Door reisdrukte en fysieke malheur een paar dagen later dan gebruikelijk, hierbij tien zaken die opvielen, met speciale aandacht voor OpenAI en Apple. Het grote nieuws van vandaag is dat OpenAI met Atlas een browser lanceert, als onderdeel van de midscheepse aanval op Google’s dominantie.

Het aandeel Google kreeg gelijk een opdonder, want Atlas is gebouwd rondom functionaliteit van ChatGPT waarmee OpenAI hoopt zowel advertentie-omzet als omzet uit e-commerce te genereren.

- OpenAI met browser en in p0rn0: liever rode oortjes dan rode cijfers

- Jon Stewart & Nobelprijswinnaar Hinton over AI: ‘are you out of your mind?’

- Deloitte betrapt op slecht AI-gebruik in overheidsrapport van vier ton: wel een kleine korting

- AI-bedrijven openen koffieshops: wennen aan product met winstmarge

- Apple heeft wel/niet een AI-probleem: misschien is afwachten juist slim

- Amerikaanse Formule 1 naar Apple: volgt wereldwijd?

- Apple met “broodrooster/koelkastcombinatie”: Macs met touchscreen

- Vinod Khosla: “meerderheid vc’s voegt niets toe”

- Ray-Ban fabrikant naar recordhoogte: profiteert van Meta AI-bril

- Big Tech kwartaalcijfers komen eraan: moment van de waarheid

OpenAI risico voor de wereldeconomie

MG Siegler vatte vlak voordat het nieuws over Atlas uitkwam uitstekend samen waarom OpenAI dit jaar een oorlog op alle fronten voert: Sam Altman moet wel, want de kostenstructuur is op lange termijn niet te financieren uit de huidige producten. Maar het risico dat OpenAI inmiddels voor de hele economie vormt, zonder enige vorm van overdrijving, ligt in de verwevenheid van OpenAI met de grote techbedrijven die de beurzen aanjagen. Siegler:

“Om het duidelijker te zeggen: het is niet alleen dat OpenAI enorme ambities heeft, en het is niet alleen dat ze investeerders hebben overtuigd om ze tientallen miljarden dollars te geven, het is dat steeds vitalere onderdelen van de aandelenmarkt nu volledig verweven zijn in deze situatie. Het begon natuurlijk met Microsoft, dat heeft geprobeerd om een deel van die relatie af te wikkelen. Maar als gevolg daarvan heeft OpenAI anderen binnengehaald zoals Oracle, AMD en ja, NVIDIA – het grootste bedrijf qua marktkapitalisatie ter wereld, met een waarde die een orde van grootte hoger ligt dan waar Apple en Exxon al die jaren geleden stonden. Het is een aandeel dat zo vitaal is voor de S&P 500 dat als het zou crashen…”

“ChatGPT wordt smeerpijperij”

Vice ziet ChatGPT verworden tot een ‘smut factory’. Dat concludeerde Vice nadat OpenAI CEO Sam Altman een tikje besmuikt sprak over ‘mensen als volwassenen te zullen behandelen.’ Vorige week werd al duidelijk dat OpenAI probeert om met Sora2 een TikTok-concurrent op te zetten in een poging reclamegelden binnen te harken en nu wordt het tijd voor een soort OpenAI-fans als variant op OnlyFans.

Wat vaak wordt vergeten: op dit moment levert elke nieuwe gebruiker van ChatGPT extra verlies op. Altman grijpt enerzijds elke financiering aan en anderzijds elke mogelijke omzetvorm, in een desperate poging de kas te vullen en de meest recente waardering van $500 miljard waar te maken.

Jon Stewart in gesprek met Nobelprijswinnaar Geoffrey Hinton

De komiek en presentator voerde een intelligent en zinvol gesprek met Hinton, die geen mogelijkheid onbenut laat om te waarschuwen voor ongebreidelde verspreiding van AI in de samenleving. Overigens was Stewart in de Daily Show terecht vlijmscherp over Zuckerberg, Altman en consorten:“Are you out of your mind?”

Stewart stelt, evenals professor Scott Galloway, dat het de Zuckerbergs van de wereld niet valt aan te rekenen dat ze winst stellen boven elke menselijke maat: dat is immers de enige prestatie waarop ze worden beoordeeld. Galloway richt zich daarom tot ons, de samenleving: ‘stop being such f**king idiots!’

Deloitte hallucineert met AI in overheidsrapport van $440.000

Het wrange aan deze rel is dat het doel van het door Deloitte uitgevoerde onderzoek juist was om het systeem van sociale uitkeringen van de Australische overheid tegen het licht te houden. Het ging om principes als rechtvaardigheid en nauwkeurigheid. De Ombudsman had eerder vastgesteld dat het systeem niet overeenkwam met de sociale wetgeving, waardoor sommige boetes onrechtmatig waren. Deloitte’s onderzoek had een weg terug naar goed bestuur moeten uitstippelen.

De oplichting – want dat is het – kwam aan het licht toen een onderzoeker van de universiteit van Sydney bij het doorlezen van het rapport als bron een boek tegenkwam dat zou zijn geschreven door een collega, met de pakkende titel: “De rechtsstaat en bestuurlijke rechtvaardigheid in de verzorgingsstaat: een onderzoek van Centrelink.” Een titel die je gelijk bij de strot grijpt, alleen, klein detail: dat boek bestaat helemaal niet. Het bleek een compleet verzinsel van Microsoft Azure ChatGPT-4, door Deloitte gebruikt bij het vervaardigen van het rapport.

Bij nadere bestudering bleek het rapport ruim twintig bronnen bij elkaar gefantaseerd te hebben, inclusief een uitspraak van een rechter die deze nooit had gedaan, hetgeen niemand bij Deloitte was opgevallen. Uit deze boeiende reportage blijkt dat de Australische overheid alleen de laatste betaling van $97.000 Australische dollars (ongeveer 50.000 Euro) heeft teruggekregen, zonder enig excuus van Deloitte. De vraag is hoeveel beleid wereldwijd inmiddels wordt gemaakt op basis van niet bestaande onderzoeken.

Waarom openen AI-bedrijven opeens koffieshops?

Gezien de hoeveelheid hallucinatie van hun producten zouden de Nederlandse variant van koffieshops goed passen bij AI-bedrijven, maar het gaat om koffieshops van de traditionele variant. Perplexity opende een Curiosity Cafe in Seoul, Anthropic’s Claude deed een koffie pop-up in New York. Het grappigst is de observatie in het artikel dat AI-merken zich willen onderscheiden van online merken door een fysiek contactpunt te openen. Alleen is iets wat iedereen doet, uiteraard niet onderscheidend meer.

Waarom Apple wel of geen AI-probleem heeft

Langzaam dringt het besef door dat Apple er misschien verstandig aan heeft gedaan, al of niet bewust, om geen eigen AI-chatbots in de besturingssystemen van de Mac en de iPhone te verwerken. In deze uitstekende videoreportage van Bloomberg wordt de uitdaging genuanceerd toegelicht.

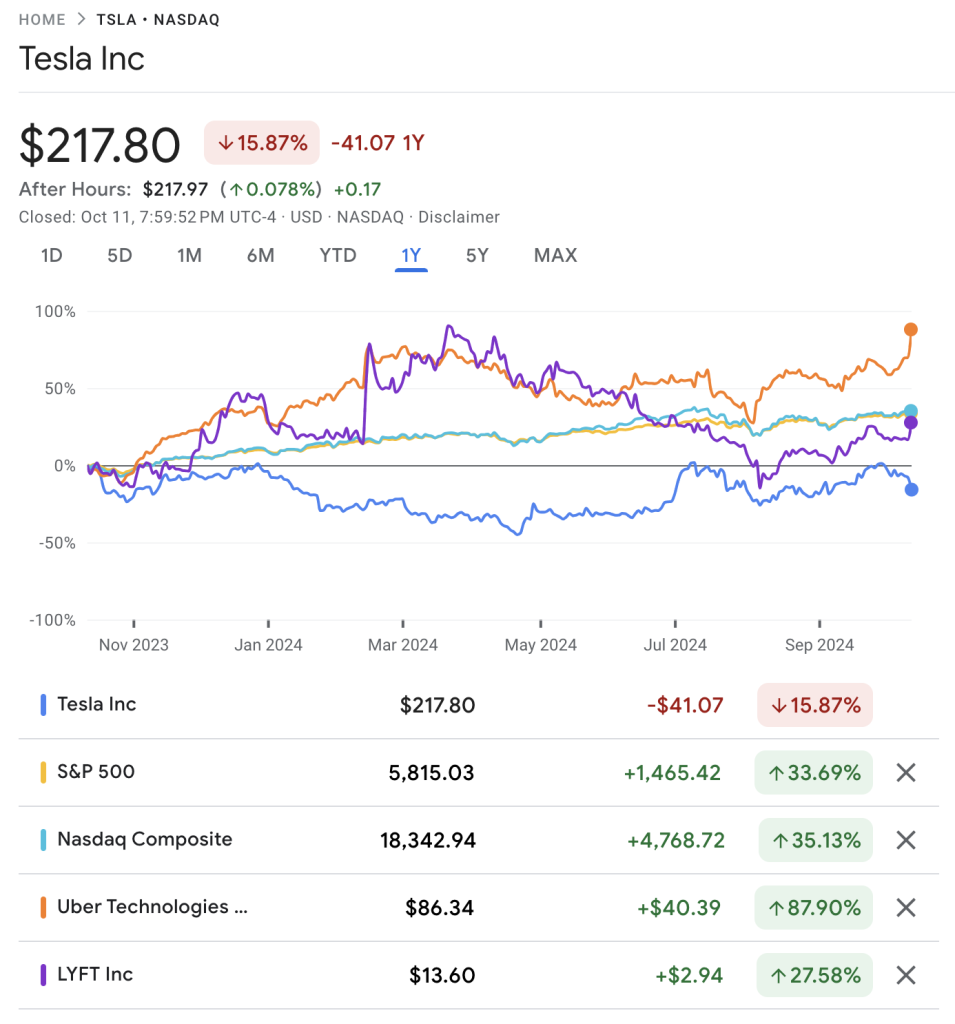

Toegegeven, als OpenAI of andere AI-bedrijven erin slagen om een directe relatie te krijgen met gebruikers zonder inmenging van Apple via de iPhone, dan kan Apple met de iPhone eindigen zoals de Blackberry. De iPhone levert immers de helft van Apple’s omzet en de deal met Google als zoekmachine in Safari levert ook tientallen miljarden op. Maar de vraag is nog steeds of OpenAI en consorten levensvatbaar zijn als de externe financiering opdroogt, bijvoorbeeld na een beurscrash.

Apple en met name Microsoft zouden dan spekkoper kunnen zijn en met hun beurswaarde en miljardenwinsten een bedrijf als OpenAI relatief goedkoop kunnen overnemen. Vooral Microsoft is dan kansrijk, want het bezit al bijna de helft van de aandelen van OpenAI.

Formule 1 in de VS naar Apple

Het was geen groot nieuws, omdat Apple naar verluidt de komende vijf jaar $150 miljoen per jaar betaalt voor de F1-rechten, maar juist omdat het bekend staat als een relatief zuinig bedrijf is het opvallend dat Apple doorgaat in de slag om sportrechten. Het is in de VS gebruikelijk dat sporten hun uitzendrechten verdelen over diverse gemachtigden, maar Apple probeert net zoals met de MLS (steeds vaker schertsend de Messi Soccer League genoemd) het alleenrecht te verkrijgen. Het zou de opmaat kunnen zijn naar een wereldwijde deal tussen Apple en F1 over een paar jaar, zodra de internationale rechten vrijkomen.

Apple combineert “tosti-ijzer en koelkast”

Intussen moeten ze bij Apple tandenknarsend hebben toegezien dat het nieuws uitlekte dat het eind volgend jaar voor het eerst Macbooks zal produceren met een touch screen. Apple probeerde deze maand juist aandacht te krijgen voor de nieuwe Macbooks met de M5-processor, maar juist omdat de huidige generatie Macbooks uitstekend is zullen er genoeg potentiële kopers een jaartje wachten in de wetenschap dat er een compleet nieuwe categorie high-end Macbooks aankomt.

De overgang naar Macs met een touch screen is een enorme stijlbreuk voor Apple. Steve Jobs zei in 2010 dat “touch screens niet verticaal willen zijn”, ofwel ongeschikt voor een computerscherm. Zijn opvolger Tim Cook stelde jolig dat het combineren van een tablet en een laptop hetzelfde zou zijn als het samenvoegen van een broodrooster en een koelkast, kortom, niets voor Apple. Dat Apple nu toch met deze koel-tosti combi op de proppen komt onderstreept slechts hoeveel moeite het heeft met het introduceren van een nieuwe product categorie, na de geflopte Apple Vision Pro.

Vinod Khosla: “meerderheid vc’s voegt niets toe”

Elke ondernemer die te maken heeft gehad met investeerders zal het roerend met de legendarische ondernemer en investeerder Khosla eens zijn. Toch heb ik nog nooit een investeerder ontmoet die enige terughoudendheid toonde in het geven van adviezen aan ondernemers, niet beseffend dat hun tips meestal even waardevol zijn als die van een meepuffende echtgenoot naast een bevallende vrouw.

Khosla stelt zelfs dat “zeventig procent van de investeerders negatieve waarde toevoegt” aan een onderneming. Hij vraagt zijn eigen teamleden op basis waarvan ze het in hun botte hoofd halen om een boardpositie te vragen bij startups, met alleen een MBA om naar te wijzen als relevante ervaring.

Ray-Ban naar recordhoogte: profiteert van Meta AI-bril

De aandelen van Ray-Ban-maker EssilorLuxottica bereikten vrijdag een recordhoogte en stegen met bijna $ 20 miljard aan marktwaarde, gedreven door enthousiasme van beleggers voor de AI-gestuurde Ray-Ban Meta-bril. Als brildrager tegen wil en dank geloof ik nog steeds niet in de bril als serieuze variant op de mobiele telefoon of zelfs de smartwatch. Maar het is een interessante ontwikkeling om de komende jaren te blijven volgen.

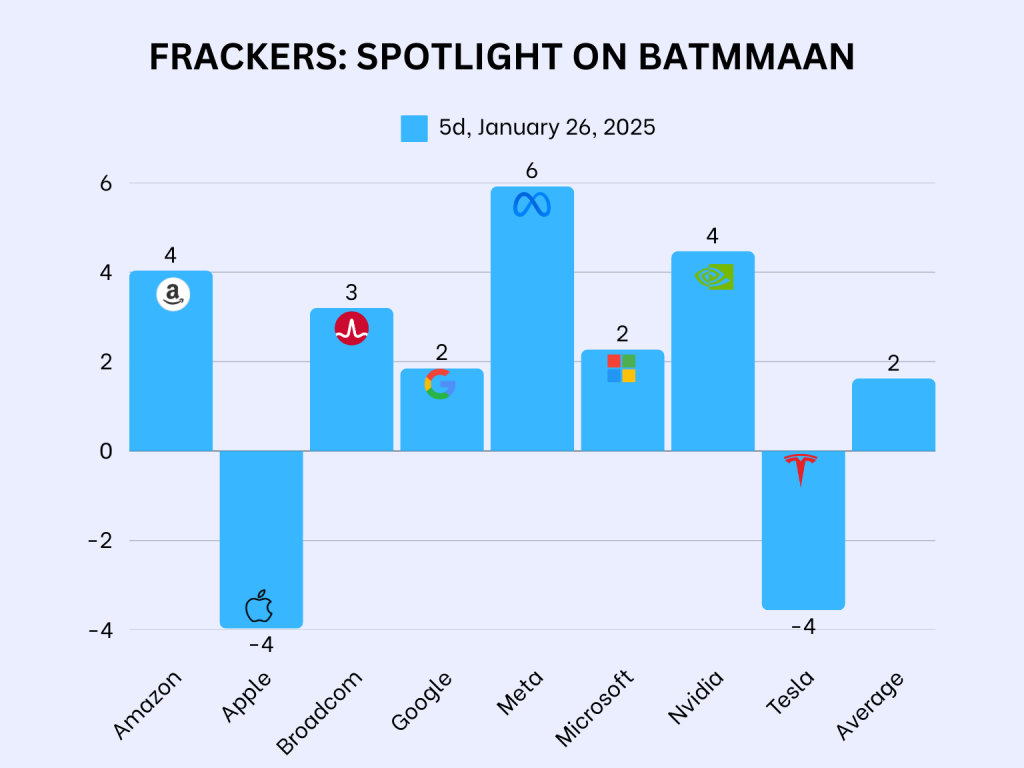

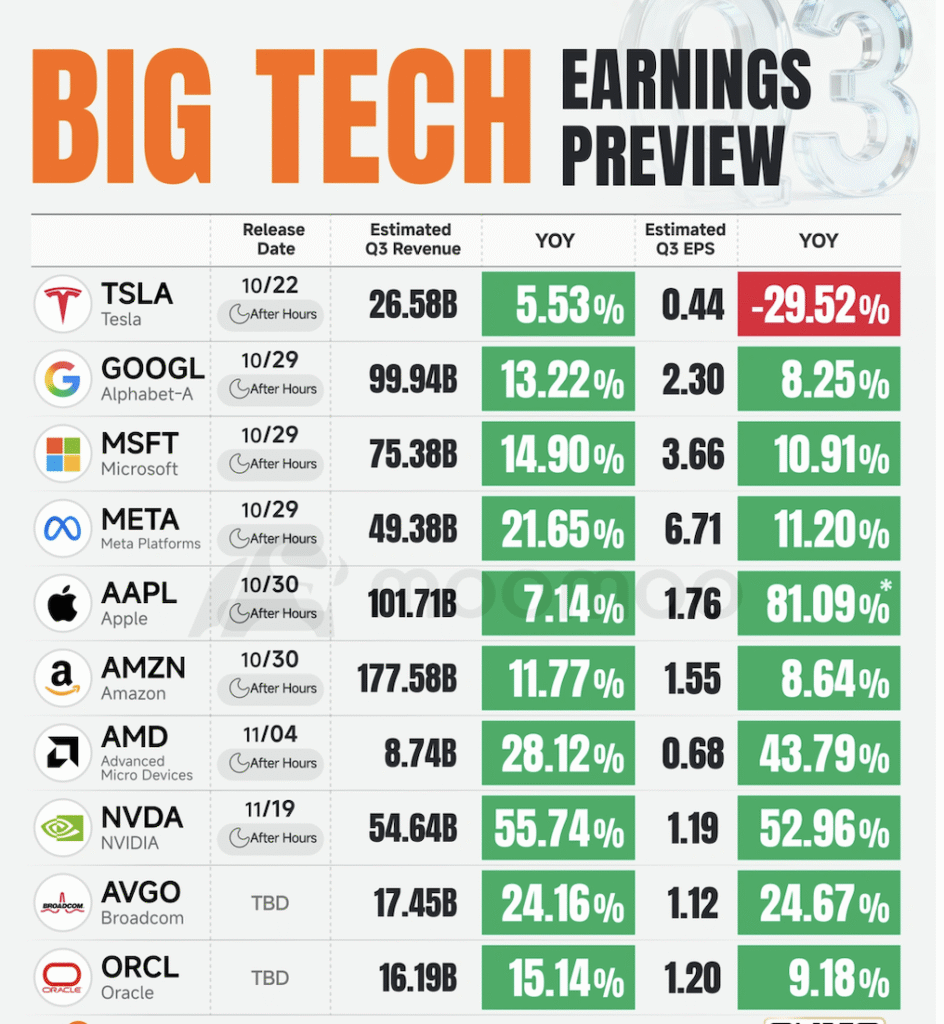

Big Tech kwartaalcijfers komen eraan: moment van de waarheid

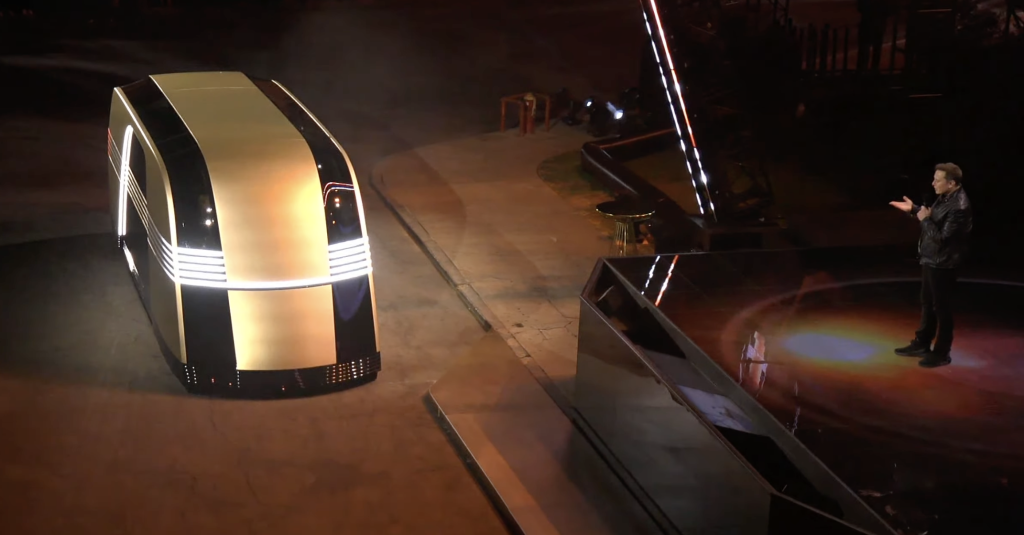

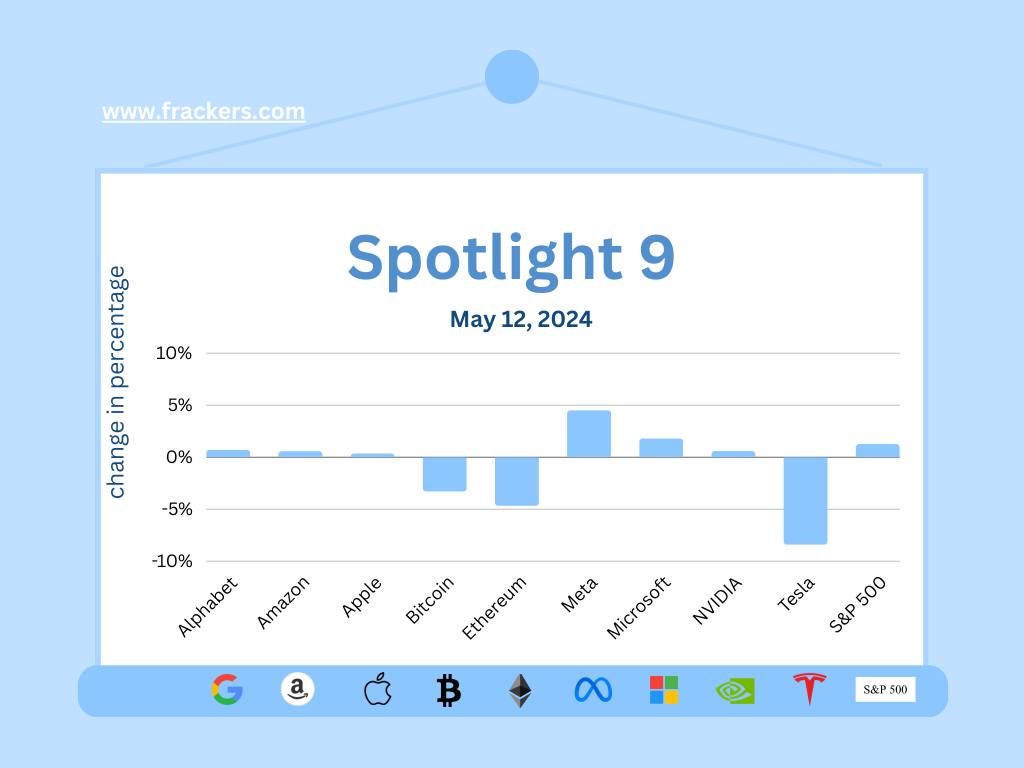

Door de enorme invloed die de grote techbedrijven hebben op de belangrijkste beursindices, zullen hun kwartaalcijfers de toon zetten voor het beleggerssentiment en de algemene richting van de markt. Vandaag publiceert Tesla als eerste van de grote jongens de cijfers, waarmee officieel een nieuwe ronde van het winstseizoen voor Amerikaanse techaandelen van start gaat.

De verwachtingen zijn zo hoog dat zelfs een kleine misser grote gevolgen kan hebben. De koerssprong van Luxottica toont aan dat de markt nog altijd veel geloof heeft in AI-gedreven producten, maar tegelijk groeit de twijfel of de huidige generatie LLM’s werkelijk de enorme productiviteitswinst zal opleveren die de honderden miljarden aan investeringen en de torenhoge beurswaarderingen rechtvaardigen.