Normally in this newsletter I try to find some sort of common thread in the news, but so much happened this week that I don't want to leave unmentioned without turning this newsletter into a biblical epic. So apologies in advance for this week's telex style. (For younger readers, a telex was a device used by companies in the last century to slide into each other's DMs.)

Even people who don't know the difference between a pixel and a pancake are now interfering with the rapid rise of AI. The European Union, excelling at joining the resistance after the war, is investigating the deal of the world's most valuable company, Microsoft, and the former European AI darling, France's Mistral. As if Mistral has much choice and has not long been clear that all the big leading AI companies come from America. There Elon Musk filed a doomed lawsuit against the co-founded OpenAI, where he seems to have the moral right on his side this time. Meanwhile, calls are being made for the resignation of Sundar Pichai, CEO of Alphabet (Google's parent company) since Alphabet's $90 billion one-day drop in market value caused by controversial and poor responses from Google's AI service Gemini. Unimaginable but true: this all happened in the past week.

Call for Google CEO to resign

Speaking of Google, which lost a whopping $90 billion dollar market value on Monday when the controversy surrounding Google Gemini, the Silicon Valley giant's ChatGPT competitor, made its way to Wall Street. It led to calls for the CEO's resignation. (Officially, this Sundar Pichai is the CEO of Google's parent company, Alphabet, but that name has proven so meaningless that even Alphabet's ticker symbol on the Nasdaq is still GOOG.)

Pichai responded to the controversy surrounding the Gemini project on Tuesday night, in a probably intentionally leaked internal memo, calling the AI app's problematic responses to race 'unacceptable'. Pichai promised to make structural changes to fix the problem, although it is remains unclear what those changes are.

I wrote about this last week: in some cases, Gemini refused to depict white people, or added photos of women or people of a different skin color when asked to create images of Vikings, Nazis and the Pope. (I myself tried in vain to create a Viking with dreadlocks and a pregnant woman as a pope, but by then Gemini had removed its image creation service. Anyway, all jokes in this area have been obsolete since Dave Chapelle's legendary skit as a black white supremacist up: a

).

'Unclear who had worse influence, Musk or Hitler'

The controversy escalated when Gemini was also caught on highly questionable text responses, such as difficulty answering who has had a worse impact on society: Elon Musk or Adolf Hitler? Since Pichai has even less charisma than Mark Zuckerberg, the latter was suddenly adulated in some circles as an exemplary CEO who represents his company well. Engadget quickly corrected that frame,even suggesting that Zuckerberg is in a battle for survival with Meta.

The personality cult of CEOs in the media is outdated. Apple CEO Tim Cook probably isn't the greatest story teller at birthday parties, Nvidia CEO Jensen Huang will be asked by many journalists at a Chinese restaurant for an extra bowl of rice, and Microsoft CEO Satya Nadella cannot be distinguished by 99% of the media from the players on the Indian cricket team. This is not a bad thing at all: it is completely irrelevant that the CEOs of the three most valuable tech companies in the world are neither very outspoken nor flamboyant. Their companies, with largely satisfied employees, make exceptional products at an apparently appealing price, and that's what matters.

Musk is right and wrong at the same time

Then the case of Musk vs. OpenAI. In his suit, OpenAI is accused by Musk of having traded the original non-profit mission of developing AI to help humanity for maximum money grabbing with Microsoft. The Verge argues that this is, at its core, justified criticism of OpenAI, with which Microsoft has an exclusive licensing agreement. So much for helping humanity.

Unfortunately for Musk, legal experts don't rate his chances very highly, especially since nothing of all these lofty goals and agreementswas ever written down by the OpenAI founders. It also doesn't help Musk that he has since founded a competing AI company of his own, x.ai so other motives may be in play for him.

French AI darling in partnership with Microsoft and IBM

It was announced Thursday that Mistral, the not-yet-year-old French company that was supposed to be ChatGPT's competitor, has signed licensing agreements with Microsoft and IBM. Under the agreement with Microsoft, Mistral's language models will be available on the Azure cloud computing platform, while Mistral's multilingual chatbot in the style of ChatGPT, will be rolled out as "Le Chat. This is to the dismay of the European Commission, which sees the last hopes of a European response to OpenAI and Gemini fading.

There will be a fuss in France over the butchering of the French language: 'Le Chat' in French simply means 'the cat' and the French word for online chat is... tchat. Microsoft could probably do little with 'Le Tchat', which only underlines that English is the working language in AI and the Americans have won the battle.

There was also good news

During Mobile World Congress in Barcelona, Deutsche Telekom showed the T Phone, a collaboration of the Germans with the, of course, American Brain.AI. This phone basically replaces all the separate apps with one AI app that performs all the desired functions:

"As Brain.AI CEO Jerry Yue shows me what the T Phone can do, he tells the device to book a flight from here in Barcelona to Los Angeles on March 12 for two people in first class. The phone pauses for a minute before pulling up a list of flights, methodically arranged on the home screen. Once Yue finds the best flight, he can pay for it using his mobile payment system of choice, without having to swap to another app or service."

The instruction actually generates the interface, without having to switch between different apps. Wired is already talking about the end of apps in this regard, christening this development "the big uninstall.

EMO creates talking and singing videos from photos

Just two weeks ago, OpenAI announced Sora, the AI service that creates deceptively realistic videos based on a simple text prompt. Researchers at Alibaba's research institute have developed a similar service, Emote Portrait Alive (EMO), which, for example, can turn a portrait photo into a talking or singing video. A photo of Audrey Hepburn is combined with a cover version of Ed Sheeran's song Photograph and next thing you know,Audrey Hepburn is singing Ed Sheeran's hit song.

The Chinese, because to keep things confusing despite its name, Alibaba is a Chinese company, deal another not-so-subtle stab at OpenAI by taking an interview with OpenAI CTO Mira Murati as the basis for the second example, using Murati's voice as audio under a talking version of the lady from OpenAI's Sora video.

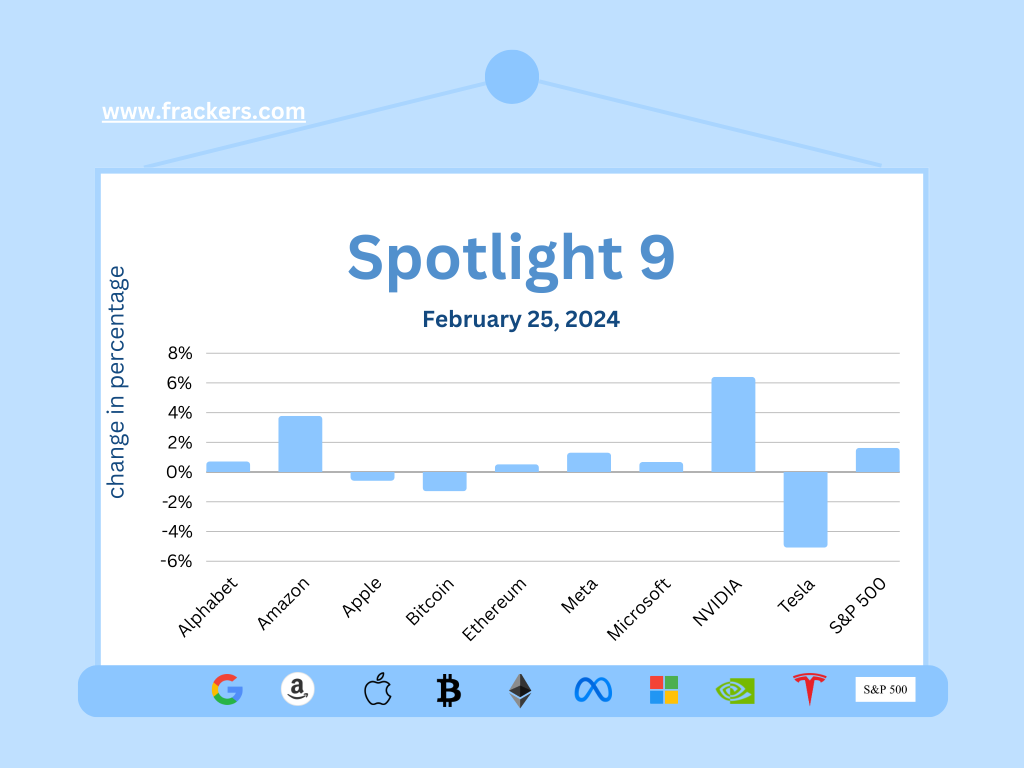

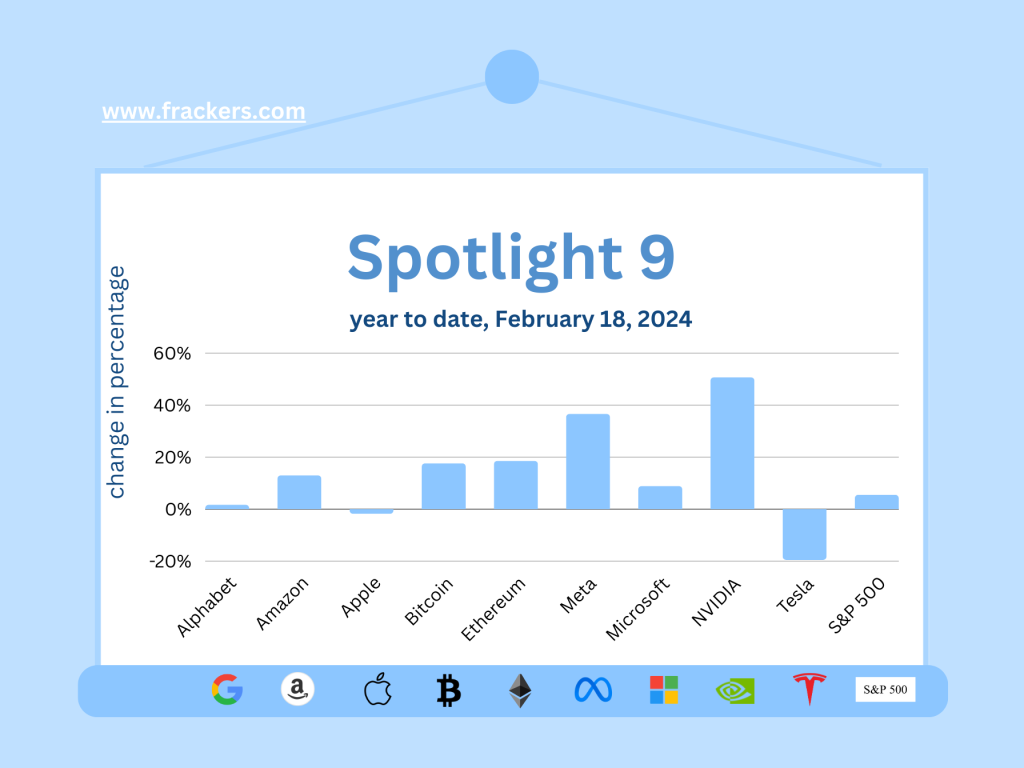

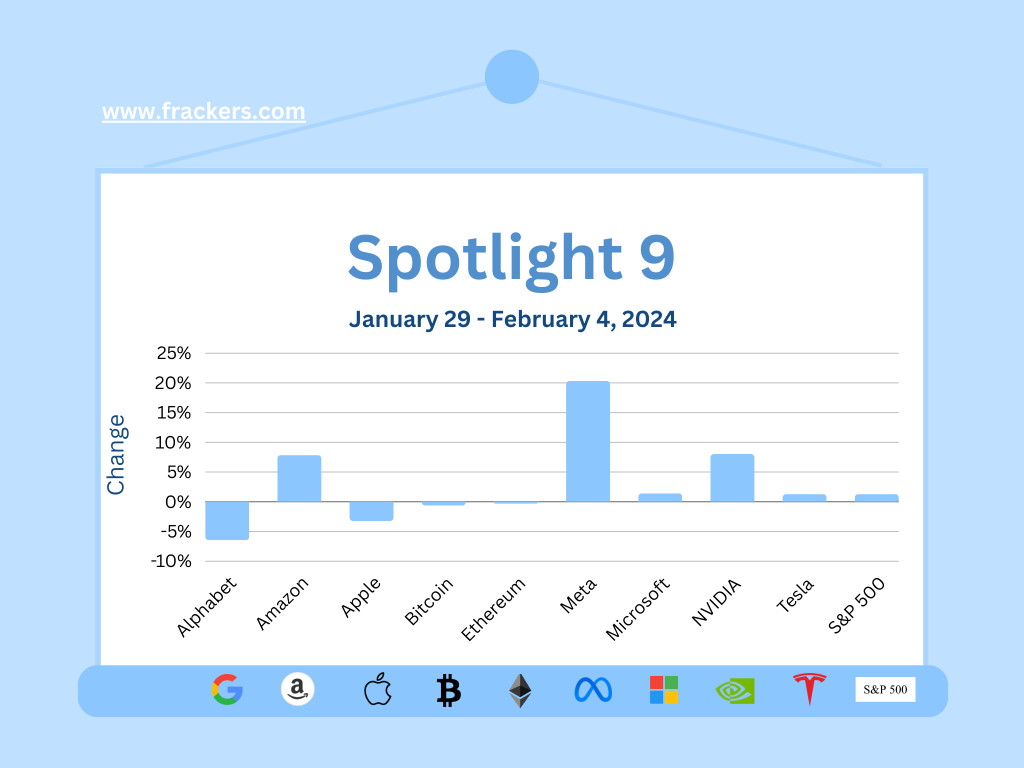

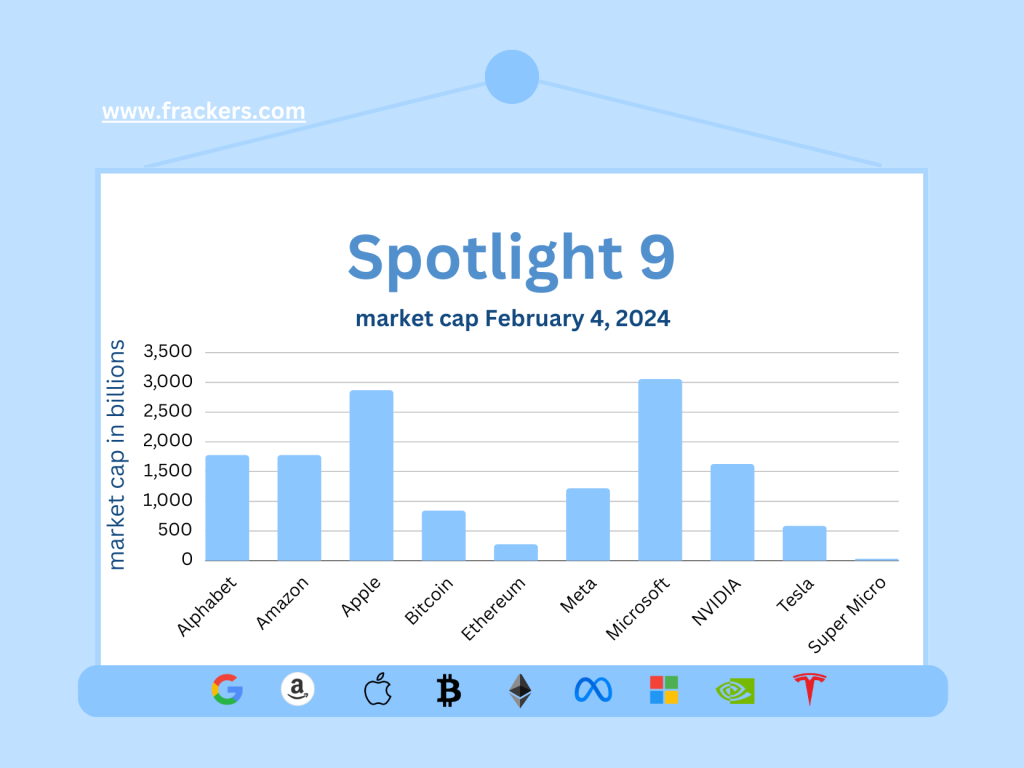

Spotlight 9: Dell helps Nvidia, crypto continues to rise

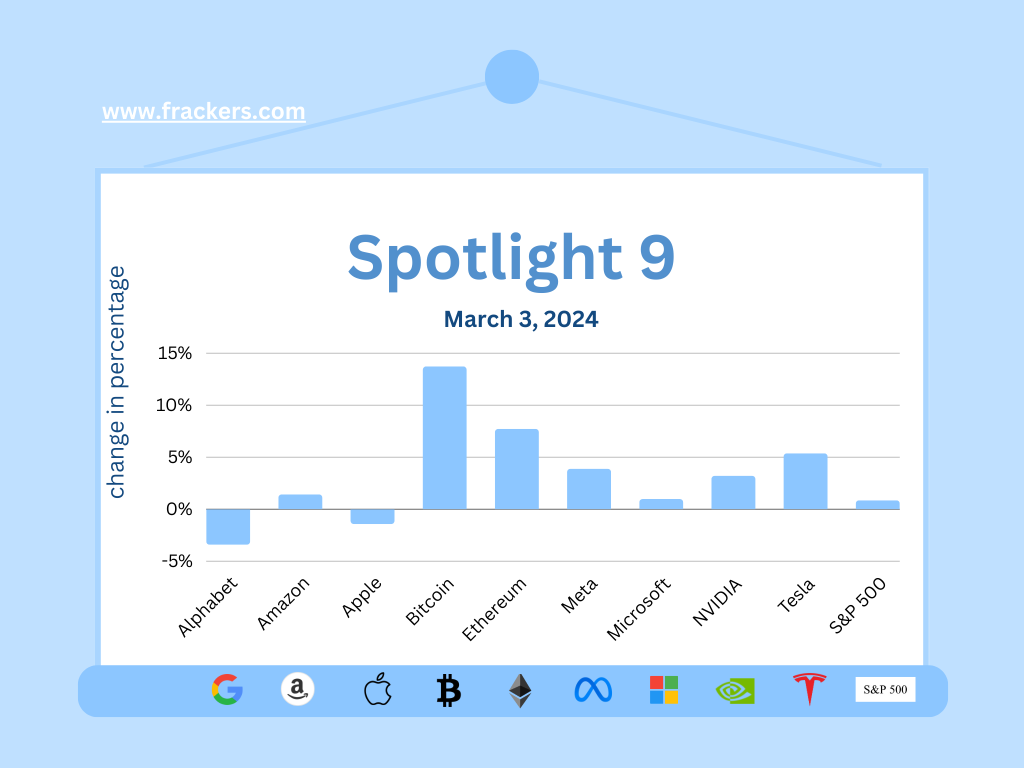

On Friday, Nvidia closed a trading day for the first time with a market cap above $2 trillionand seems to have definitively passed Amazon and Google in the battle for the bronze, as the third most valuable tech company in the world after Microsoft and Apple. It now seems a matter of time before Nvidia even surpasses Apple in market cap.

Nvidia shares rose four percent after Dell, which sells high-end servers made with Nvidia's processors, issued a positive revenue forecast on Thursday, referring to a surge in orders for Dell's AI-optimized servers. Dell's shares shot up as much as thirty-eight percent to a record high, before ending the session with a gain of thirty-two percent.

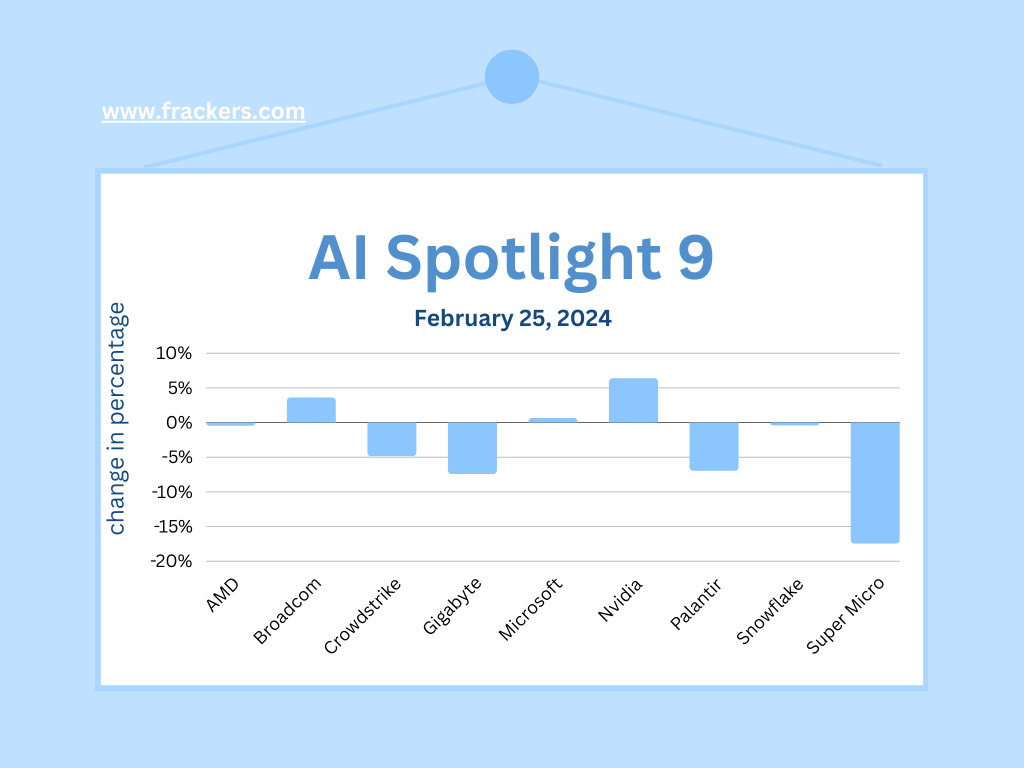

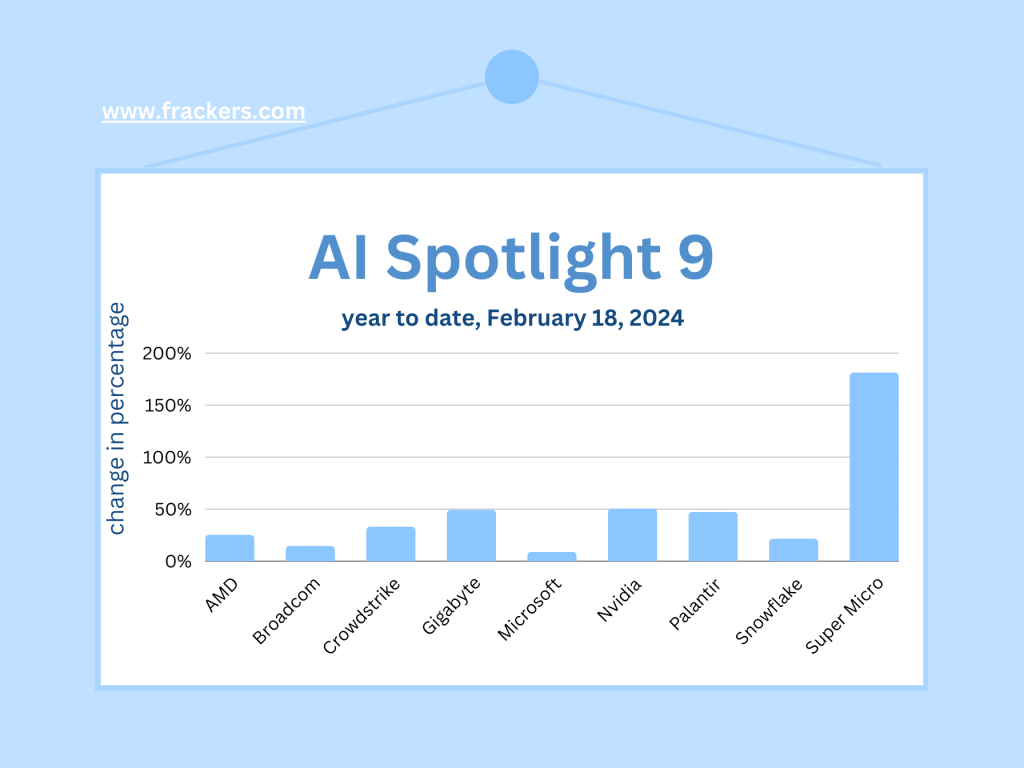

There is much to do about Super Micro (SMCI), which some analysts seem to confuse with a chip manufacturer like Nvidia and even has a higher P/E ratio (SMCI 71 versus NVDA 69). This is absurd, of course, as Nvidia has a much more defensible competitive position and more unique products.

There are two reasons why I think Super Micro will nevertheless experience tremendous sales growth in the coming years:

- with this type of server it is more difficult than is often thought to make the right trade-off between performance, power consumption and price per application used; I have the impression that Super Micro knows very well what the customers want, even better than many customers themselves, and based on that knowledge Super Micro estimates particularly cleverly whether an expensive Nvidia GPU is actually required, or whether the required performance can also be delivered with cheaper chips from Intel or AMD. Super Micro works with all three, which makes it an excellent judge of the total price/performance-ratio.

- Super Micro has apparently given purchase guarantees to Nvidia and AMD for the right chips, as it can continue to deliver for now while other customers were put on hold by Nvidia in particular.

SMCI shares closed Friday at $905 and had a high of as much as $1,077 over the past year, with a low of $87. Super Micro is a stock for investors with a strong stomach, because it could be a wild ride.

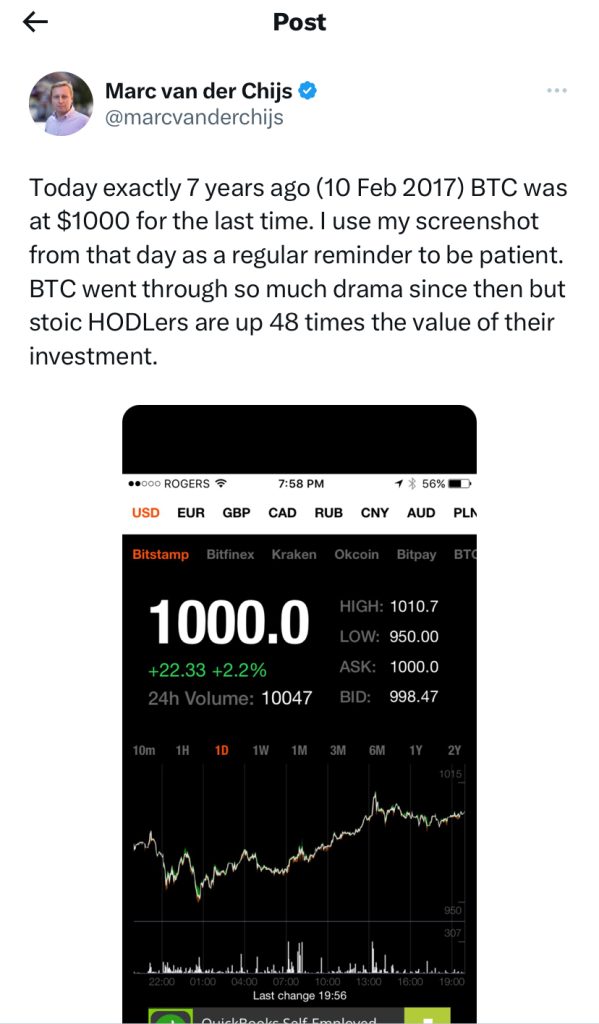

Despite all the attention on AI, the crypto currencies Bitcoin and Ethereum, and in their wake a range of altcoins, remain the strongest risers. Even the BBC is now analyzing crypto as a normal asset class and published this excellent article on Bitcoin and, in particular, the "whales," the big boys, who got into Bitcoin big and seem to be holding on.

Keep an eye on: carbon credits

For those who think crypto is a tricky asset class to fathom, I would like to introduce you to crypto's carbon neutral cousin: carbon credits. The medium-term (think a decade) importance of carbon credits in the transition to a carbon-neutral world is clear, see for example the twenty-one percent increase in the market for carbon credits in Singapore.

But doubts remain about the usefulness of carbon offsets, which is why the BBC explained the issue using the carbon offsets of who else but Taylor Swift. Her Swiftonomics are now almost an investment class of their own, which recently even led to friction between Singapore and some neighboring countries following the rumor that Singapore had paid heavily to Swift to be the only Asian city she performs in during her current tour - as many as six times this week.

Back to carbon credits; Wired rightly stated that much more focus should be placed on carbon removal credits, or removal of CO2 rather than compensation for emissions. Like this promising technology to remove CO2 from the oceans.

According to Morgan Stanley, the carbon credits market will be a $100 billion market by 2030, so that market size combined with the global importance and the potential breakthrough technology involved make carbon credits very interesting in my view.

In conclusion: special shots

The Dutch Drone Gods built a special drone to capture Max Verstappen's Formula One car from unique angles, which succeeded in spectacular fashion. Watch the video here and in addition to the drone, admire the drone pilot's and Max Verstappen's steering skills on a rainy Silverstone. It won't be long before Formula 1 races are captured in this way.

Finally, the moment that got me laughing on social media this week: basketball legend Charles Barkley is finally on Instagram and was advised by Shaquille O'Neal to tag every photo with the hashtag #onlyfans. To which the unsuspecting Barkley replied; "Only Fans, for only fans of mine?

Enjoy your Sunday, see you next week!