Welcome to the hundredth edition of this newsletter. This personal milestone is not a time for nostalgia, so I do not want to look back extensively, but draw a few conclusions about what has changed in the world since the first newsletter. From the dominance of AI and the maturation of crypto to the geopolitical power of chips: this edition is a snapshot and a look ahead. Because I obviously have the pretension to be able to make a few predictions that we can laugh about in edition 200.

Topics in this anniversary edition:

- AI is everywhere – mediocre to bad

- Crypto especially popular as… IPO

- Techbros are getting more and more annoying

- From Silicon Valley to the world

- AI via LLMs more like a Swiss army knife than a new steam engine

- Microsoft believes in OpenAI for its own revenue and market value

- Why Most AI Companies Will Be Acquired

- Crypto from alternative money to ‘enabling layer’

- Regulation of AI is inevitable

1. AI is everywhere – mediocre to bad

This is not exactly a shocker: in 2022, AI was still something for developers, exotic startups and research institutes, but in 2023 everything changed with the introduction of ChatGPT, which attracted hundreds of millions of users in record time. What happened with the internet in the nineties and smartphones in the last twenty years, has been happening with AI since then; only faster. Precisely because the internet and smartphones have made the use of AI extremely accessible.

At the same time, effective use of AI is lagging far behind expectations. Various studies show that the business community in particular is struggling with the question of how AI can be used practically and usefully. At the moment, the business use of AI is in such a sad state that the most common response to this newsletter is: ‘you clearly don’t write it with AI.’ In other words; texts written with AI are clearly recognizable as clichéd and impersonal. Everyone has that colleague who ends every second sentence – with that annoying hyphen at the end. Anyone who still uses ‘let’s delve deeper into this’ or ‘let’s explore’ identifies as a ChatGPT junkie.

MIT recently published an excellent study confirming what was widely feared: the current generation of AI tools is making people dumber . People who wrote without AI-tools used their brains the most. People who used AI were less active with their minds, remembered less, and felt less engaged with their own text. They were also less able to explain what they had written themselves. AI makes writing easier, but in the long run it turns out to be bad for learning and thinking skills.

2. Crypto now a serious investment class – especially as an IPO

Anyone who has been reading this newsletter from the beginning has witnessed Bitcoin’s rise from $15,000 to well over $ 100,000 . I don’t give investment advice – it’s no coincidence that my podcast with Dr. Nisheta Sachdev is called NFA : Not Financial Advice – but it’s still remarkable that Bitcoin has risen by more than 500% in those few years. For crypto freaks, it’s hard to accept that Nvidia stock did much better in the same period, or that even Microsoft outperformed the number two in crypto, Ethereum.

But apart from the undeniable financial return, I blame myself for apparently not having succeeded in making clear why blockchain applications, with cryptocurrencies as the most well-known manifestation, are so fascinating. The core of blockchain lies in two aspects in my opinion: first of all, decentralization, the absence of a central link that can control an ecosystem.

A good blockchain doesn’t have a Bezos or Zuckerberg as a tsar on the throne. Bitcoin is the best example of that, because nobody even knows who its founder is. The system works on the basis of the second fascinating aspect of blockchain: smart contracts.

These programmed agreements completely exclude the intervention of an intermediary. No notary who does ‘copy and paste’ on a deed twice for a few thousand bucks. This allows the number of frictionless transactions in blockchains to easily multiply.

Granted, the number of good blockchain applications outside of finance has been too limited so far, and speculation on nonsense like memecoins has even earned the US president a billion . But for those who doubt the importance and growth of crypto, I would like to point you to the excellent page of investment firm Andreessen Horowitz entitled ‘5 charts that explain crypto right now .’ Don’t believe me, but investigate why the investor behind Facebook, Twitter, Airbnb, Instagram, Skype, Slack and Pinterest has also invested so much in crypto exchange Coinbase and dozens of other crypto companies.

How ironic that crypto IPOs will be the hottest investments on Wall Street by 2025. Or, as Barron’s puts it, “Circle Stock Went Gangbusters. Crypto IPOs Are the Next Big Thing.”

3. Techbros are obnoxious

Elon Musk has been mentioned no less than 47 times in 100 newsletters. From his takeover of Twitter to Grok’s tendency to use a photo of a dog show to draw attention to alleged white genocide in South Africa: Musk is the most reliable source for content you can’t make up. But I continue to argue for judging the man on his work, not on his extracurricular activities.

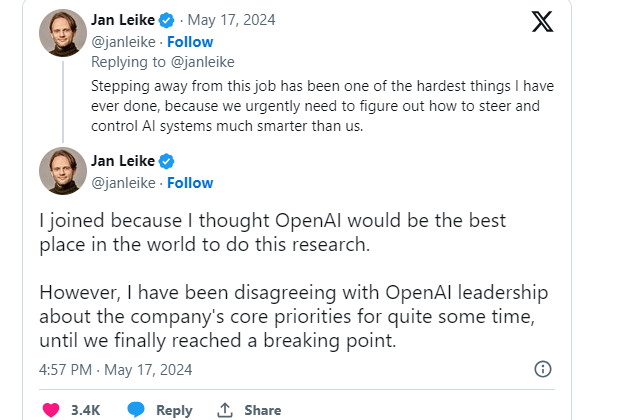

OpenAI CEO Sam Altman is the second most mentioned in this newsletter after Musk (39 mentions), but the fact that his name has yet to be preceded by a job title indicates the limitations of his fame. Altman does everything he can to profile himself as the messiah of the AI era, but apparently has little historical awareness about how things usually end for a messiah. From announcing the $500 trillion Stargate project in the Oval Office to a $3 million video of himself drinking coffee, Altman is constantly on everyone’s nerves.

There are now two excellent books that have been published in which Altman’s dubious character is extensively discussed. Mark Zuckerberg is more slippery than an eel in a bucket of snot immersed in a barrel of motor oil in a bathtub full of green soap, but if you let Sam Altman look after your house for a weekend, don’t be surprised if, when you return, your house has been sold, the proceeds are in Altman’s account and he assures you that you are happier with less possessions and that the world will be a better place because of it.

4. From Silicon Valley to the world

Coverage of technology and innovation has evolved from Silicon Valley to the rest of the world, from Abu Dhabi as a possible home to the world’s largest AI data center, to Singapore testing AI applications with South Korea and China with the surprising DeepSeek. Every politician understands that the country that masters AI and ‘compute’ (data centers) can become a global power.

Technology is now at the heart of geopolitics, from chip restrictions on China to subsidy races for AI startups. The growing importance of technology is creating a kind of cross between a mating dance and a strangulation between governments and tech companies: Nvidia and ASML can’t export to China without permission from Trump and whoever is in charge of the Dutch government; but at the same time, Trump can’t do without tech companies’ donations to the Republican Party, and the Dutch economy needs to innovate to keep growing. Musk saw through this mutual dependency and donated himself into a position of power within the US government, if only for a short period of time.

Whoever owns the computing power, the data centers, and the chips, has the power. Europe is lagging behind, China wants to become an independent superpower and the US dominates the top. Tech is no longer an industry, it is the core infrastructure of everything that keeps society running, from healthcare to defense and everything in between.

The predictions

So much for the analysis of where we are at the moment. These are conclusions and predictions for the period during the next hundred editions of this newsletter:

1. AI via LLMs more like a Swiss army knife than a new steam engine

The smokescreen raised by people like Altman suggests that LLMs like ChatGPT and DeepSeek will be as fundamental as the internet. The reality is different. LLMs are impressive at times, but they continue to fall short despite hundreds of billions of dollars invested. From a cost perspective, the current generation of LLMs is a digital equivalent of taking a shower with a hundred dollar bill, tearing it up and hoping that some of it will remain lying on top of the drain.

Current LLMs increase productivity, but do not create new network effects. It is still not proven that a billion users of ChatGPT generates a better product than a million users. Compare that to social media, where the value for each user increases with each new user.

The current generation of LLMs has no clear defensible competitive position, which the Americans so nicely describe as a moat. (I always have to chuckle that Americans have a specific word for this concept that European languages do not have, while the US has no castles or moats, unless you count Disneyland.)

The big LLMs OpenAI, Claude from Anthropic, Google Gemini, DeepSeek, Mistral and Meta’s Llama all have different target audiences rather than fundamentally different approaches or quality. Ethan Mollick has created a nice overview of this.

If the much-discussed AGI (Artificial General Intelligence) or much-vaunted Superintelligence emerge in the next decade, it won’t come from the continued scaling of LLMs or LRMs. The difference between LLMs, which provide an immediate answer based on pattern recognition, and LRMs, which reason step by step before providing an answer, is used by AI prophets like Sam Altman as evidence that this methodology will quickly lead to AGI or Superintelligence. But Apple and Microsoft think very differently.

What Apple writes about AI is more important than what it does

A few weeks ago, a group of Apple employees published a much-discussed study showing that the new generation of LRMs perform no better than regular AI on simple tasks, show advantages at moderate difficulty, but fail completely on very difficult problems. They also showed that they do not use clear calculation rules and sometimes reason contradictorily. The study shows that these models think differently than widely believed and raises fundamental questions about how well they can really reason.

The AI mob went completely berserk and pointed the finger at the sender, just because Apple has failed so far with its own AI applications. But that doesn’t make the analysis and conclusion any less correct. Then it got really fun: on X, all sorts of self-proclaimed AI experts cited a study by a certain C. Opus and A. Lawsen, which supposedly showed that Apple’s research was completely flawed.

Small problem: it wasn’t a real study, but a joke by Alex Lawsen that Anthropic’s Claude had used to make up some rebuttals to Apple’s study. Nicholas Thompson of The Atlantic makes a great point about how ridiculous it is that AI experts don’t realize they’re citing a fake study created with AI without actually understanding the research itself. This serves to underscore my first point in this newsletter: AI is being used everywhere — and mostly badly. (See, one can use that – at the end of a sentence without ChatGPT).

2. Microsoft believes in OpenAI for its own revenue and market value

Skepticism about the AI industry is not only prevalent at Apple, but also at Microsoft, which is one of the biggest players in this exploding sector. Microsoft owns, among other things, 49% of the shares in OpenAI, which, under the leadership of Sam Altman, wants to reform its structure into a traditional commercial company in order to attract new investors and retain top staff, more on that later.

Microsoft has invested more than $13 billion in OpenAI and in return will receive, in addition to the 49% equity stake, as much as 75% of OpenAI’s profits until the $13 billion is recouped, followed by 49% of OpenAI’s profits up to a maximum of $92 billion.

In addition, Microsoft will receive as much as 20% of the revenue that OpenAI generates through the Microsoft Azure platform until 2030, although that percentage may decrease over time. Once the agreed profit cap is reached, all future profits will remain with OpenAI.

OpenAI wants to relax those conditions in order to gain more commercial freedom itself. At the same time, OpenAI is in a hurry: if the restructuring is not completed before the end of 2025, promised investments, such as the often-mentioned injection of $30 billion from SoftBank, among others, could expire or be converted into debt.

In addition to the financial agreements, Microsoft has major strategic advantages from the deal with OpenAI, which is required (!) to run all of its models on Microsoft Azure, which generates billions in cloud revenue for Microsoft. Microsoft also has an exclusive license to OpenAI’s technology and is allowed to integrate it into its own products such as Copilot, GitHub and Bing. Through the Azure OpenAI service, Microsoft is also allowed to resell and sublicense the models to third parties.

Count with us: Microsoft grabs $2.3 trillion market cap on OpenAI?

Sam Altman is negotiating with Microsoft without many cards in his hand. Because although Microsoft’s 49% stake in OpenAI theoretically has $147 billion in value at OpenAI’s $300 billion valuation, a simple calculation shows that the current revenue and profit agreements yield Microsoft much more.

Microsoft will receive up to $92 billion in profit sharing from OpenAI, which, given Microsoft’s staggering net margin of 37.7%, equates to $34.7 billion in net profit. Given that Microsoft is valued on the stock market at a P/E ratio of 31.6, that profit translates to over $1 trillion in additional market value. The use of Azure, the exclusive licenses, and the profit sharing make the deal much more valuable to Microsoft than just an equity stake.

Things get even more exciting for Microsoft if OpenAI lives up to Altman’s rather megalomaniacal revenue projections. Based on OpenAI’s projection of $125 billion in revenue by 2029, Microsoft could generate $73.5 billion in profit from that alone. This includes a 49% share of OpenAI’s profits (up to a maximum of $92 billion), 20% of revenue from Azure sales, and profits from OpenAI’s use of Azure infrastructure with a 30% margin.

This substantial annual profit contribution could significantly increase Microsoft’s valuation. Multiplying the $73.5 billion by Microsoft’s current price-earnings ratio of 31.6 would potentially add trillions to Microsoft’s market value.

For those interested: especially for this 100th edition, I asked Google Gemini to calculate exactly what the deal with OpenAI will yield in market value for Microsoft, based on OpenAI’s revenue forecasts and the current agreements with Microsoft. The answer: 2.3 *trillion*. The entire Google Doc explaining how Gemini arrived at this figure is here.

For comparison, Microsoft’s current market cap is $3.55 trillion. Compared to a simple 49% equity stake in OpenAI at a $300 billion valuation (which would generate $147 billion), the current multi-tiered partnership creates significantly more value for Microsoft.

Microsoft CEO Satya Nadella can sit back and relax while Altman has to share all of OpenAI’s crown jewels with Microsoft. In all cases, Microsoft benefits most from the potential value creation.

3. Most AI companies will be acquired because they lack a structural competitive advantage

OpenAI, Anthropic, Mistral, xAI: many differences in approach, but few in structural advantages. No one has monopolies on datasets, chips or architectures. Therefore, there is little chance of dozens of independent AI companies in the long term. Meta, Amazon, Google, Microsoft and Apple will acquire the best. The largest sub trillion market cap tech companies (Oracle, Salesforce) will also look to acquisitions to expand their AI product range.

Anyone who still wants to become a horizontal AI platform is probably too late. Unless a fundamentally different path is taken than LLMs, as seems to be the idea behind the new startups of former OpenAI executives Ilya Sutskever and Mira Murati.

Zuckerberg Pays $100 Million Salaries Out of Despair

Murati’s Thinking Machines Lab (with that nice website ) raised $2 billion from investors this week , at a valuation of $10 billion. Mark Zuckerberg tried to buy the product-less company SSI (click to see what’s apparently cool in Silicon Valley now) from Murati’s ex-colleague Ilya Sutskever for $32 billion and when that didn’t work out, Zuckerberg bought the CEO.

Zuckerberg seems to acknowledge that his current strategy of building a competitor to OpenAI with Llama has failed and is following the strategy he successfully used before: throwing money around to build things he can’t develop himself. The rumors about a $100 million signing fee for top developers appear to be untrue: it’s ‘just’ salary.

Zuckerberg bought 49% of Scale for $14.3 billion to lure in another top AI talent in the person of 28-year-old Alexandr Wang. The billions in investments in companies of a few founders and the millions in salaries for developers show that the difference in AI is made by individuals. There is no AI company with a competitive advantage. There is no economy of scale. That is why Altman is trying to make a difference with the $500 billion Stargate based on capital, but that is science fiction.

So there won’t be ten or twenty AI companies that are worth hundreds of billions, which is necessary to recoup all the billions invested in AI in recent years. Investors and AI entrepreneurs will often play it safe and, when the music in this musical chairs stops playing, sell as quickly as possible to a liquid party such as a listed tech company. Microsoft will once again be one of the big winners.

4. Crypto shifts from ‘alternative money’ to ‘enabling layer’.

The ideological promise of crypto as a replacement for banks has not disappeared, but it has become subordinate to practical applications. The focus is now on RWA (Real World Assets), gaming, identities and infrastructure. Layer 2 solutions, stablecoins and low-fee chains enable microtransactions and on-chain applications.

Blockchain applications will also increasingly be used in supply chain management, the least sexy sector on earth, but where fraud-free control of the origin of goods is becoming increasingly important.

5. Regulation of AI is no longer a question, but a necessity.

Social media proved that tech companies cannot regulate themselves. The damage to mental health, polarization and disinformation is enormous. With AI, the risk is even greater, because it is more scalable and less visible. Regulation is slow in coming, but it is inevitable.

The question remains simple: would you trust people like Bezos, Altman, Zuckerberg or Musk to take of your dog for a weekend? If not, would you give them free rein to introduce global, potentially society-disrupting technology? Social media has all sorts of incredibly positive and fun implications, such as keeping in touch with friends and family or like-minded people. But no one can deny that the rise of social media has proven that the tech bros can’t handle their power properly.

Regulation of AI is therefore no longer a question, but an absolute necessity. The big question becomes: how?

“Degen Girl vs TradFi Chad guy”: Nish & Frackers on the NFA Podcast

Nish Got Rugged

Or: ‘Nish was slow.’ That is the conclusion of episode 19 of the NFA Podcast , in which we discuss various topics that were briefly touched upon in this newsletter. With the emphasis on the word short, because the question is inevitable whether Zuckerberg would be nicer if he were four inches taller. What is it with the short king syndrome?

Madame Sachdev and I will probably never agree on the difference between speculating and investing, but it does lead to stimulating discussions. In which the undersigned won our investment competition this week, with a result of… 2.69%.

Finally

Frackers on Tech began at a time when technology was still often discussed as a separate topic. Technology is now everywhere and inevitable, fully penetrating the capillaries of society. AI, crypto, chips and algorithms increasingly determine how the world functions, how companies compete and countries outdo each other. The next hundred episodes will follow a world that reacts even faster and more intensely to the influence of technology.

Thanks for following, reading and commenting over the years. On to episode two hundred.