What's the reason an oompa loompa went off on Apple CEO Tim Cook?

Image created with Midjourney.

In the latest commercial for the iPad Pro, titled Crush, virtually every expression of human creativity is crushed by a huge vise until what remains is an iPad Pro that has survived the slaughter. A ridiculous idea in terms of content, and also an almost exact copy of a 2008 commercial for an LG cell phone. Apple imitating LG, the company actually called "Lucky Goldstar". How the mighty have fallen.

Since Crush debuted on Tuesday, Apple has been getting hammered daily in leading publications such as AdAge and Variety, but even the usually cautious BBC eagerly quoted actor Hugh Grant, who I adored in his role of Oompa Loompa in Wonka, responding to Apple CEO Tim Cook on X: 'The destruction of the human experience. Thanks to Silicon Valley.' A brief anthology of other headlines:

Apple doesn't understand why you use technology

Apple's 'Crush' ad is disgusting

Oops.

Afrojack versus Apple

Afrojack found it "maybe not such a good campaign. When the man, who parked a new Ferrari in the guardrail within an hour after picking up from the dealership and who fathered a daughter named Vegas with a contestant from a reality tv-show called The Golden Cage, when that man is concerned about your brand, we may speak of a crisis situation.

Apple has since announced it will no longer air the commercial and even apologized. A revealing report on how things could have gone so wrong at the company behind the most legendary TV commercial of all time, 1984's Superbowl commercial for the Macintosh, will surely appear at some point.

'Marketing is about values'

It has now been thirteen years since Steve Jobs passed away, and it's cheap to shout at every Apple mistake that it never would have happened under his leadership. But it is interesting to revisit this internal presentation Jobs made in 1997 just after his return to Apple. Introducing the campaign around the new slogan "Think Different," which was even grammatically incorrect, Jobs told the Apple employees:

"For me, marketing is all about values. The world is very complicated. It's a noisy world. We don't get many opportunities to make sure people remember us. No company gets that chance. That's why we have to be very clear about what we want them to know about us."

What impresses regardless of the content is that throughout the 15-minute presentation, Jobs never reads anything aloud, doesn't look at any screen or uses cheat sheets; the man lives this text, he means it. That's the only reason he can convey it so clearly. Even while wearing cargo shorts.

Apple was: help dissenters

The crux of the Crush commercial's failure lies in the fact that its creators seem to have forgotten Apple's values. Apple in the 1980s stood for the slogan "the power to be your best.Apple wanted to provide the tools that allowed people to be their best. So in 1997 it became "think different," an ode to people who think differently and follow their dreams.

In Crush, iconic symbols of creativity are literally crushed to introduce a new iPad, in a tragic unintentional metaphor for Apple's current identity crisis. The clumsy attempt to equate technological progress with the total destruction of artistic expression underscores how far Apple has strayed from its original mission.

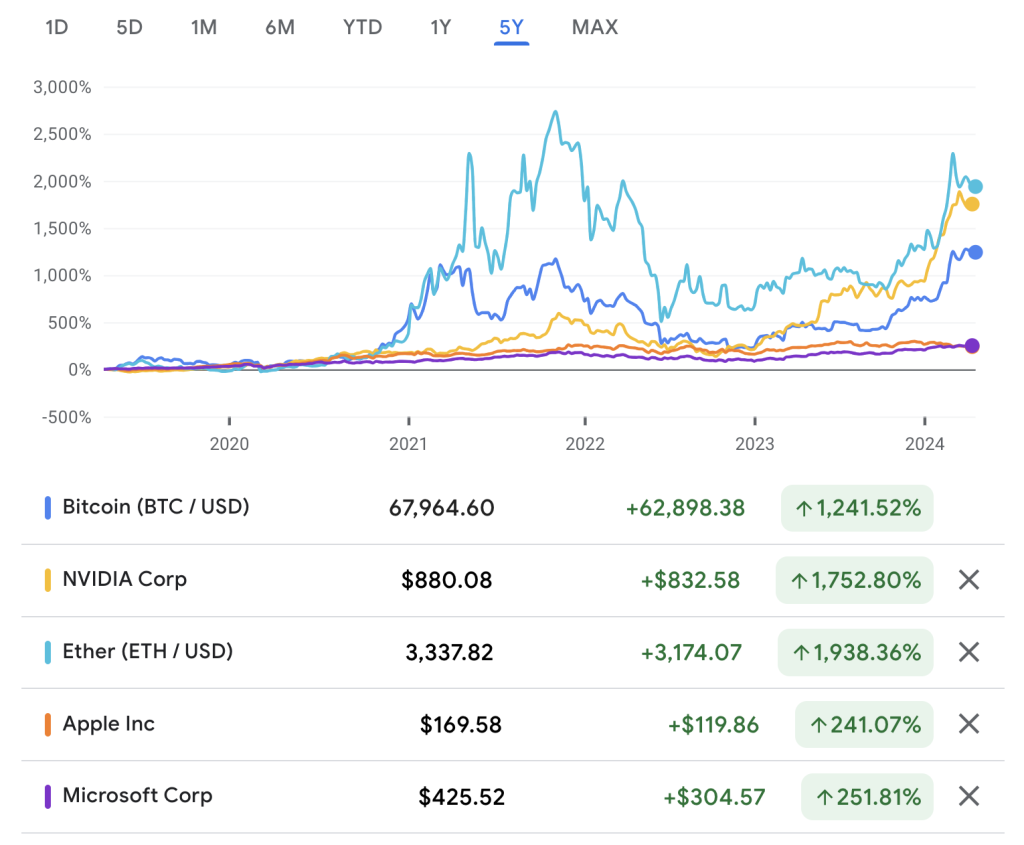

Instead of unveiling revolutionary products, Apple is now focusing on licensing technologies such as OpenAI's ChatGPT. Such collaborations illustrate the shift from innovative leadership to reliance on external sources for innovation. The lack of appealing new products is the reason behind steadily declining sales. The Apple Vision Pro is beautiful, but a drop in the bucket in terms of sales.

It's high time Apple remembered the lines from its own Think Different TV commercial:

"Because the people who are crazy enough to think they can change the world, are the ones who do."

Webinar on Tracer on May 22 and 23

Speaking of the kind of optimists who think they can make the world a better place: I've been getting a lot of questions about the blockchain project Tracer and how to participate in the emerging gigaton industry of CO2 removal, which I wrote about last week.

I share the amazement of many readers at the downright gigantic expectations expressed by firms like McKinsey, Morgan Stanley and Boston Consulting Group in their reports about the huge market of carbon removal.

The team at Tracer is therefore kindly hosting a webinar next week, especially for the readers of this newsletter, on the latest developments in carbon removal, how blockchain plays a role in it and how you can support this initiative. The webinar will be given in Dutch on May 22 and in English on May 23. Register for the obviously free webinar here.

On May 22, I talk with Gert-Jan Lasterie, Chief Business Officer of Tracer. While studying business administration, he started the weblog Flabber, which grew into a site with millions of visitors per month, partly due to successful series such as New Kids and Buitenbeeld. Lasterie sold Flabber to the American media conglomerate Vice, after which he headed social media at Coolblue with the lovely self-titled "chatty boss" and held various management positions at Telegraaf/Mediahuis.

In addition, Lasterie wrote the book "Bitcoin and other crypto currencies," which is considered the Dutch standard work on crypto investing. If only for the amusing subtitle: 'How you thought you were late getting into crypto but became more successful than people who didn't read this book.'

On May 23, in the English-language webinar, Chief Technology Officer of Tracer Philippe Tarbouriech joins us. Tarbouriech held technical positions at startups and large tech companies in Europe and the U.S., with his time as a Technology Fellow at Electronic Arts (EA) including working on the gaming classic SimCity. In a transition from virtual city builder to real life world savior, Tarbouriech has in recent years focused on blockchain applications such as the Carrot smart contract, which creates and tracks carbon removal tokens .

During the webinar, Lasterie and Tarbouriech will, of course, also discuss Tracer's funding and how you can still participate in the project during the seed round this month.

Microsoft signs largest ever contract for CO2 removal

The day after my last newsletter, which was devoted almost entirely to the carbon-removal industry (high word value in Scrabble), the New York Times published an article about it with the headline, 'Will there be a carbon market? A huge amount of work is being done to remove carbon from the atmosphere, but who is going to pay for it?'

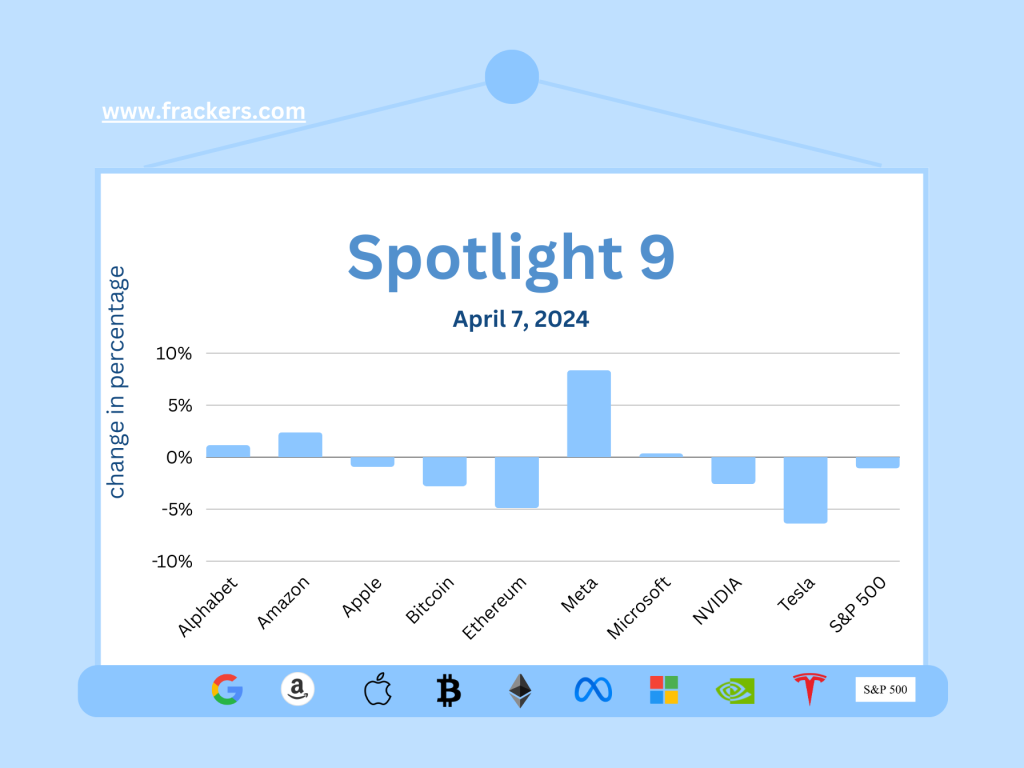

Coincidence makes sense, to paraphrase Johan Cruijff, so it was nice that less than a day later Microsoft and Swedish energy company Stockholm Exergi announced a 10-year off-take agreement, under which Stockholm Exergi will supply Microsoft with more than three million tons of carbon removal certificates from its planned bioenergy plant with carbon capture and storage (BECCS) in Stockholm.

It is the largest carbon removal contract in history.

In an effort to be not only carbon-neutral but even carbon-negative by 2030, Microsoft has in recent months announced a series of carbon removal agreements covering a wide range of technologies and approaches, including reforestation, direct air capture (DAC), ocean carbon removal and biochar-based projects.

On Thursday, Microsoft also announced that it will buy three million tons of removal credits in Brazil over a 15-year period. With this, the world's most valuable company gives a clear answer to the New York Times as to who will pay for carbon removal. No amounts were disclosed with either purchase, but I estimate that Microsoft is setting aside at least three billion dollars for these six million tons; an average of five hundred dollars per removal credit.

As if it were agreed work, the world's largest CO2 vacuum cleaner also opened in Iceland on Wednesday. Everything about Mammoth, from Climeworks, is impressive, as is seeping from the report CBS made. From nearly a thousand dollars per ton of CO2 removed, the price of removal credits produced by Mammoth should drop to less than three hundred dollars by 2030.

Companies give sustainability higher priority

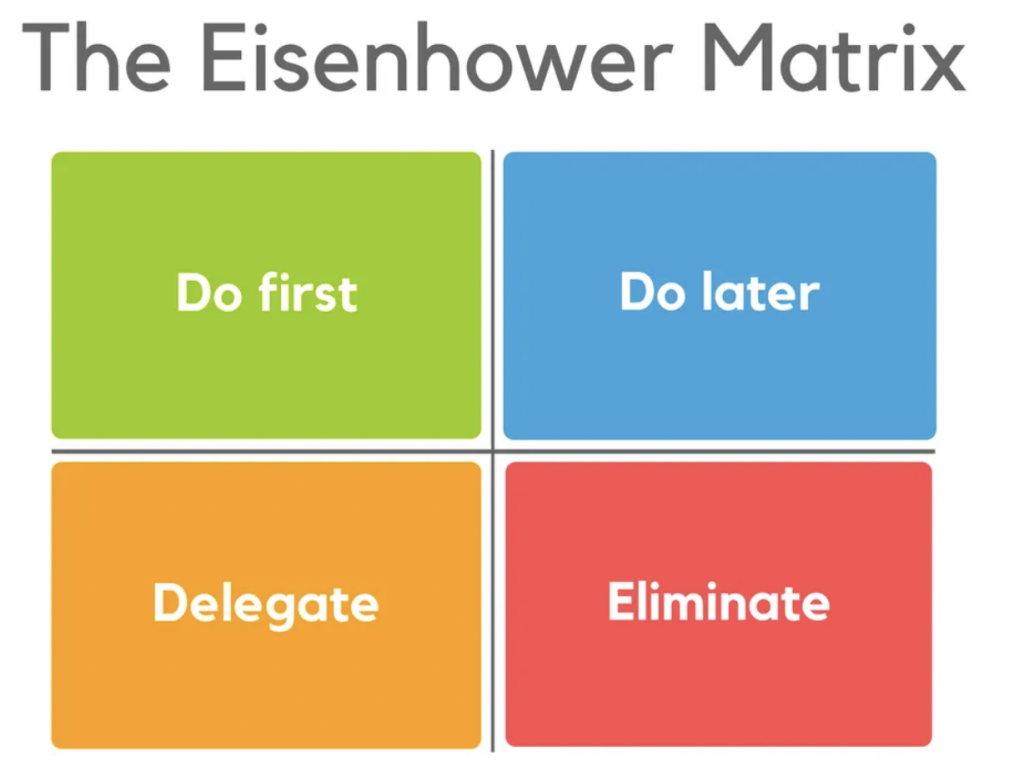

It is striking that while in the political arena many conservative parties are in power around the world, with lackadaisical policies on climate, it is precisely companies that are taking the lead on carbon removal. It seems as if companies better understand that in order to make annual sales and profits, it is quite convenient if there is still a livable planet thirty years from now. Politicians tend to view the world through a lense with a 4 year view, at most: until the next election.

The rosy forecasts from McKinsey, BCG and Morgan Stanley are obviously based on information coming directly from their clients' boardrooms. More than half of CEOs indicate that sustainability is a higher priority now than it was a year ago and that carbon removal is considered the top long-term strategic priority, according to a new survey by EY.