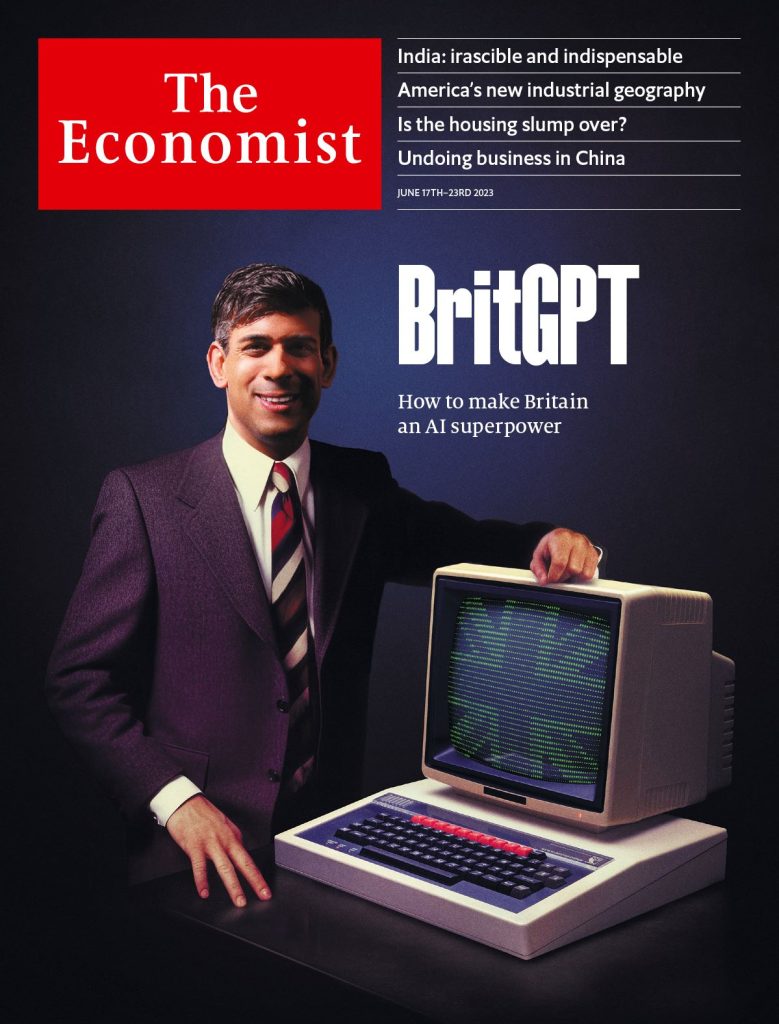

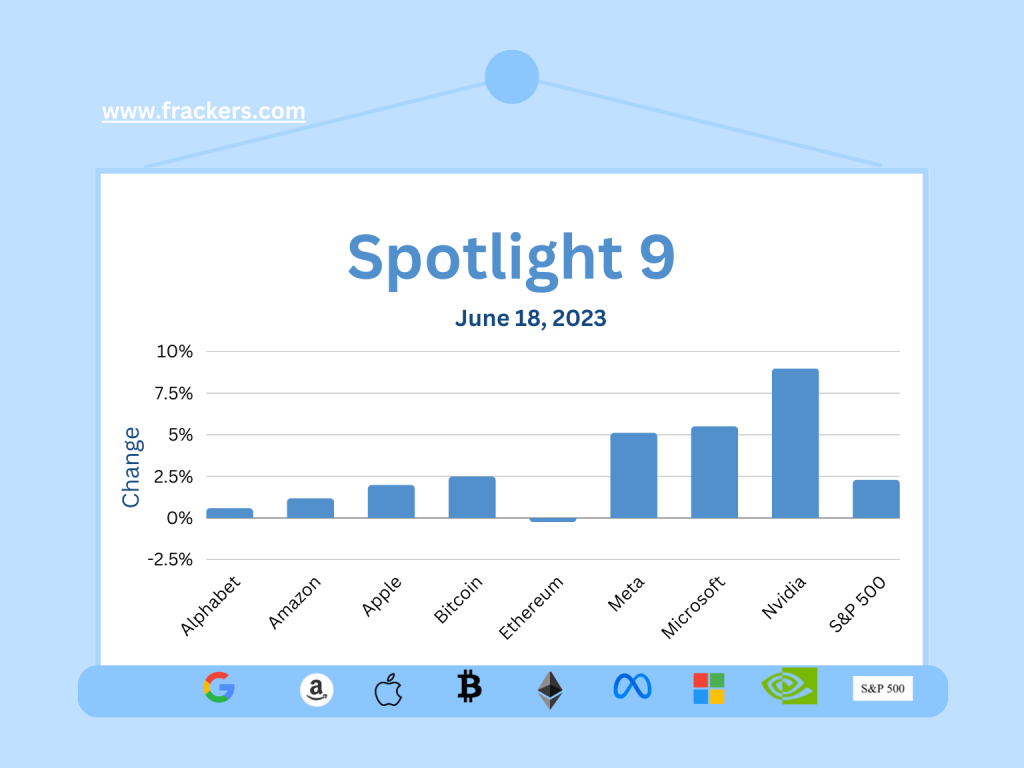

Nvidia dominated the news in the technology world last week in a way reminiscent of Netscape's 1995 IPO. That legendary IPO heralded the start of the Internet era, just as the launch of the iPhone in 2007 marked the breakthrough of the smartphone. Similarly, we will one day look back on Nvidia's stunning Q2 results, which launched the world into the AI era. This was the big bang of artificial intelligence.

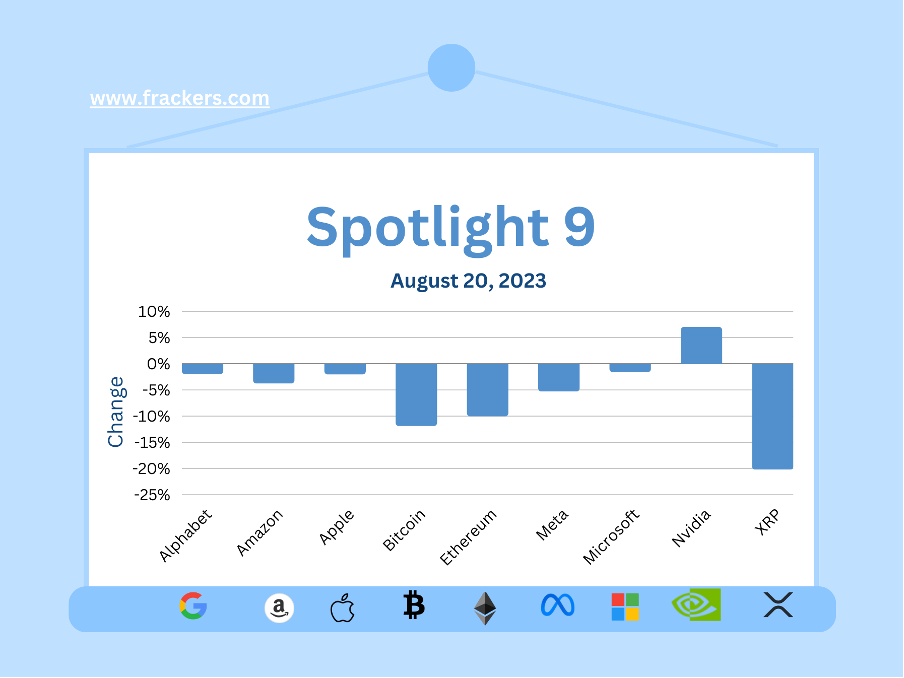

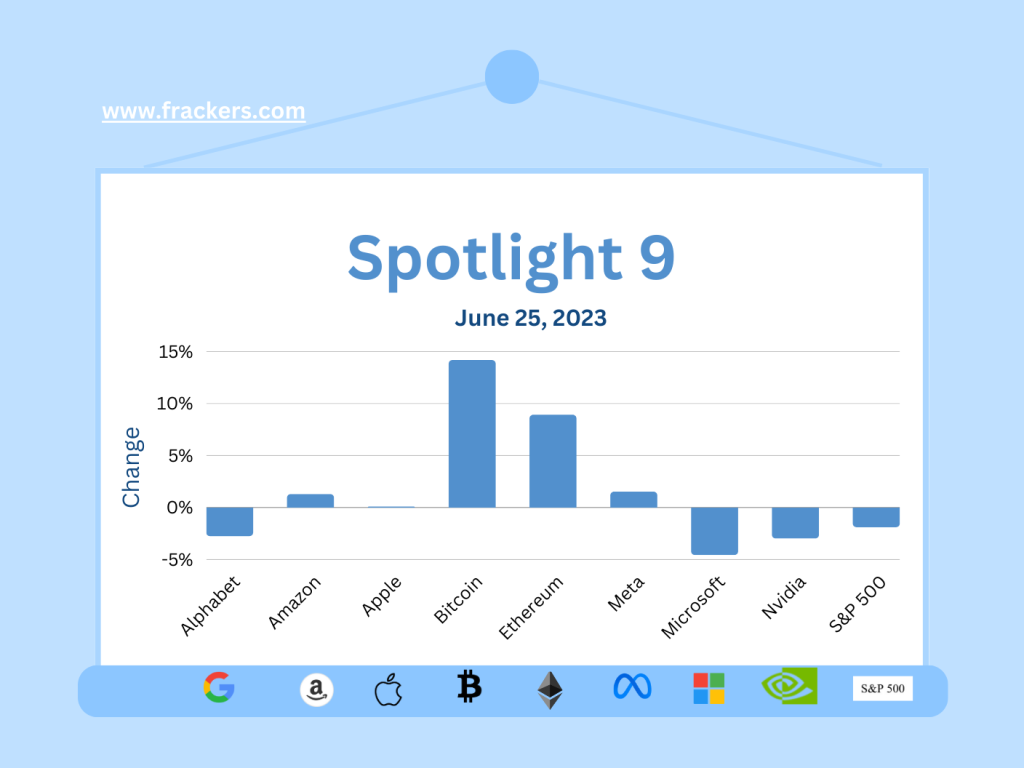

Compared to last year's second quarter, revenue doubled from $6.7 billion to $13.5 billion, while profits rose 843% (no typo), from $656 million to nearly $6.2 billion. The outlook for next year is even brighter. What lies behind these stunning numbers and why does the "shovel and pickaxe maker" Nvidia earn more than the digital gold diggers, the AI application makers?

"A new computing era has begun. Companies worldwide are moving from general-purpose to accelerated computing and generative AI."

Jensen Huang, CEO Nvidia

"A new computing era has begun. Worldwide, companies are moving from general-purpose to accelerated computing and generative AI," said Jensen Huang, founder and CEO of NVIDIA in releasing his figures. Usually CEOs believe too much in themselves and the creation of their own success, but Huang is absolutely right.

That's why in this week's newsletter I don't pay attention to other newsworthy events, such as the announcement of chipmaker Arm's IPO that may be a precursor to a definitive revival in the technology sector after a year of mass layoffs, but try to make sense of Nvidia's development in the suddenly rapidly changing technology world.

Ghost valley

"Everyone seemed pretty gloomy, looking at each other and wondering why nothing exciting seemed to be happening in the Valley anymore." It could be a quote from sentiment in the technology sector before OpenAI launched Chat GPT late last year, but it is a quote from Netscape founder Marc Andreessen about the atmosphere he encountered when he moved to Silicon Valley in 1994.

The personal computer had broken through worldwide in the 1980s, Microsoft dominated that market in software, and there were a few big players in the traditional world of mainframe computers and networking. But nobody's heart was beating faster from companies like HP, Novell or my favorite company name, Digital. (What an inspiring brainstorming session it must have been where they came up with that name).

The success of the free Netscape browser and subsequent IPO completely changed that sentiment. Suddenly, large companies were developing applications for the Internet and Internet startups were getting serious funding - eBay was founded less than a month after the Netscape IPO, Amazon went public two years later, and that was less than a year before Google launched, to name a few examples.

Nvidia's recent success seems to echo the Netscape IPO. At Nvidia, the sales and profits led to investor enthusiasm, but at Netscape in 1995, jubilation arose around the share price. That is a major difference... The expected introductory price was $14 but demand was so high that a last-minute decision was made to double the introductory price to $28, something that rarely, if ever, happens because the introductory price is determined after months of talks with investors worldwide.

Netscape closed the first day of trading at a price of $75, which meant that the company had left billions on the table with its still too-low introductory price and the first buyers were able to book record profits on the very first day. From Wall Street to Main Street, as it is so nicely phrased, everyone was reading in the newspaper the next day about that miraculous invisible phenomenon called the Internet. (Unfortunately, I don't have time to explain to readers under 35 what a newspaper is, but think of it as a pile of printed out homepages with very large banners that you read for free at the hairdresser's, excuse me, hair stylist's.)

Cisco no disco, but briefly the biggest

The clamor around Netscape stock quickly died down because of relatively modest revenue and profit growth, mainly due to fierce competition from Microsoft that culminated in an infamous lawsuit (in which, incidentally, to my surprise, an offer Microsoft had made me at my first company Planet Internet to switch browsers was entered into evidence by Netscape).

Meanwhile, almost unnoticed, another much less sexy company grew to become the most valuable company in the world: Cisco. Products from this maker of telecommunications equipment were used by virtually every telecom company in the world, which rushed to offer the Internet as a new service alongside telephony, as well as in corporate networks that were massively connecting to the Internet.

In March 2000, Cisco was the most valuable company in the world with a market value of more than $500 billion. Its P/E ratio was a staggering 196, meaning an investor was willing to pay $196 for $1 of the company's profits at that share price. The party did not last long, and two decades later Cisco is a fine company, but it is worth only half of that sky-high valuation of the early 2000s. By comparison, anyone who had bought Apple stock for a thousand dollars back then would now have made over a 20,000% return and makeover $200,000.

Is Nvidia the Netscape, Cisco or Apple of 2023?

The Netscape browser opened up information and commerce to a global audience. The greatest value, however, turned out to lie not in the creators of the infrastructure (Cisco) or the creators of the application layer (Netscape), but in the developers of applications on that enabling technology: first Yahoo and eBay, then Amazon and Google.

Similarly, Facebook, Whatsapp, Instagram and later Tiktok benefited from the smartphone breakthrough, especially after 2010 when the iPhone 3 appeared and Android enabled good licensing versions for Samsung and Chinese smartphone makers such as Huawei. That technology, combined with globally cheaper subscriptions and data traffic bundles, led to exploding social media usage.

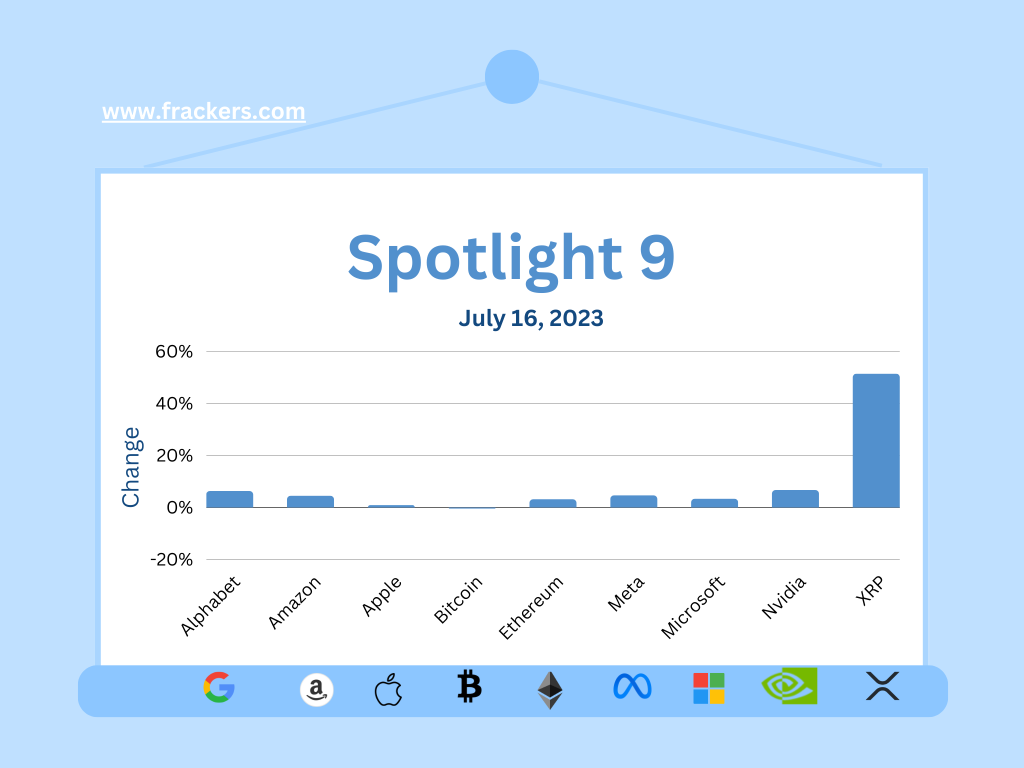

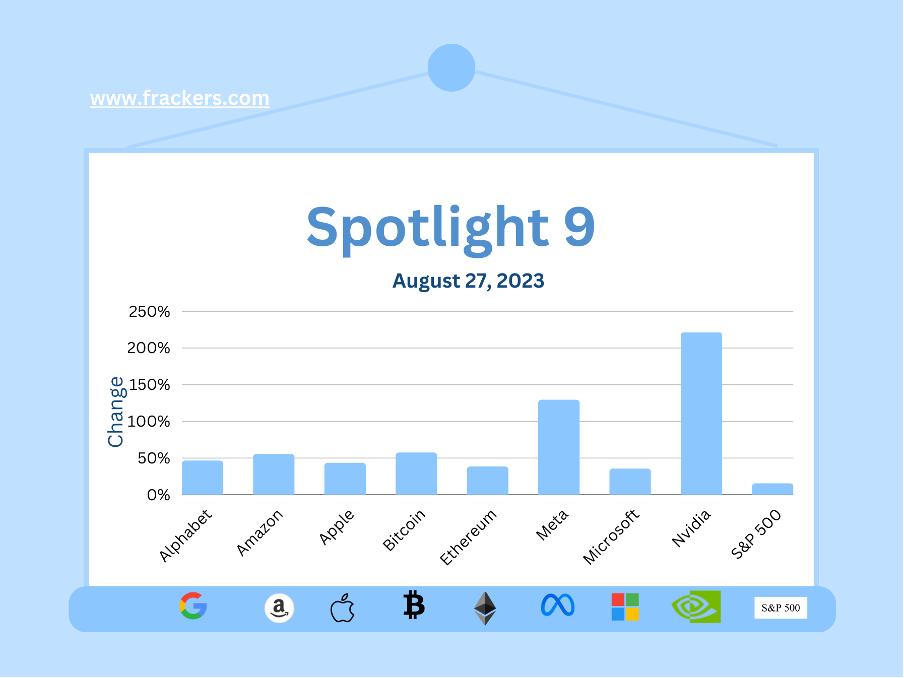

From the market value of Meta (owner of Facebook, Instagram and Whatsapp) of over $700 billion, as well as the over $200 billion market value of ByteDance (owner of TikTok and Lemon8), you would think that the greatest value is again in applications. Were it not for the fact that Nvidia is already worth a whopping $1.1 trillion, $1100 billion.

Analyst Stephen Guilfoyle says of Nvidia:

"The business is not as good as gold, but much better. Cash flows are growing at an amazing rate. Costs and expenses are under control. The balance sheet is beautiful. While growth in the data center business is beyond what I thought possible not too long ago, gaming also seems to be back on track."

Several analysts and investors have now raised their expectations for Nvidia stock to above $550 and even $600, which would mean that Nvidia will be worth more than Amazon.

There are only five

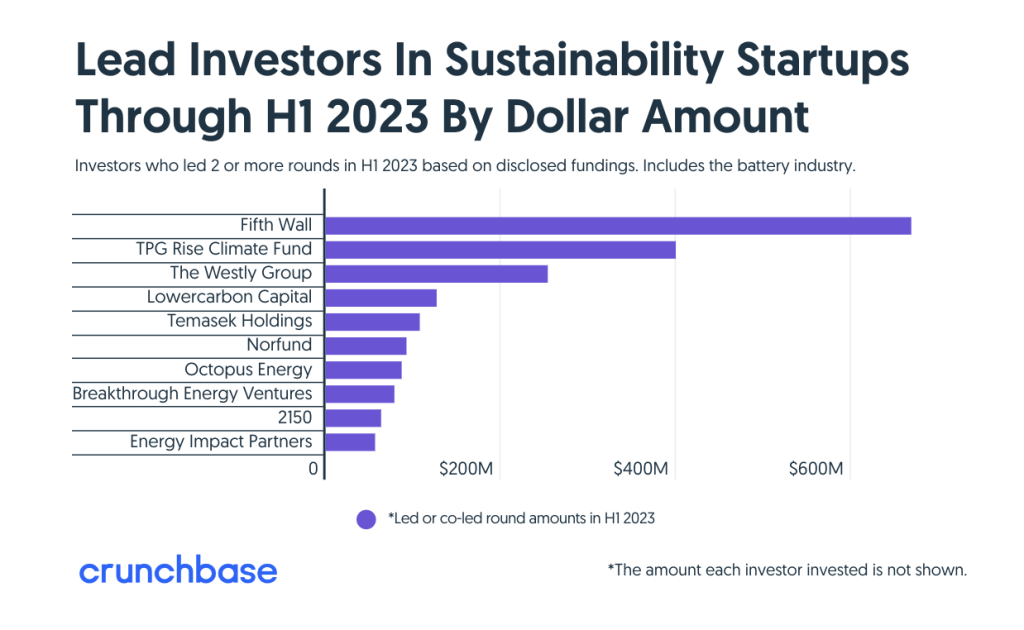

Excluding Saudi state oil drillers Aramco, Nvidia is already currently one of only five companies in the world that has reached the $1 trillion (thousand billion) market value milestone - along with Apple, Amazon, Microsoft and Google's owner Alphabet - and the only one that is not a household name.

Founded in 1993, Nvidia became known primarily as a maker of graphics cards for high-end gaming computers; everyone has one of those nephews in the family who would come over to give you a sweaty hand when you visited, before quickly hobbling back to the attic to continue gaming on his PC with an Nvidia GeForce graphics card. That was also the image investors had of the company for years.

Under Huang's leadership, Nvidia quietly developed into a formidable competitor to giants such as Intel. "We saw early on, about a decade ago, that this way of making software could change everything. And we changed the company from the bottom up and sideways. Every chip we made was focused on artificial intelligence," Huang told CNBC.

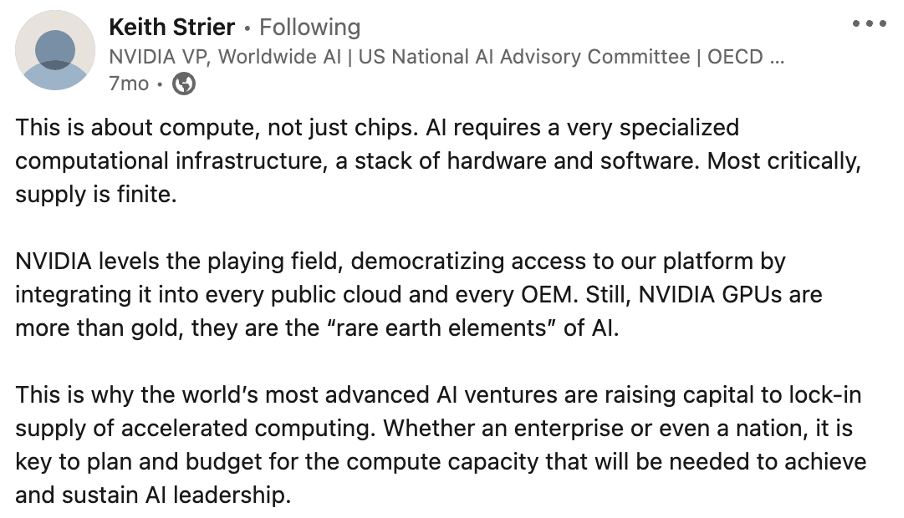

Anyone looking superficially at Nvidia is quick to make the mistake of concluding that the company only makes chips and is very sensitive to competing chips as already announced by Nvidia's own customers, including Google, Microsoft and Amazon. Only it turns out that the lead Nvidia has built up is far less easy to catch up with than widely thought. As the New York Times concluded, Nvidia has developed a competitive moat around AI chips.

Therefore, orders are being placed by various companies and even countries for years ahead; previously I wrote about orders from the Chinese Internet giants and from the Arab world. The rumor is persistent that orders are being made for billions for chips that Nvidia has not yet announced, let alone has in production.

The scarcity of components and manufacturing capacity could be an Achilles heel for Nvidia. After all, manufacturing is outsourced entirely to TSMC, but not entirely coincidentally, TSMC also makes all of Apple' s chips which seems to have a preferred position.

Conclusion: Nvidia example of completely new business form

It can be argued that Nvidia has built a better competitive position than Cisco ever had and the margins are arguably much higher. While Nvidia is an enabling technology, it is far less easy to replace than, say, Netscape once was. But it is also not an extremely scalable company like Google or even Meta because it depends on hardware production.

To understand Nvidia and the AI craze, it is interesting to see how, for example, ChatGPT uses Nvidia. The company OpenAI, whose shareholders include Microsoft, developed ChatGPT and together with Microsoft' s cloud service , Azure, and Nvidia built the cluster on which ChatGPT runs. Quickly summarized: Microsoft's cloud service Azure uses Nvidia's famous H100 chips for this particular application in a data center and the application ChatGPT uses the service.

OpenAI has licensed use of ChatGPT to Microsoft, which uses the technology in its Bing search engine, among others. But Microsoft also makes its own AI chips that will eventually compete with Nvidia.

It is like slowly finding out that your uncle on your father's side is married to your mother's sister, only on a prenuptial agreement and not in community of property.

It is crucial to understand that the AI applications we see today are almost all based on Large Language Models (LLMs), a type of artificial intelligence models designed to understand and generate human-like text from large amounts of data on which it has been trained.

The PT in ChatGPT stands for Pre-Trained: ChatGPT uses deep learning to process and produce text in a coherent and contextually relevant way. Because of its size, which includes billions of parameters, it can handle a variety of tasks, from answering questions and writing essays to generating creative content. Only, and here it comes, that pre-training, feeding the system with data, requires such extreme computing power that can currently only be provided by Nvidia.

30,000 GPUs for ChatGPT

So when Hubspot, the tool I use to create this newsletter, announces, for example, an AI module claiming to be "Powered by OpenAI," not only Hubspot but also OpenAI earns from it, obviously Microsoft (because OpenAI uses Azure) and, above all, Nvidia. This kind of value chain will become commonplace in AI: specific applications developed on horizontal AI platforms like OpenAI, from which ultimately Nvidia always earns.

To complete the example of OpenAI with ChatGPT: only those involved know exactly how the system is put together, but the claim that no less than ten thousand Nvidia GPUs were used to make ChatGPT and another twenty thousand are needed to run nicely does not sound implausible. With a purchase price of $30,000, that's an order for a whopping $900 million for Nvidia.

What is unique about Nvidia's AI technology stack is that they are no longer motherboards or graphics cards that my nephew can pull right out of his PC, but software applications specifically designed for the capabilities of, say, Nvidia's flagship H100. Because depreciation on these types of systems is spread out over many years, it will be years before Nvidia is replaced - if any new, better technology comes to market than Nvidia offers, which does not seem likely at this time.

When Jensen Huang first used ChatGPT, he asked for a poem about Nvidia. So I asked for a poem about Nvidia, the H100 and revenue potential. This is the result.

In the realm of tech, where ambitions reside,

Poem by ChatGPT about Nvidia and the H100

The H100 emerges, with potential untried.

Nvidia's beacon, shining so bright,

Promises profits, reaching a new height.

Markets await, their hopes taking flight,

For with this chip, the future's so right.

Nvidia stands poised, ready to soar,

With the H100, revenue's lore is in store.

Next week another regular installment of my newsletter. Happy Sunday!