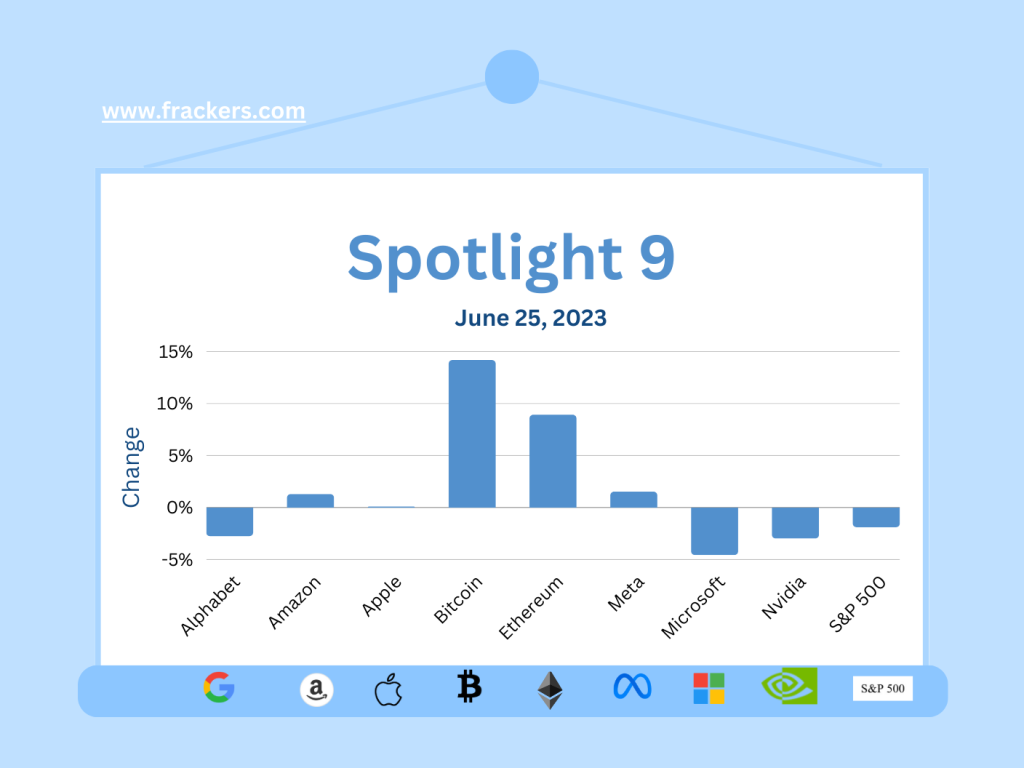

The problem with people who believe something is that they often do so without any factual basis. By the way, Bitcoin and Ethereum rose more than Alphabet (Google) last week.

Other short news

The Morin and Lessin couples are journalists, entrepreneurs and investors, making them a living reflection of the Silicon Valley tech ecosystem.

Together they make an interesting podcast that this week includes a discussion of Google's Gemini and the crypto rally.

It's great that Google founder Sergey Brin is back to programming at Google out of pure passion. The Wall Street Journal caught onto it this summer. Curious what Brin thinks of the marketing efforts of Gemini, which he himself is working on.

Elon Musk's AI company, x.AI, is looking for some start-up capital and with a billion, they can at least keep going for a few months. Which does immediately raise the question of why Musk accepts outside meddling and doesn't take the round himself. Perhaps he already expects to have to make a substantial contribution to x.com, the former Twitter.

Mistral, the French AI hope in difficult days for the European tech scene, didn't make a video, not even a whitepaper or blog post, but it linked in a tweet to a torrent file of their new model, attractively named MoE 8x7B. It made one humorous Twitter user sigh "wait you guys are doing it wrong, you should only publish a blog post, without a model." It will be a while before people stop taking aim like this at Google. Anyway, as far as I'm concerned, only amour for Mistral.

Details should become clear in the coming days, but the fact that Amnesty International is already protesting because of the lack of a ban on facial recognition is worrying. EU Commissioner Breton believes this puts Europe at the forefront of AI and therefore he would likely thrive as a tech investor on Wall Street.

CFO Paul Vogel got kicked while he was already down: "Spotify CEO Daniel Ek said the decision was made because Vogel did not have the experience needed to both expand the company and meet market expectations." Vogel was not available for comment but still sold over $9 million worth of options. It remains difficult to build a stable business as an intermediary of other people's media.

Apparently, MBS is an avid gamer. After soccer and golf, Saudi Arabia is now plunging into online gaming and e-sports.

I hold out hope that AI will be used in medical technology, to more quickly detect diseases, make diagnoses or develop treatments. But right now, the smartest kids in the class seem focused on developing AI videos that mimic the dances of real people on TikTok.

Where are the female automotive designers? 'Perhaps the way forward in the automotive industry lies neither with the feminine (the unwritten page) nor the masculine (full steam ahead), but somewhere in the middle that combines the practical and the poetic, with or without a ponytail,' according to Wired.