I had a very different opening to my newsletter in mind, but the fact that the tech elite is stuck in the desert mud with their private jets at Burning Man is too much news for me to ignore. As one Burner sums it up in this sad video: Burning Man 2023 is screwed. In other news: OpenAI, maker of ChatGPT, is on its way to $1 billion in revenue.

You are reading the web version of my free weekly newsletter about the technological, economic and social events that define our lives. You can subscribe for free here to receive the newsletter in your mailbox every Sunday.

Burning Man is the Coachella for the tech industry

When I was a student at San Francisco State University deep in the last century, I regularly rode my scooter from campus back home past Baker Beach and China Beach. Campfires were often lit there by homeless people, hippies or groups of hipsters. It was the first time I realized that their clothing was so similar that even up close I could not tell the difference between "hipsters or homeless."

One such beach party got so out of hand that it was banned in the early 1990s and moved to the Nevada desert. Here the concept of the "Temporary Autonomous Zone" was realized - a city built from the ground up, where the usual social norms and commercial transactions were suspended in favor of a "gift economy." Sounds wonderful.

Burning Man has grown considerably over the years, attracting more than 70,000 participants from around the world in recent editions. In recent years, the area has grown into a veritable Black Rock City, a temporary city built for the event, designed as a series of concentric circles centered on "The Man," a large wooden effigy that is burned at the end of the festival. The city also features themed camps, art installations, workshops and a series of performances.

What Coachella is to the Los Angeles entertainment industry, Burning Man became to the Silicon Valley tech industry: a few hours' drive to a long weekend of escapism in the desert. This is what it looked like from the air earlier this week.

I've never been to Burning Man because I don't like the combination of fine sand, short showers and large groups of mostly drugged people who like to hug. But everyone I know who's been there had a fantastic time and so I'm as much a fan of Burning Man as I am of moon landings: I don't quite get it and gladly don't participate in it, but from a distance I enjoy seeing so many people having fun.

Alternative protest against formerly alternative festival

Rapid growth has drawn criticism for its environmental impact. Building a temporary city of 80,000 people in the desert is actually bad for the planet, Vox reported Wednesday as climate activists headed down the road toward Burning Man:

'All together, each Burning Man generates about 100,000 tons of carbon dioxide. That's more than about 22,000 gas-powered cars produce in a year. What began as a gathering on a beach in San Francisco has become a destination for celebrities and the ultra-rich, especially tech billionaires. That's why private jets have become a problem. There are now fancy camps, meals prepared by private chefs and VIP parties. Keep in mind that all of this is built just for the week-long festival at the end of summer and everything has to be taken down and removed afterward. One of the basic principles of Burning Man is "leave no trace," but even the event organizers were baffled by how much trash was left in the desert last year.

Vox

Last Monday, a small group of climate protesters parked a 2.5-meter trailer across the road, causing miles of congestion for participants on their way to Burning Man. The protesters demanded a ban on the use of private planes, single-use plastics, unnecessary propane burning and unlimited generator use.

The protest ended when a ranger rammed through the blockade with his pickup truck and, with weapon drawn, worked a woman to the ground. Looking at these images, my thoughts wandered to those fire making hippies on Baker Beach in San Francisco; how could something so relaxed and joyous get so out of control? What once began as counterculture has become mainstream, then a new counterculture emerges to protest it. It is tiring because of its predictability.

Chris Rock and Diplo are out

So the vibe wasn't there from the start, but the situation worsened when the festival grounds were closed yesterday due to heavy rain by organizers, who called for conservation of water, food and fuel. Participants may be stuck for days as vehicles are stuck in the desert that has turned to mud.

A number of participants then decided to leave the site, on which a dead person had since been found, on foot. The famous angel investor Gil Penchina walked 8 miles through the mud until he could score a ride. Dj Diplo absolutely did not want to miss a gig last night and also went for a walk, only he was lucky enough to do so in the company of Chris Rock, who confessed to also having once started out as a DJ.

Rock sighed to Diplo, hitchhiking in an open pickup truck, "If I would have known DJs would ever make money, I would have never told a joke. Brazilian DJ Lukas Ruiz, better known as Vintage Culture, is still stuck in the desert and canceled several gigs via Instagram. The organization has since launched a "Wet Playa Survival Guide. The mix of celebrities, heavy rain and a photogenic desert is irresistible to the media, so for the next 48 hours Burning Man will dominate the news.

Brief other news:

OpenAI on its way to $1 billion in revenue

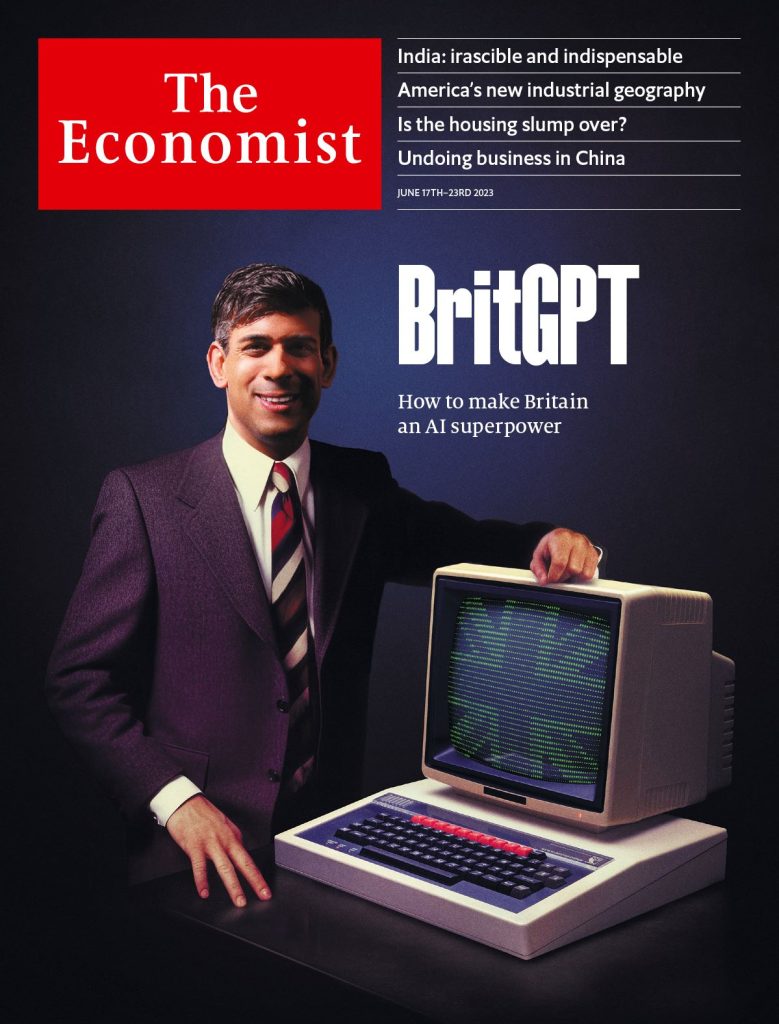

The Information reported this week that OpenAI, maker of ChatGPT, is well on its way to achieving one billion dollars in annual sales. That revenue is achieved primarily on companies that deploy ChatGPT and pay a license fee to OpenAI to do so. With the launch of ChatGPT Enterprise, OpenAI will be able to significantly increase revenue very quickly, because despite all the recent criticism of OpenAI, there does not seem to be a competing product on the market that can be so easily integrated by companies.

Venture capitalist Reid Hoffman downsizes role at Greylock

The LinkedIn co-founder is one of Silicon Valley's most influential AI enthusiasts. While it is not known what Hoffman will do next, the expectation is that he will delve even further into AI. This recent interview with Hoffman on AI is highly recommended. He calls AI "Amplification Intelligence," amplified intelligence.

Thousands of participants examined weaknesses in AI

For two and a half days in Las Vegas, thousands of participants - including 220 community college students and others from organizations traditionally kept out of the early stages of technological change from 18 U.S. states - engaged in leading AI models. Participants exchanged 164,208 messages in 17,469 conversations as they searched for bias, potential harm and security weaknesses in 21 challenges designed to expose the potential gaps in the trust and security of AI models. The challenge was this.

How do you talk to an AI?

Practical guide on how to achieve extraordinary results as an average person with a chatbot such as ChatGPT. Nice example: ' Ask chatbots to explain things using examples from your favorite novels. You could do the same with, say, Harry Potter or "Keeping Up With the Kardashians."

Bumble's CEO says AI will help you get more dates.

Let me know if it works, and I'll share the tips and experiences in this newsletter, with your photo and contact information if desired because I like to bring my community together.

AI fever turns Anguilla's ".ai" domain into a digital gold mine

The tiny Caribbean island may rake in 10% of its GDP from domain sales this year. Anguilla's success in selling AI domain names is bound to be viewed with great envy by the neighboring island with a less commercially attractive name to abbreviate, St. Maarten.

Back to the office or fired?

Amazon CEO Andy Jassy tells employees that it is "past time" to commit to the company's "return to office mandate" and that their jobs are at stake. I prefer remote work, but is it so strange for a company to ask employees to come to the office at least three days a week?

A venture capital firm has built an AI-powered pitch deck generator for startup founders - and is giving it away for free

I have not been able to test it yet because I am still on the waiting list, for which you can sign up here.

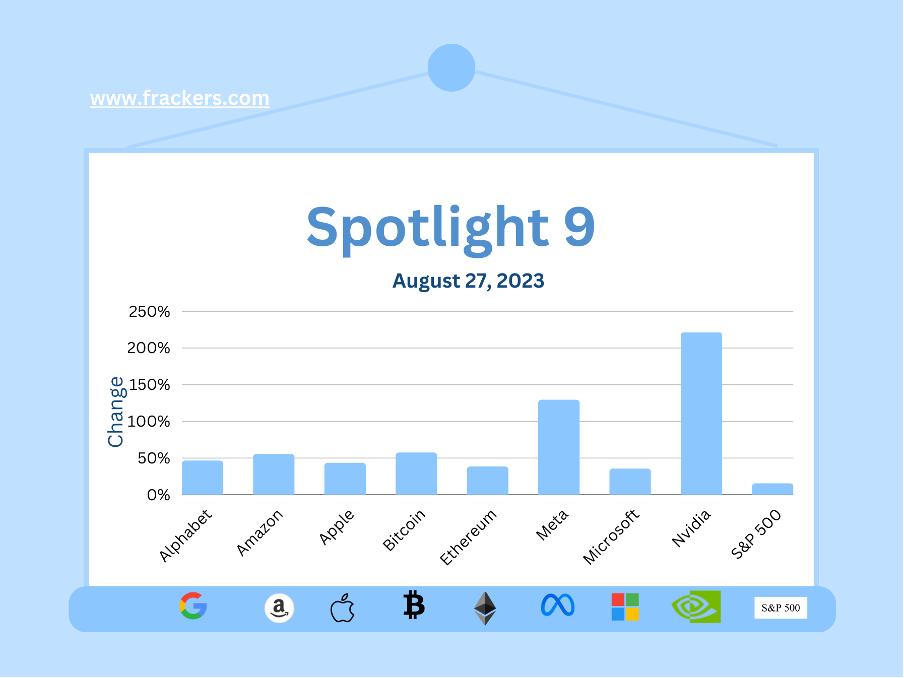

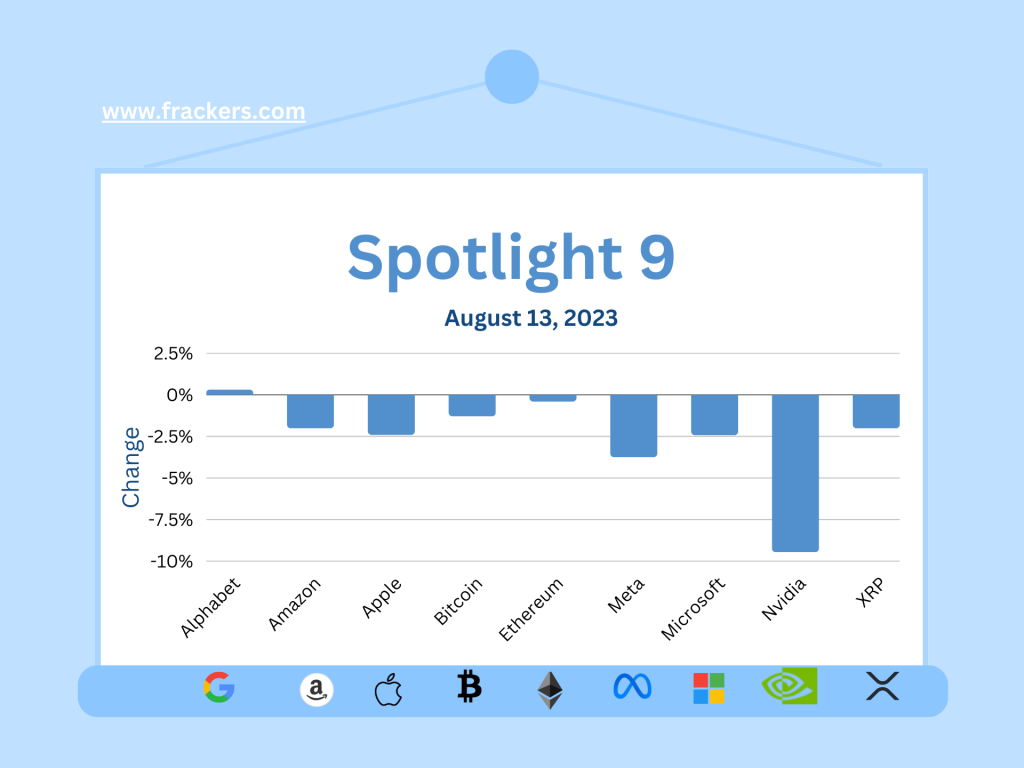

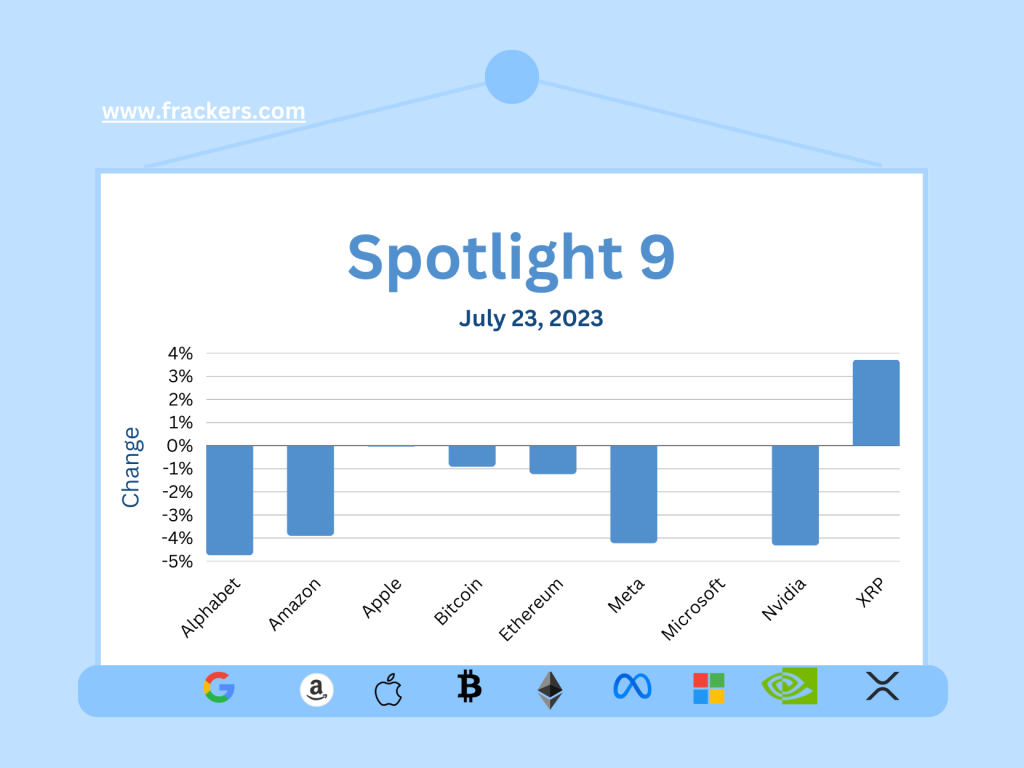

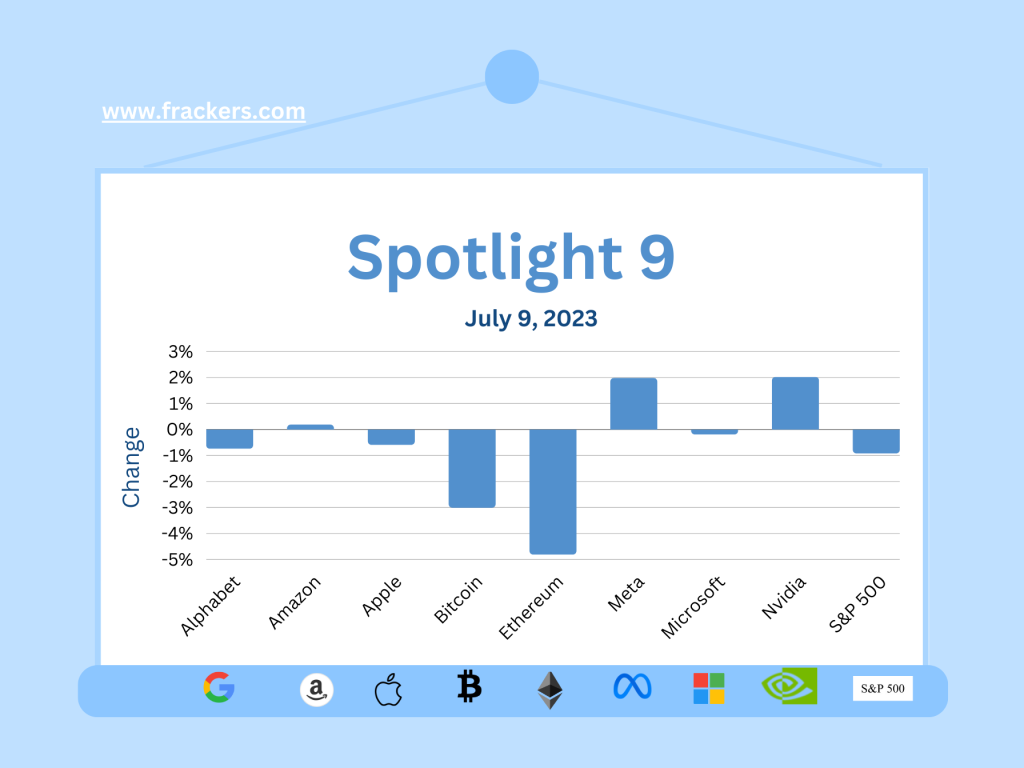

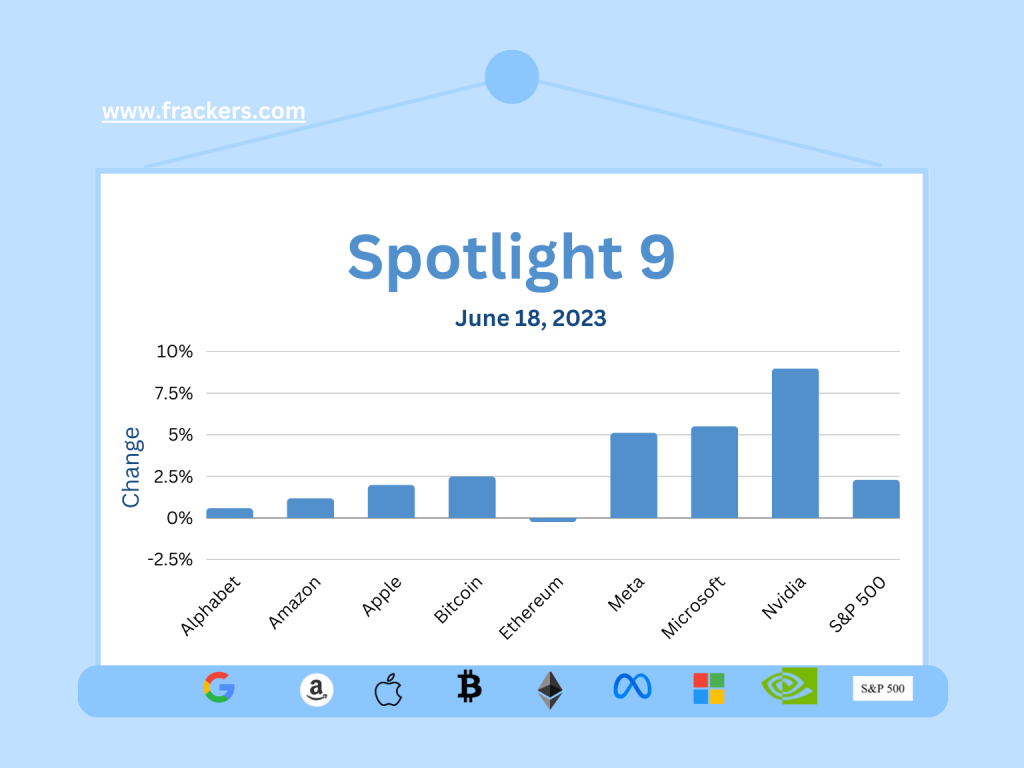

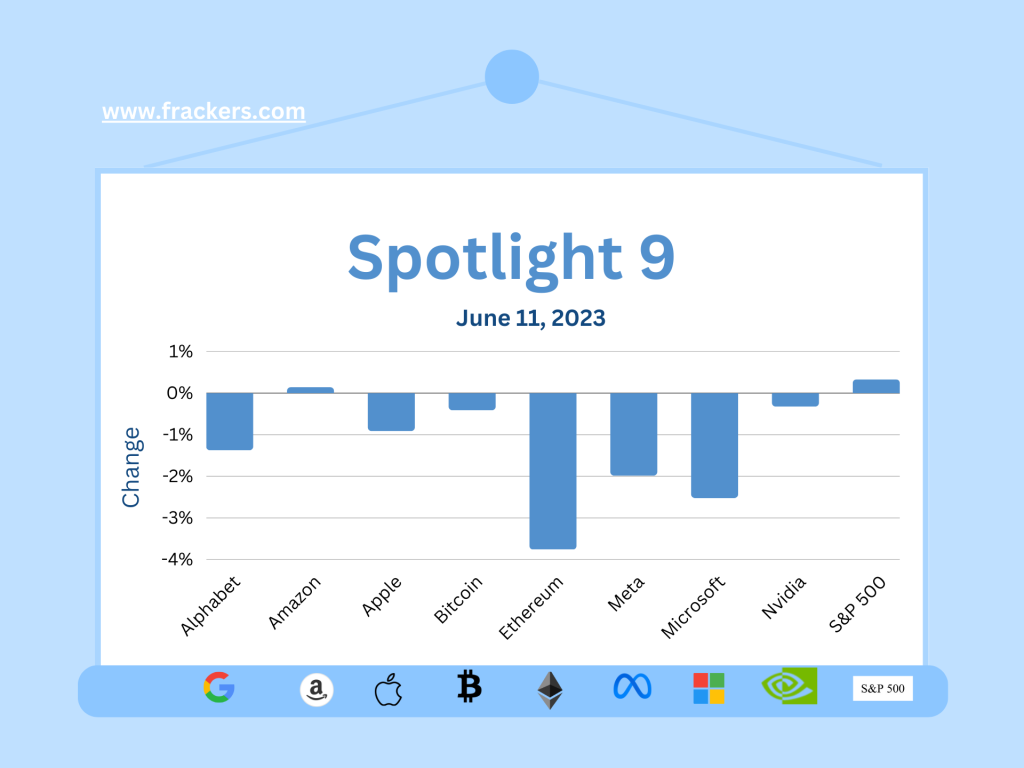

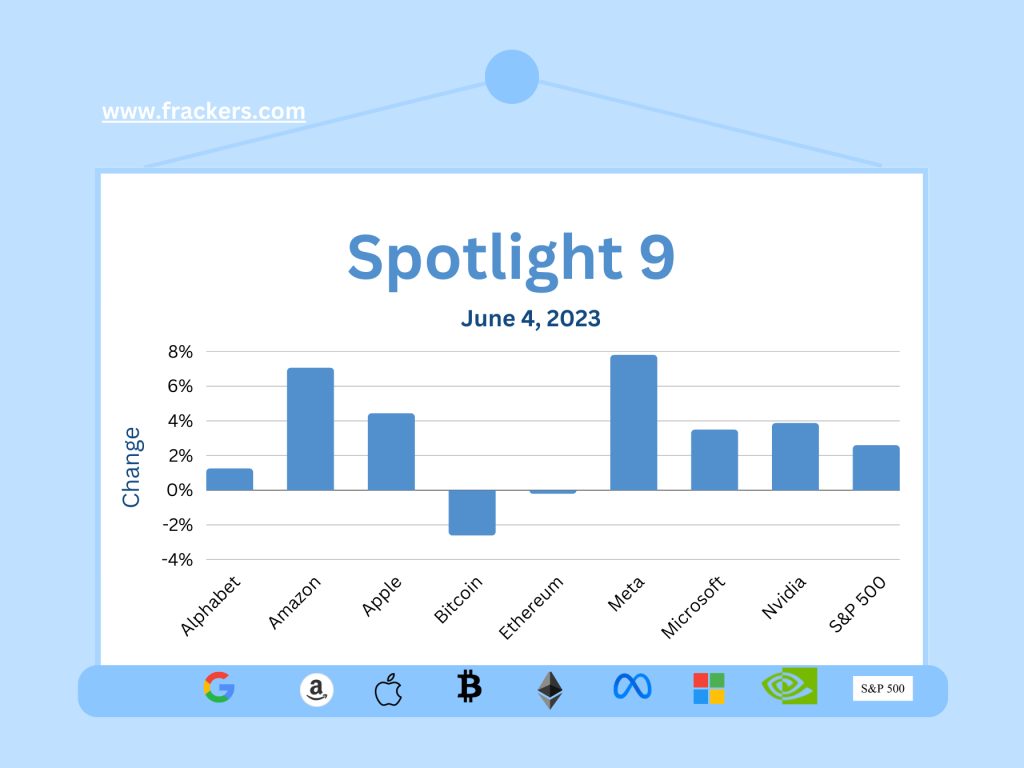

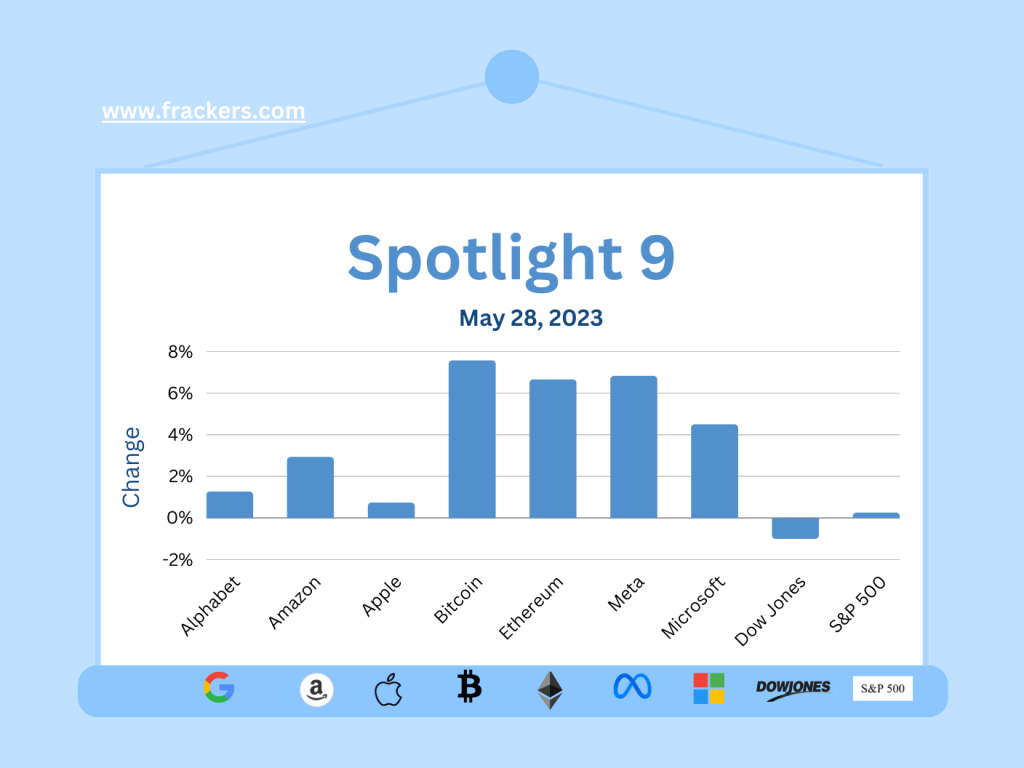

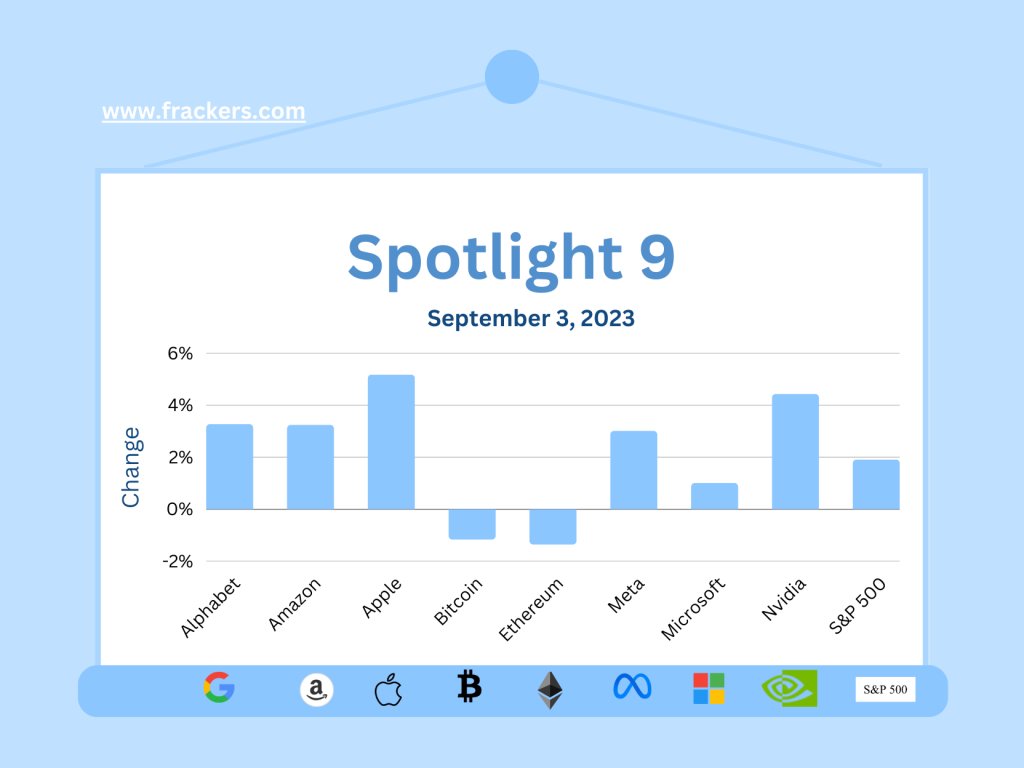

Spotlight 9: tech stocks are the hits of the week

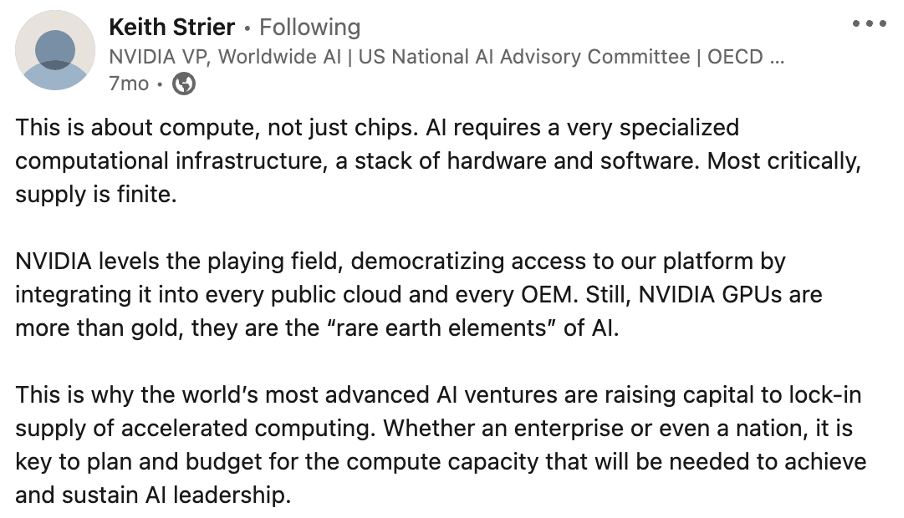

Hedge funds have record exposure to the seven largest tech stocks by market capitalization, according to data released Friday by Goldman Sachs, in a week after Nvidia shares hit an all-time high because of spectacular sales and earnings results.

"Hedge funds continue to embrace mega cap tech and the theme of artificial intelligence," Goldman Sachs' brokerage said in a note sent to a limited group of clients that was obtained by Reuters.

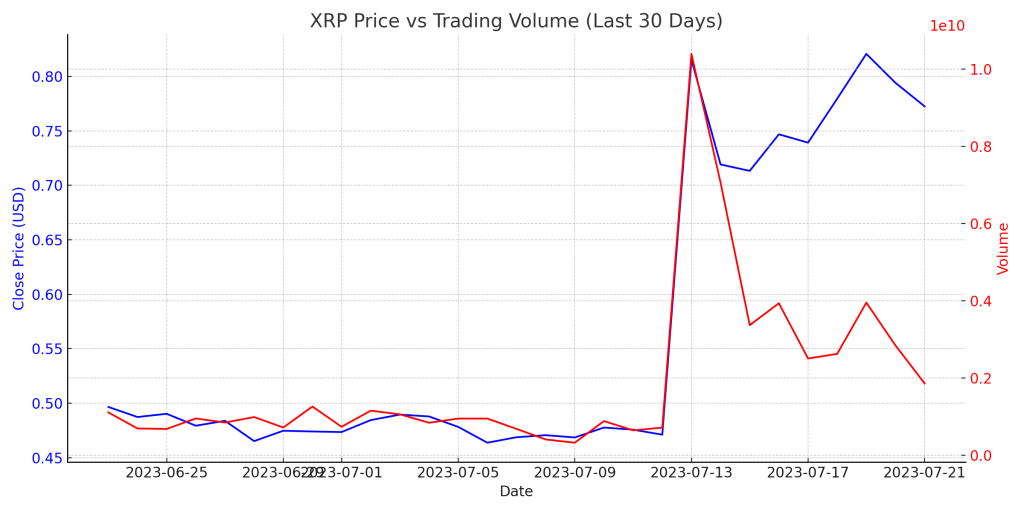

It is striking how last week Bitcoin and Ethereum, the main cryptoassets, fell while the rest of the market rose. Especially because they seemed to move along with the mainstream market for the rest of the year, especially that of tech stocks.