With all the wrangling at OpenAI, you would almost forget, but ChatGPT just celebrated its first birthday this week. Over a hundred million people use an OpenAI service each month, and annualized revenue is over $1.3 billion, a first step toward possible market dominance.

ChatGPT4 nicer than Google

As a subscriber to ChatGPT, these days I ask almost every question first to ChatGPT4, instead of searching on Google. 'The best day to fly between Europe and Asia, what shoe size is Shaquille O'Neal and under what three names was that movie starring Tom Cruise and Emily Blunt released?' Just three questions I asked ChatGPT today. But also, 'tell me about investors Vinod Khosla and Reid Hoffman,' but more about them in a moment.

Compared to Google, ChatGPT's answers seem better and I like that I don't have to click through to other websites. No doubt Google has tracked the change in search behavior through Google Chrome and the other gimmicks Google uses to capture people's behavior. This makes it all the more painful that Google, according to The Information, decided this weekend to delay the launch of OpenAI competitor Gemini until early next year.

Search and buy through ChatGPT?

One company that is also seriously threatened by OpenAI is Amazon, and it is rarely noticed. Especially in the US, Amazon has become "the Google of buying": as soon as Americans think about buying something, they search directly on Amazon. Other websites no longer play a role here.

It looks like it will be months rather than years before ChatGPT is fed sales information from the world's largest online stores. All parties that now sell through Amazon Marketplace can then directly serve their customers outside of Amazon. Of course, fulfillment then remains an issue, and in that Amazon is almost unbeatable, but the company is not worth $1.5 trillion because it is so good at shipping packages efficiently.

Amazon is so valuable because it is where buyers find their products and where transactions take place. OpenAI has a great tool with ChatGPT to take over that function, because with its Plus subscribers it already has a payment relationship that can be easily expanded. Amazon is no doubt already formulating a response to this threat.

iPhone users switch from Siri

Apple is surely following with suspicion how many people program the new "action" button on the iPhone 15 with ChatGPT. The idea was that it would allow people to launch their email or camera app faster but article after article appears urging people to get rid of Siri as if from herpes after a ski weekend with a frat house.

A headline like "Throw Siri off your phone and use ChatGPT for help" must hurt intensely at Apple. Siri never became what Apple had hoped it would, and if many people use ChatGPT as the first search function on the iPhone, heads will roll at Apple. The question has long since ceased to be whether ChatGPT has this potential, but whether the OpenAI board will become stable enough quickly to successfully introduce this kind of product.

Hoffman and Khosla, billionaires with an opinion

Viewed in this light, it was nice to see an excellent podcast on Thursday featuring legendary entrepreneurs and investors Reid Hoffman (PayPal, LinkedIn, Greylock) and Vinod Khosla (Sun Microsystems, Khosla Ventures), both investors in OpenAI.

By the way, note the almost mocking title with which Khosla describes himself on LinkedIn: "venture assistant. That's like Lionel Messi creating a LinkedIn profile with the feature "ball boy.

Hoffman was the first contributor to OpenAI from one of his private foundations, when it was still just a benevolent club of academics. After all, you don't do well as a billionaire until you have at least one foundation named after yourself, although I found this one-page website for Hoffman's other foundation, the Aphorism Foundation, amusing.

Khosla put into OpenAI double what he had previously invested in a startup: $50 million. In short, Messrs. Hoffman and Khosla are not entirely neutral (cough).

No restriction of competition, China a risk

Hoffman focused on market forces in the conversation. " Startups are not hindered right now," he explained, despite the apparent dominance of OpenAI and mega-cap tech companies such as Microsoft. Hoffman has been on Microsoft's board since he sold LinkedIn to Microsoft and doesn't think his "own companies" have too much power. "I don't think it limits competition on any level," he said, to nobody's surprise.

Khosla called the focus on existential risks of AI "nonsensical talk from academics who have nothing better to do". But he sees China as a major risk and thinks the U.S. is "in a techno-economic" war with China and should take a tougher stance. " I would ban TikTok in a nanosecond," said Khosla, in contrast to Hoffman, who had spoken with President Biden just before recording the podcast. After all, if anyone knows the value of a good network, it is LinkedIn's founder.

Khosla is firmly against open-source AI models as well due to the China risk. Bio-risk and cyber risk are real concerns too, he noted. But if China or rogue viruses don’t kill us, Khosla thinks the near-future is very bright: “I do think in 10 years we’ll have free doctors, free tutors, free lawyers” all powered by AI.

Elon Musk had a tough month

At the last minute, Tesla published this amusing video in which the new Tesla Cybertruck makes mincemeat of a Porsche 911 in a sprint. Pay special attention to the bouncer, because the Cybertruck has something hanging from the tow hook and it's not a caravan. Marques Brownlee made a whopping 40-minute review video.

Not everyone is a fan of the Cybertruck, for example, Engadget writes: "Teslaa's Cybertruck is a dystopian, masturbatory fantasy. In Elon's future, the rich should be allowed to dominate (and probably run over) the poor with impunity."

Cute that a Cybertruck gets to 60 miles an hour (100 km/h) in 2.6 seconds, but I am particularly curious to see how this paintless, silver doghouse weighing over three thousand kilos (over 6,000 lbs) behaves on a mountain pass full of hairpins. Or how you park it in reverse in the parking lot of your local supermarket.

Musk chases advertisers off

Reuters puts it beautifully, "Elon Musk is keen to achieve what no business leader has done before, from mass-producing electric cars to developing reusable space rockets. Now he is blazing another trail most chief executives have avoided: the profane insult.." Not only that: gross insult to customers.

Musk said it twice to advertisers who left his social media platform X for complimenting a text with anti-Semitic content: "go fuck yourself.

Musk felt it necessary to name one such departing advertiser, Disney CEO Bob Iger, unprovoked. Consider the weeks Musk has had behind him: on November 18, SpaceX sent the Starship into space, where it blew up, intentional or not.

The same weekend saw the leadership fiasco at OpenAI, with the fired Sam Altman and the other key players communicating with the outside world almost exclusively through Musk's platform X. That was vindication for Musk, who earlier this year saw Mark Zuckerberg's Threads becoming the fastest-growing social media platform - dying out as quickly as it emerged, but that's for another time.

Due to Musk's unprecedentedly stupid action (his own words) of complimenting anti-Semitic sewer texts, many advertisers withdrew from X and the long term consequences remain to be seen. So Musk headed to Israel, which has been an unpopular midweek destination lately.

The irony of fuck and freedom of speech

Watch the whole item at Fox. Musk looks like captain Jack Sparrow after a rough night. He, probably just back from Israel and suffering from jet lag, looks even whiter than the average Fox viewer, and despite trying to appear masculine in his leather jacket with smutty teddy collar over a too-hot-washed t-shirt, he makes a vulnerable and frustrated impression. Here sits someone trying very hard to look like someone who is not trying very hard.

The whole segment at Fox is an adulation of Musk as a defender of freedom of speech, which was supposedly sorely missed when X was just called Twitter. I think the nice thing is that all five panelists, with that ball room dancing teacher in the middle surrounded by four born again nymphs, don't realize that it's hilarious that they spend minutes talking about freedom of speech, but the term "fuck" used by Musk is bleeped out twice by Fox.

So no viewer knows what Musk actually said. You can guess, but you don't know, because you can't hear it. No one repeats it or comes back to it. I love that discomfort. It's a moment like when a notorious meat eater finds out that the barbecue he's generously serving for his second plate is made of vegan meat.

Musk, willingly or unwillingly, with all his absurd attempts to regulate X on the one hand and then open it up on the other, demonstrates the total insanity of American morality that he himself struggles with as a South African. Anti-Semitism? Bad for business. Saying fuck on TV? Not allowed, but you can then worship him as a champion of Fox's supposedly so desired freedom of speech.

Breakfast TV (h)honest

It reminded me of the time I gave an interview about virtual reality during Web Forum in Dublin for a BBC breakfast program. I made the unforgivable mistake of saying that in the future VR would have all sorts of wonderful applications, from news to film, music and sex. Hey ho ho no jeez Louise, stop, panicked the BBC crew: I had said sex.

That wasn't allowed in a breakfast program. Because it's early in the day, blushing kids just eating their oatmeal, well surely I understood. "Am I allowed to say machine gun or weapon of mass destruction?" I asked. It certainly was allowed. 'Bloody mass murder?' No problem at all. ' How graphically may I describe the Catholic Church's misconduct with young boys?' Um, there were no specific rules for that, so in the end I had a great morning. That the item ever aired shows the editing skill of BBC editors.

Techbros need help

Musk is not the only tech CEO struggling with freedom of speech and regulation of his social media network. I recently wrote about my own struggle with freedom of speech when subscribers to my first company Planet Internet were found to be distributing child pornography. Deciding not to distribute certain messages was easy, but determining where that boundary lay was difficult, not to mention technically complex.

Mark Zuckerberg is in deep trouble now that the Meta platforms (Facebook and Instagram in particular) seem to have become popular platforms among pedophiles. According to the Wall Street Journal, Meta has spent months trying to fix child safety issues on Instagram and Facebook, but is struggling to prevent its own systems from enabling and even promoting a vast network of pedophile accounts.

The Meta algorithms unrestrainedly promote the content the user clicks on, with dire consequences. The U.S. Congress is becoming more alert, and the European Union is also now rightly targeting Meta.

I firmly believe that the limited social gifts of people like Musk and Zuckerberg have led them to think differently, more autonomously, than us simple souls and are therefore capable of achieving more; at the same time, they have limited empathy and genuinely don't understand why the world has trouble with their policies. What makes them great as entrepreneurs keeps them small as human beings.

Special links

- What did an iPhone do to the arms of this distraught bride?

Bride-to-be stands in front of the mirror, takes a picture and suddenly she looks bewitched. Pay close attention to her arms.

- High costs and fierce competition lead to battleground among streaming services

In Europe, Viaplay is struggling; in America, Apple and Paramount are discussing a partnership.

- DNA data should never be stored centrally

The day you knew was coming: 23andMe was hacked and highly confidential data of thousands of users was captured.

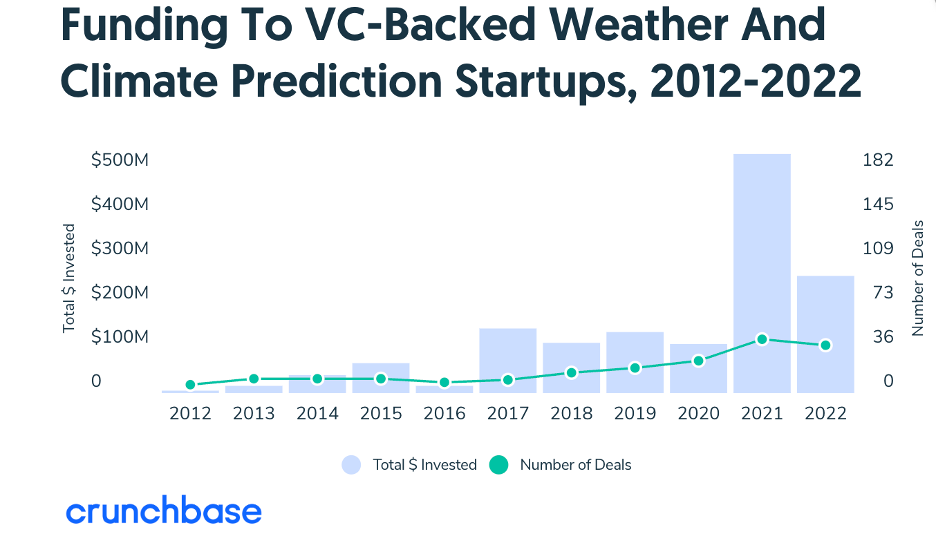

- Plane flies over Atlantic on fat and sugar

The UN climate conference COP28 has begun in Dubai, led by Abu Dhabi's oil boss. Before we get cynical, here is the good news that hard work is being done on sustainable aviation. Applause for Virgin Atlantic.

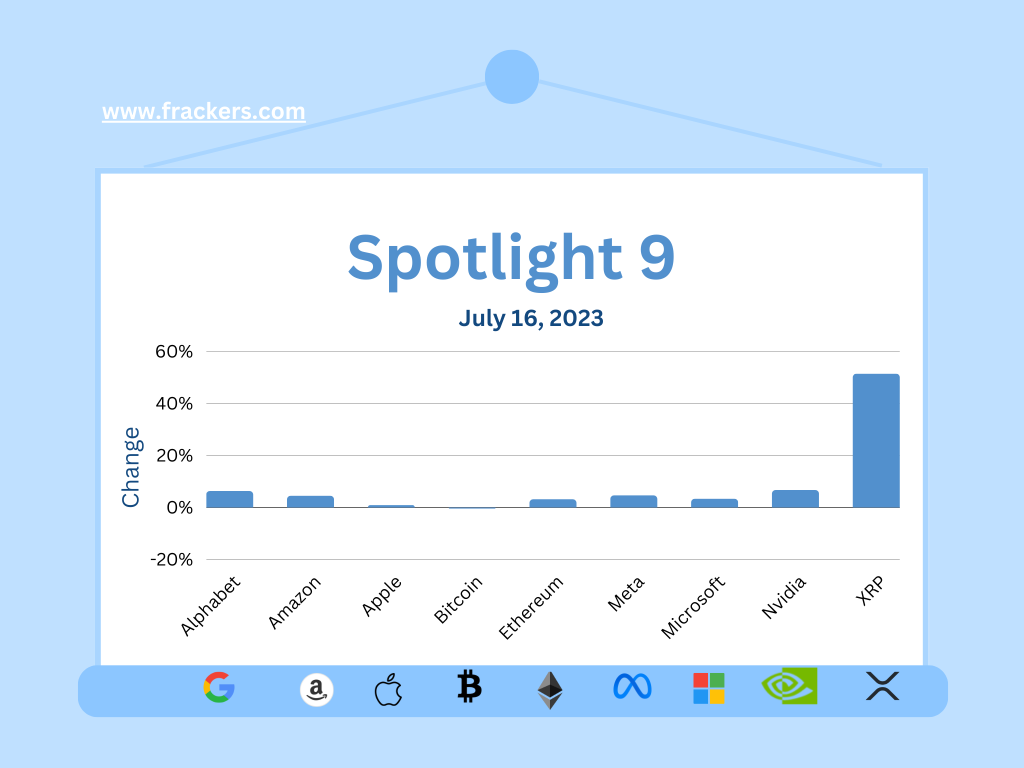

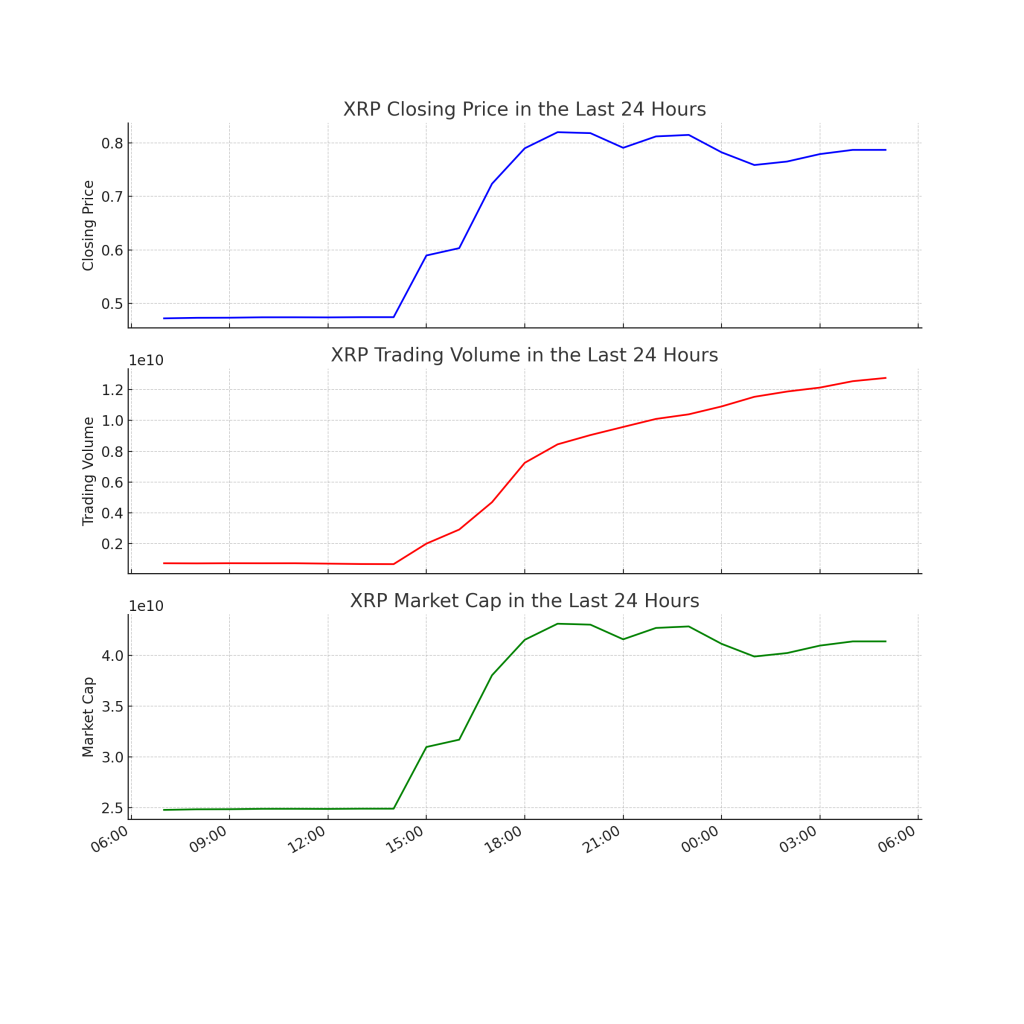

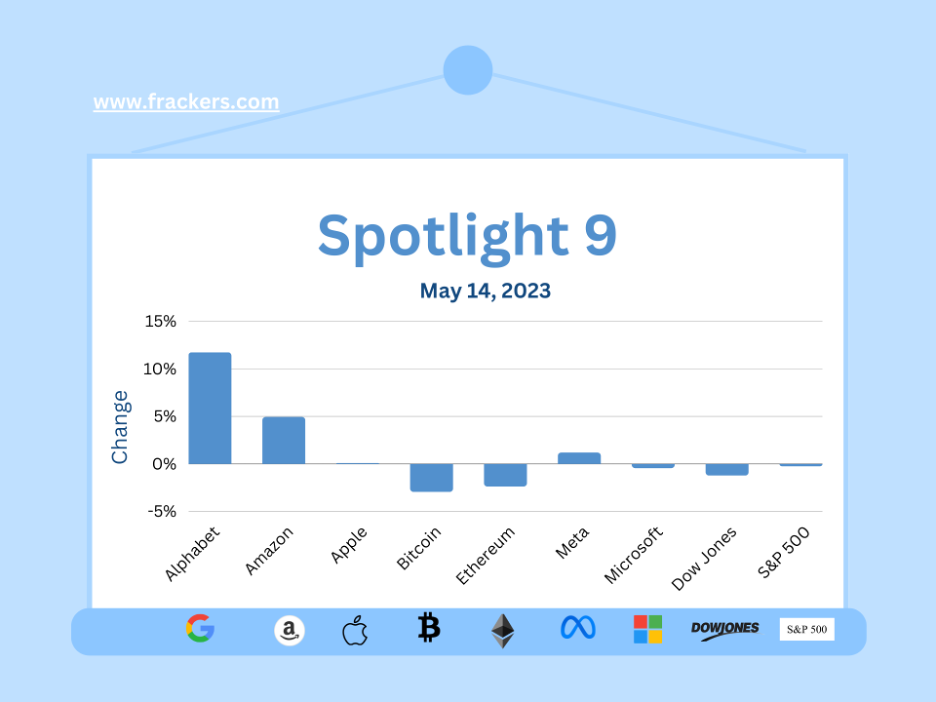

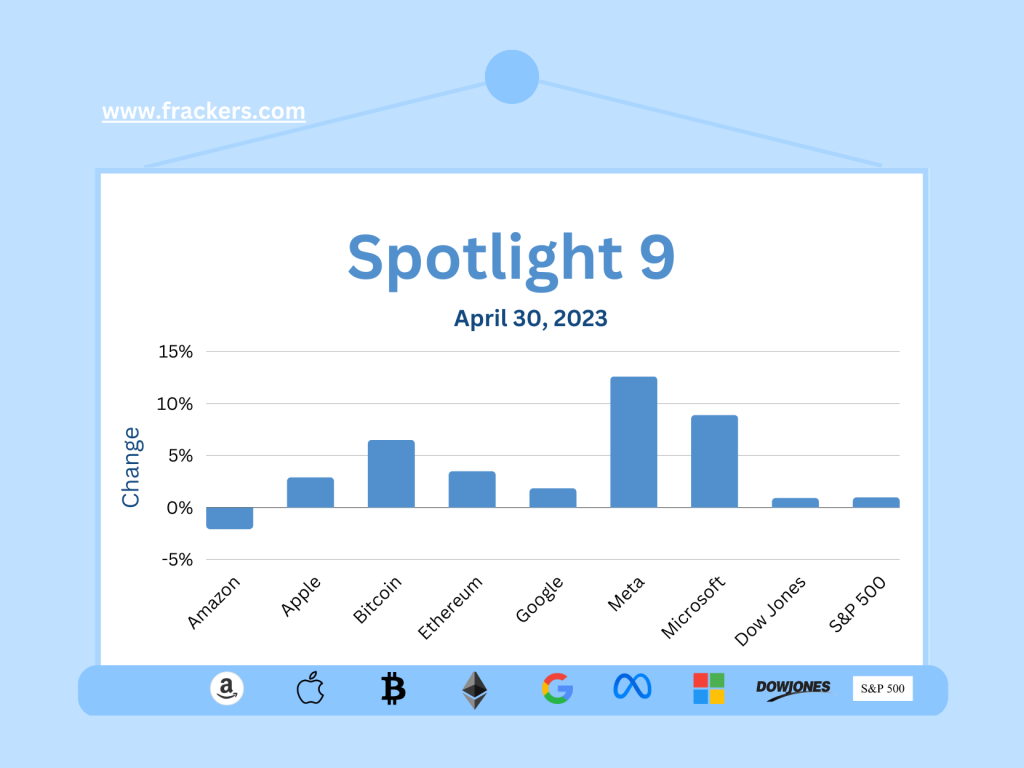

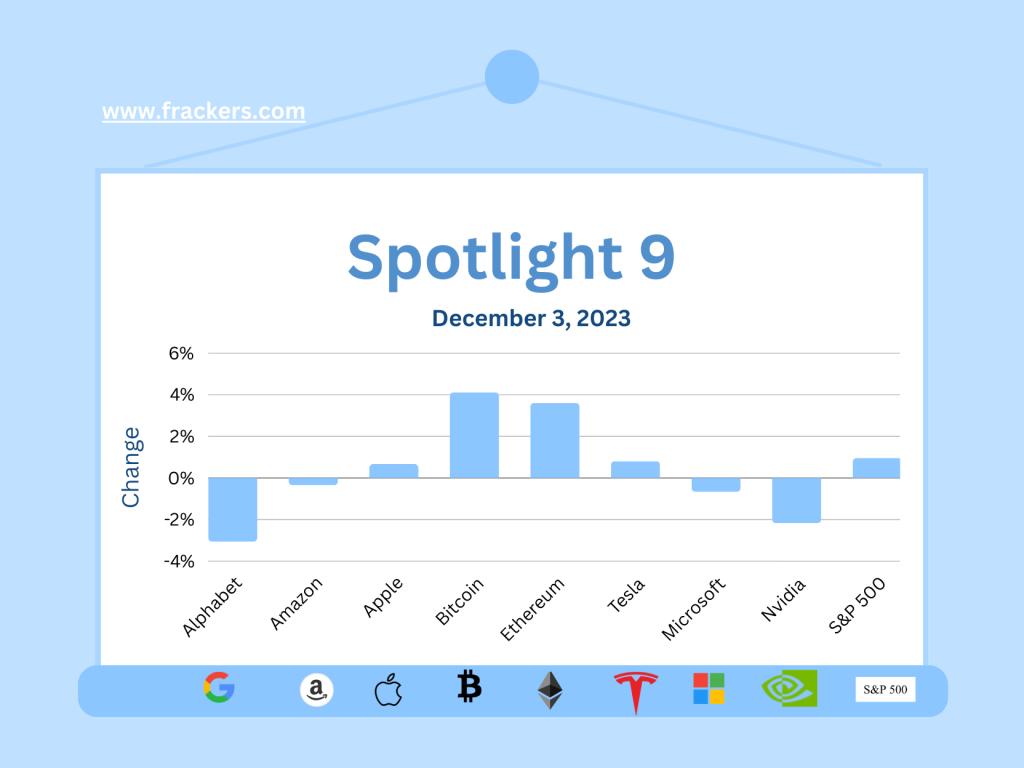

Spotlight 9: crypto week!

It was a dull week for investors, unless you dare to get into cryptos because Bitcoin and Ethereum seem to be definitely back!